Dublin, January 28, 2025 (Globe Newswire) – The “Generative artificial intelligence in Fintech – Report on global strategic businesses” The report was added to Researchandmarkets.com offer.

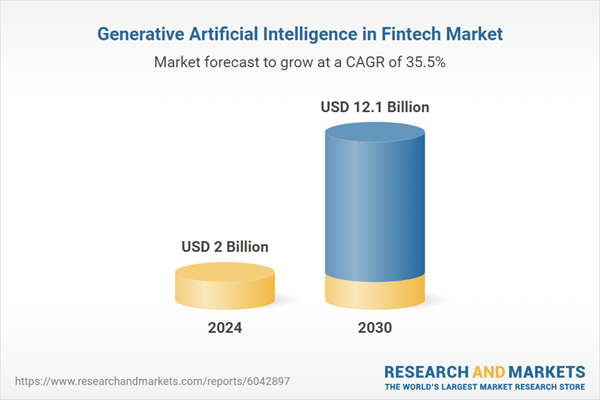

The global generative artificial intelligence market in Fintech was estimated at 2 billion US dollars in 2024 and is expected to reach $ 12.1 billion by 2030, increasing TCAC of 35.5% from 2024 to 2030. This full report provides an in -depth analysis of market trends, engines and forecasts, helping you make informed commercial decisions.

The growth of generative artificial intelligence on the Fintech market is motivated by a confluence of technological innovation, market demands and consumption behavior. One of the main engines is the growing need for personalized financial solutions, consumers expecting services adapted to their specific needs and circumstances. The generative capacity of the AI to analyze behavioral and transactional data allows fintech companies to meet these expectations with precision. In addition, the growing sophistication of cyber-men has made the tools for detecting and prevention of fraud in AI essential, as they can simulate attack scenarios and provide proactive attenuation of risks.

Regulatory compliance requirements also stimulate the adoption of AI, with complex generative AI processes such as money laundering money laundering (AML) and knowing your customer checks (KYC). The rise of digital banks, mobile financial platforms and decentralized finance (DEFI) still accelerates the demand for secure, scalable and intelligent systems powered by AI. Consumer trends such as preference for real-time transactions and self-service platforms oblige Fintech companies to innovate continuously. Collectively, these engines highlight the transformative role of generative AI in finches, positioning the market for robust growth and a redefinition of financial services in the years to come.

Study scope

The report analyzes generative artificial intelligence on the Fintech market, presented in terms of market value (US $ mille). The analysis covers key segments and geographic regions described below.

Segments

Component (Fintech software, Fintech services); Deployment (on -site deployment, cloud -based deployment); Request (request for compliance and fraud detection, predictive analysis request, asset management request, insurance request, personal assistant application, commercial analysis and report application, other requests); Final use (final use of the investment bank, final use of the retail bank, equity negotiation companies, final use, speculative funds for final use, other final uses).

Regions / geographic country

World; UNITED STATES; Canada; Japan; China; Europe (France; Germany; Italy; United Kingdom and remains of Europe); Asia-Pacific; Rest of the world.

Key information:

- Market growth: Understanding the significant AI generator segment trajectory in Fintech software, which is expected to reach $ 7.5 billion by 2030 with a 34.6%TCAC. The AI generator segment in Fintech services should also increase TCAC 37.0% during the analysis period.

- Regional analysis: grant information on the American market, worth $ 515.6 million in 2024, and China, expected TCAC growth of 33.7% to reach $ 1.8 billion By 2030. Discover growth trends in other key regions, including Japan, Canada, Germany, and Asia-Pacific.

Characteristics of the report:

- Complete market data: Independent analysis of annual sales and market forecasts in millions of US dollars from 2024 to 2030.

- In-depth regional analysis: detailed overview of key markets, notably the United States, China, Japan, Canada, Europe, Asia-Pacific, Latin America, the Middle East and Africa.

- Business profiles: coverage of major players such as Genie AI, Google LLC, IBM Corporation, Microsoft Corporation, mainly AI and more.

- Additional updates: Receive free report updates for one year to keep you informed of the latest developments on the market.

Key questions answered:

- How should the world generative artificial intelligence on the Fintech market evolve by 2030?

- What are the main engines and constraints affecting the market?

- What market segments will increase the most during the forecast period?

- How will market share for different regions and segments will change by 2030?

- What are the main market players and what are their prospects?

Some of the 25 companies presented in this generative relationship of artificial intelligence in the Fintech market include:

- Genie ai

- Google LLC

- IBM Corporation

- Microsoft Corporation

- Especially ai

- OPENAI

- Salesforce, Inc.

- AI synthesis

- Vesual

Key attributes

| Report attribute | Details |

| Number of pages | 197 |

| Forecast period | 2024-2030 |

| Estimated market value (USD) in 2024 | $ 2 billion |

| Planned market value (USD) by 2030 | $ 12.1 billion |

| Compound annual growth rate | 35.5% |

| Covered regions | Global |

Key topics covered

I. Methodology

II Executive summary

1.

- Insights influencers

- World market trajectories

- Economic boundaries: trends, tests and transformations

- Generative artificial intelligence in Fintech – Market share of world key competitors in 2024

- Competitive presence of the market – strong / active / niche / trivial for players around the world in 2024

2. Concentrate on some players

3. Market trends and drivers

- The growing demand for personalized fintech solutions leads to the adoption of the generating AI

- Progress in detection of fraud led by AI propel the growth of fintech applications

- The AI generating role in automating loans and credit approval processes extends market opportunities

- Increased accent on customer support powered by AI improves adoption on Fintech platforms

- The integration of generative AI in digital portfolios and payment solutions stimulates growth

- The request for predictive analyzes in Fintech reinforces the profitability analyzes for the implementation of the AI

- Regulatory examination of financial information generated by AI shapes market dynamics

- Financial planning and hyper personalized consulting services stimulate market expansion

- The generation of financial content focused on AI creates opportunities in marketing and communication

- The growing need for real -time transactions monitoring the generative deployment of AI

- Generative AI in credit rating systems improves the accessibility of poorly served markets

- The emphasis on decentralized finance (DEFI) motivates the adoption of the generator

- Chatbots supplied by AI in Fintech applications rationalize customer interaction

- The increased use of generative AI for risk assessment strengthens the growth potential of technologies

4. Perspective of the global market

III. MARKET ANALYSIS

IV. COMPETITION

For more information on this report, visit https://www.researchandmarkets.com/r/s8phyu

About Researchandmarkets.com

Researchandmarkets.com is the world’s main source of international market research reports and market data. We provide you with the latest data on international and regional markets, key industries, main companies, new products and latest trends.