Growth and Trends in the European Fintech Market

Overview of the European Fintech Market

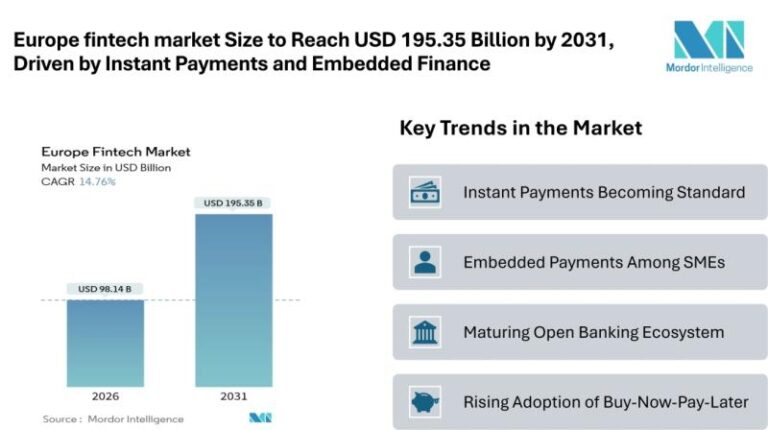

The European fintech market is on an upward trajectory, with projections estimating its growth from USD 98.14 billion by 2026 to USD 195.35 billion by 2031, reflecting an impressive CAGR of 14.76% during the forecast period. This expansion is fueled by increasing digital adoption across various sectors, including banking, payments, lending, and insurance.

Regulatory Support and Growth Drivers

One significant catalyst behind this growth is the implementation of the Instant Payments Regulation in the EU. This legislation mandates 24-hour instant transfers, enhancing transaction speed and security. As a result, businesses experience better liquidity management while consumers enjoy swifter and safer transfers, laying a strong groundwork for fintech expansion.

Instant Payment Adoption

A primary growth driver in the fintech sector is the swift adoption of instant payments. The EU regulation obliges traditional euro transfer providers to offer instant options without additional costs. This transformative move is crucial in promoting real-time transactions across the region while reducing fraud risks through a beneficiary verification system.

Integrated Payments for SMEs

Small and medium-sized enterprises (SMEs) are also witnessing a trend toward integrated payment solutions. Companies are incorporating payment acceptance, card issuance, and financial management within their accounting and commerce systems. This integration simplifies operations, thereby enhancing financial workflows and accelerating market responsiveness and efficiency.

The Rise of Open Banking

Open banking is reshaping the fintech landscape in Europe by enabling banks to leverage standardized APIs to develop revenue-generating services. By sharing customer data securely, financial institutions can create tailored solutions, driving competition and enriching digital product offerings across the sector.

Growth of Buy Now, Pay Later (BNPL) Solutions

The Buy Now, Pay Later (BNPL) model is gaining traction within European e-commerce, allowing consumers to opt for flexible short-term financing during purchases. As updated consumer credit guidelines promote affordability assessments, AI-driven underwriting tools enhance the accuracy of approvals and repayment performance, paving the way for robust BNPL growth and partnerships with merchants.

Future Outlook for the European Fintech Market

As the European fintech market undergoes systematic expansion, regulations, instant payment mandates, and increased demand for embedded finance will continue to influence market trends. Despite challenges such as capital prudence and licensing fragmentation, initiatives promoting harmonization are gradually improving scalability across borders, ensuring a positive growth outlook.

Conclusion

The landscape for European fintech remains dynamic and ripe for innovation. As businesses and consumers lean towards real-time, mobile-responsive financial solutions, the future holds significant promise. For those wanting to dive deeper into the European fintech market, further insights and detailed data are available through Mordor Intelligence.

For more information about this evolving sector, visit the Mordor Intelligence website.