Bigbear.ai Faces Challenges Amidst Mixed Financial Results

Bigbear.ai (Bbai), a prominent data analysis company focused on artificial intelligence, reported disappointing financial forecasts for the fourth quarter of 2024. The company’s projected sales and losses fell significantly short of expectations, highlighting a loss that was three times greater than anticipated. Furthermore, projected annual sales for 2025 are expected to be markedly lower than market predictions.

Growth in Specific Areas

Despite these financial challenges, Bigbear.ai reported an 8% increase in revenue for the fourth quarter of 2024 compared to the previous year. This growth can be largely attributed to additional income linked to contracts with the Department of Homeland Security and Digital Identity. However, the disappointing overall financial results led to a dramatic 39.50% decline in stock value, underscoring the persistent difficulties faced by the company.

Achievements in AI Solutions

Bigbear.ai specializes in AI decision-making solutions, leveraging advanced analytics and predictive models to assist organizations across various sectors, including national security, defense, travel, and trade. Recently, the company secured a contract with the Chief Digital Defense Officer and the AI Office (CDAO) to enhance the Virtual Anticipation Network (VANE). This project aims to aggregate and analyze critical data points, providing insights into multi-domain environments and identifying key trends in potentially hostile foreign regions.

Additionally, Bigbear.ai was awarded an Indefinite Delivery Indefinite Quantity (IDIQ) contract as part of the U.S. Navy’s Next Generation program, Seaport NXG. This contract paves the way for Bigbear.ai to deliver essential technologies and support to the U.S. Navy and other federal agencies, with initiatives focusing on advanced autonomous surface vessels, digital twins, and computer vision technologies.

Financial Performance Overview

In the fourth quarter of 2024, Bigbear.ai achieved revenues of $43.8 million, a substantial increase from $40.6 million in the same quarter in 2023, primarily driven by enhanced income from the Department of Homeland Security. The company also recorded an improved gross margin of 37.4%, which is an increase from 32.1% in the prior year’s quarter. However, changes in the fair value of derivative liabilities related to convertible notes significantly impacted net profit, resulting in a loss of $108.0 million for the quarter, compared to a loss of $21.3 million in the fourth quarter of 2023.

Analytical Outlook

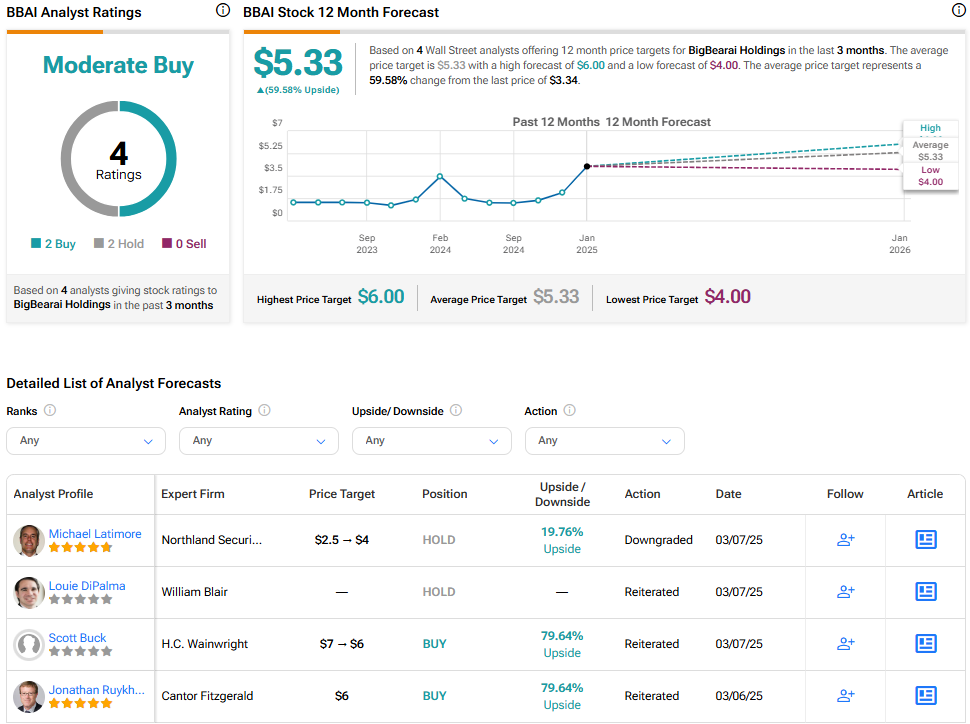

In response to these financial outcomes, analysts have adopted a more cautious stance regarding Bigbear.ai’s stock. Louie Dipalma of William Blair maintained a neutral outlook, citing lower guidance for 2025 and an uncertain funding environment as crucial factors. Conversely, Jonathan Ruykhaver of Cantor Fitzgerald reaffirmed coverage with a lowered price target of $6, down from $8, while still maintaining an “overweight” rating despite the uncertainty surrounding Q4 forecasts.

Future Perspectives

Bigbear.ai currently holds a consensus rating of “moderate buy” based on recommendations from four analysts. The average price target for shares is set at $5.33, indicating a potential upside of 59.58% compared to current trading levels. Despite recent setbacks, the company’s potential for growth remains under scrutiny as it navigates the evolving landscape of AI technology.

For more insights on Bigbear.ai and to stay updated on analyst ratings, visit this link.