Overview of the South African Fintech Market

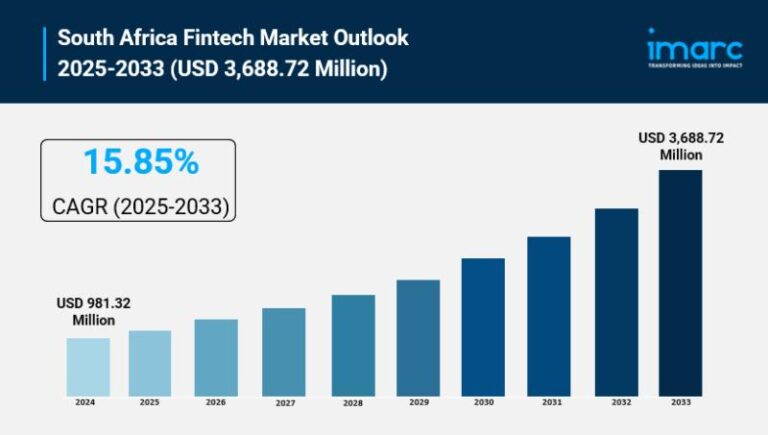

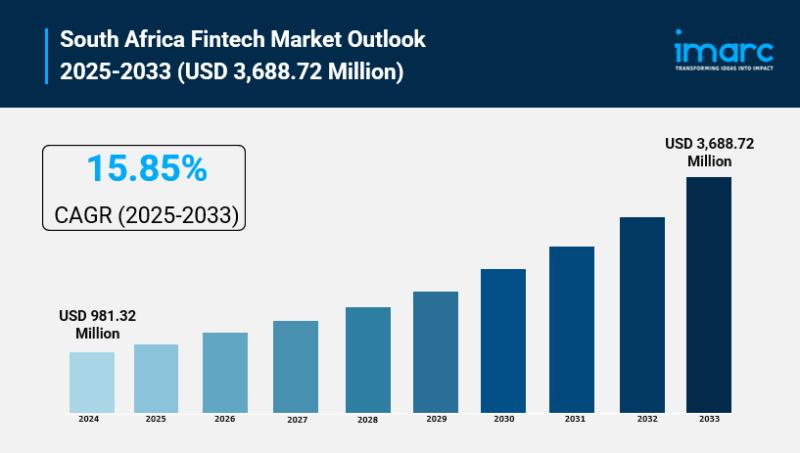

The South African fintech market is undergoing remarkable transformation, highlighting its burgeoning potential. As of 2024, the market size has reached approximately $981.32 million, with projections estimating it will soar to $3,688.72 million by 2033. This growth reflects a strong compound annual growth rate (CAGR) of 15.85% from 2025 to 2033.

The Role of AI in Shaping the Future

Artificial Intelligence (AI) is revolutionizing the South African fintech landscape. Leading banks are at the forefront of AI adoption, with over 50% incorporating AI in various functions such as fraud detection and personalized customer services. For instance, banks like Capitec utilize AI to combat fraud in real-time, which helps save clients significant amounts of money and reduces financial crime.

Empowering Financial Inclusion

Fintech startups, including Jumo and Pineapple, harness AI to enhance credit scoring and facilitate instant lending decisions. Such innovations are crucial for improving financial inclusion, particularly for underserved populations. By utilizing alternative data and accessible mobile platforms, these companies are breaking barriers that traditionally exclude many from the financial system.

Driving Growth Through Digital Payments

The rapid uptake of digital payment solutions is transforming how South Africans conduct transactions. The introduction of systems like PayShap have made it easier for consumers to engage in seamless, contactless transactions, while businesses leverage these solutions to streamline operations. This shift is not only enhancing user experience but also promoting collaborations between traditional banks and fintech companies.

Embedded Finance: A Game Changer

Embedded finance is emerging as a pivotal aspect of the fintech market in South Africa. Non-financial platforms are now integrating services like lending, insurance, and payments directly into their offerings. This trend allows businesses such as e-commerce sites and mobile applications to provide tailored financial solutions, improving customer convenience and loyalty.

Regulatory Support and Industry Collaboration

Government initiatives, including regulatory sandboxes and supportive frameworks from the South African Reserve Bank (SARB) and Financial Sector Conduct Authority (FSCA), are fostering responsible AI use in fintech. These measures encourage collaborative efforts between conventional banks and innovative startups, which are essential for sustainable growth in the sector.

Market Outlook and Future Opportunities

As the South African fintech market continues to evolve, with advancements in regtech and the increasing popularity of decentralized finance (DeFi), the outlook remains optimistic. By addressing the needs of the unbanked and underbanked populations, the fintech sector not only drives economic growth but also fosters a more inclusive financial ecosystem.

For those interested in gaining deeper insights into the South African fintech landscape, sample reports and additional resources are available for exploration.