MobileMoney Ltd Hosts Successful Fintech Stakeholder Forum 2025 in Accra

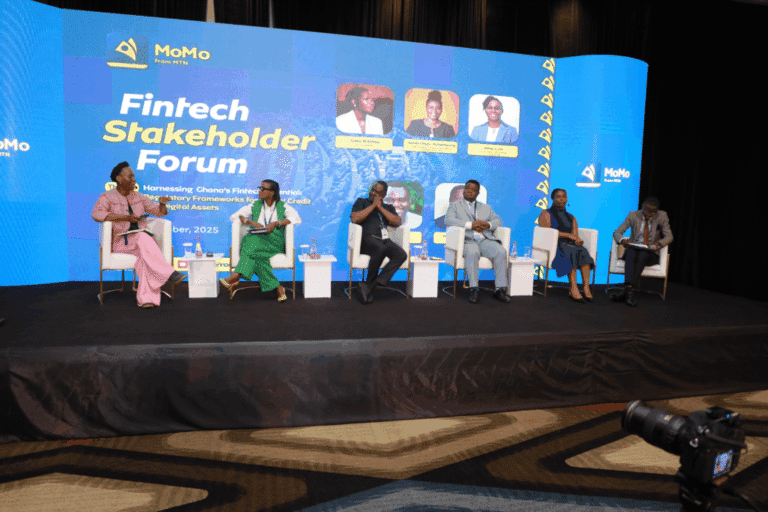

MobileMoney Ltd (MML) recently held the Fintech Stakeholder Forum 2025 in Accra, attracting over 200 key players from the financial, regulatory, and technology sectors. This pivotal gathering aimed to discuss the rapidly evolving fintech landscape and establish a sustainable trajectory for digital finance growth in Ghana.

Themed Discussions on Digital Finance

The forum was organized under the theme “Harnessing Ghana’s Fintech Potential: Regulatory Frameworks for Digital Credit and Digital Assets.” Participants explored the crucial intersections of policy, regulation, and innovation necessary for building a robust and inclusive digital financial ecosystem.

Insights from the CEO of MobileMoney Ltd

Shaibu Haruna, CEO of MobileMoney Ltd, set a collaborative tone for the forum by emphasizing the importance of partnership in shaping the future of digital finance, not only in Ghana but potentially throughout Africa. He highlighted that with the fintech economy’s evolution, it is essential for policymakers, regulators, and industry players to engage with innovators to harness the potential of digital credit and assets, thereby fostering financial inclusion and empowering small businesses.

Commitment to Innovation with Integrity

In her opening remarks, Ms. Matilda Asante-Ouest, Second Deputy Governor of the Bank of Ghana, stressed the central bank’s commitment to establishing “new rules of trust.” She underscored the need to balance innovation with financial integrity and consumer protection, recognizing digital finance as a pivotal infrastructure of opportunity across Africa.

The Growing Importance of Digital Credit and Crypto Adoption

Ms. Asante-Ouest noted that the estimated number of digital credit users in Ghana ranges between 2 and 5 million, with crypto adoption on the rise. This context underscores the timeliness of the forum’s theme and the critical need for regulations that foster innovation while ensuring consumer trust.

Key Regulatory Updates and Future Directions

During the forum, Ms. Asante-Ouest provided essential updates regarding regulatory frameworks impacting digital finance. She announced the recent enactment of the Digital Credit Directive, which mandates ethical lending practices and transparency, as well as the impending introduction of the Virtual Asset Service Providers (VASP) Bill. The Bank of Ghana will begin accepting applications for digital credit licenses starting November 3, 2025.

Engaging Conversations Among Industry Experts

The forum featured presentations from prominent figures, including Selorm Branttie of Imani Africa and Professor Peter Quartey from the Institute for Statistical, Social and Economic Research (ISSER). These experts shared valuable insights on the future of fintech in Ghana. The discussions were further enriched by contributions from panelists such as Clara Arthur, CEO of GhIPSS, Ethel Cofie, CEO of Edel Technologies, and Sylvia Otuo Acheampong, Director of Products and Services at MobileMoney Ltd.

MobileMoney Ltd expressed optimism that the ideas exchanged and the spirit of collaboration demonstrated at the forum would influence the next steps in digital finance policymaking and ensure that innovation continues to enhance the lives of Ghanaians.