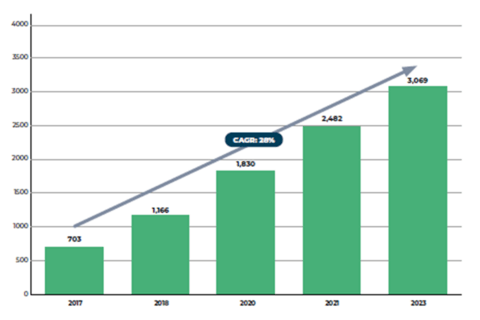

– Between 2017 and 2023, BAC’s fintech ecosystem recorded growth of 340%.

– Brazil, Mexico and Colombia represent 57% of total companies.

– Fintechs are strengthening their position in the payments segment.

BOGOTA – The fintech ecosystem has seen more than 340% growth in the number of tech finance startups created over the past six years, from 703 companies in 18 countries in 2017, to 3,069 in 26 countries in 2023, according to the fourth report in the Fintech in Latin America and the Caribbean series (available in Spanish). The joint study by the Inter-American Development Bank (IDB) and Finnovista was presented at the fifth annual meeting of FintechLAC, which is being held in Bogota, Colombia, with the support of the Grand Duchy of Luxembourg.

Figure 1: Fintech Startups in Latin America and the Caribbean, 2017-23

Source: Data collected by Finnovista and the IDB for this report (2023) and historical data. The 2023 report considers 26 LAC countries, including the Bahamas, Barbados, Belize, Guyana, Haiti, Jamaica, Suriname and Trinidad and Tobago.

The results of the study, entitled “A consolidated ecosystem with the potential to contribute to regional financial inclusion”, reflect market stabilization and progress toward long-term strength and resilience. More than half of fintech companies serve the underbanked or unbanked population and the region has seen dynamic regulatory development, with an increase in the number of regulatory frameworks for the development of segments such as open finance and the use of regulatory innovation structures such as innovation hubs. and regulatory sandboxes. Fintech is the sector that attracts the most venture capital investment.

According to the report, the current growth of the fintech ecosystem in the region is due to strong financial consumer demand, the state of digital financial infrastructure and the availability of a specialized workforce. The consolidation and stability of the ecosystem does not only result in an increase in the number of emerging companies, particularly in countries where the sector was nascent, but also in the diversification and distribution in terms of segments and economic models. , capitalization and generic technologies.

Brazil remains the country in the region with the highest number of fintech startups, with 24% of the total. Mexico follows with 20%, Colombia with 13%, and Argentina and Chile with 10% each. The countries with the highest growth over the last two years have been Peru, with 5.3% in the number of companies, followed by Ecuador with 3% and the Dominican Republic with 2.1%.

Peru, Ecuador, the Dominican Republic, Uruguay, Costa Rica and Guatemala constitute a group of emerging markets which are developing with notable dynamism, recording an average annual growth of 44% between 2017 and 2023. These markets have gone from only 7% of the regional ecosystem in 2017 (48 projects), to almost 15% in 2023 (455 projects).

The largest segments in terms of number of platforms in the region remain payments and remittances, with 21% of total businesses, lending with 19% and corporate financial management with 13%. These three segments experienced average annual growth of 24%, 31% and 28%, respectively.

A growing number of fintech startups in Latin America and the Caribbean are targeting underbanked or unbanked people and businesses, showing the positive impact of this sector on financial inclusion. Currently, 57% of fintech companies target this population group, while in 2021 this percentage was 36%. The lending segment is the first to serve the unbanked, while payments and remittances is the segment that most serves underbanked small and medium-sized businesses.

Sector-specific regulations are associated with its development. Thus, countries with permanent or interim measures have recorded growth or consolidation of their fintech ecosystems. In this regard, some notable cases for the period 2021-2023 are the publication and start of implementation of the Fintech Law in Chile, and the publication of specific regulations for low-value interoperable instant payments and finance opened in Colombia.

“The data collected in the report constitutes a key input for countries in the region to generate public policies that provide clarity for investors and catalyze the growth of the regional Fintech ecosystem,” said Anderson Caputo, Head of the IDB Connectivity, Markets and Finance Division. “The report’s findings reaffirm the enormous potential of financial technology to close the financial inclusion gaps in the region,” he added.

Fermín Bueno, co-founder and managing partner of Finnovista, highlighted that “the Fintech ecosystem in Latin America and the Caribbean is consolidating as a key driver of innovation and economic growth in the region, as well as financial inclusion and accessibility to financial services. for millions of people and small businesses. Our commitment is to continue to support this development, promoting collaboration between all players in the ecosystem and paving the way for a more inclusive and prosperous future.

For businesses surveyed, the top two challenges are scalability (41%) and access to financing (19%). In the latter case, the study shows a trend in Fintech towards institutional funding sources, as well as venture capital investments, both local and international. Although between 2021 and 2022 venture capital investments halved to reach $7.8 billion, fintech remains the sector with the greatest participation, representing 43% of the total, and an important line for investments foreign direct to the region.

The report “A Consolidated Ecosystem with the Potential to Contribute to Regional Financial Inclusion” is a collaboration between the IDB and Finnovista, as well as countries and strategic allies in the region. This edition of the report contains data from 26 countries and includes for the first time the Bahamas, Barbados, Belize, Guyana, Haiti, Jamaica, Suriname and Trinidad and Tobago. Its rigorous mapping identified 3,069 fintechs. Additionally, he conducted surveys of fintech ecosystem companies, regulators and investors. A total of 404 viable responses were obtained from companies, representing 13% of the total fintech company universe, with a margin of error of 4.54% and a confidence level of 95%. In addition, 25 investors and 32 financial authorities responded to the IDB and Finnovista survey, carried out in November and December 2023.