Draper, Utah, February 6, 2025

Josh Daniels, 34, has always been interested in finances and entrepreneurial companies.

“Since I was small, I loved finance. When we went to visit my family in Japan, I wanted to know why the dollar was worth more than the yen. For a dollar, I could buy fireworks and candies at the store in Japan, but a dollar here only made two candy bars to me. I was blown away. I sold candy when I was a child, I launched small businesses, swimming companies, I have always been intrigued by the operation of business and money. As I get older, I kept noticing that these models prove that money is just a tool. It is a business for experience.

Its new business, SMPLaims to provide personalized financial planning through AI, targeting 70% of Americans living the pay check to the pay check.

We sat with Daniels to find out more about the career path that led to the creation of SMPL. Daniels abandoned the University of Utah Valley to continue a business career in business. “I could probably have graduated, but the school was simply not for me. My wife told me that I should probably choose to be in school or not, because I would hang out with her when I was supposed to be in class. »»

Daniels joined the Divvy partnership team in 2020. He described how he got involved with Divvy from the advice of two good friends, Robert Henderson and Bert Curtis, who, for months, convinced him Join this Rise of Divvy rocket in its early years. At the time, Daniels working at Skipio, making partnerships and channel sales.

“A good friend there, Jake Bryant, gave me advice that stuck to me-always have an” expiration date “to register with yourself and make sure you learn and grow in the way You need, “said Daniels.

“At the end of 2019, I reached this expiration date and I realized that it was time to go to the next challenge that would help me develop the skills I would finally need to manage my own business. Robert and Bert finally made me interview with Divvy, where I met Melissa Lane, Jon Stoddard, Woody Klemetson and a lot of the team.

Daniels described that Divvy was like a masterclass in execution. “Every day, we felt like a rocket that takes off. The team was incredibly talented, we moved quickly and we had fun doing it. But above all, I learned three key lessons that shaped the way I thought of building a business:

- Sell → Design → Build – Make sure people want what you build before building it. If you can sell it first, you know you are on the right track.

- Fail quickly, fail forward – faster, the faster you find an adjustment of the product market. Failure is not the enemy – stagnation is.

- Focus, alignment, communication, execution – success comes from the alignment of good people around good vision and to move quickly with clear communication

Before his visit to Divvy, Daniels actually tried to start SMPL in 2015 when he was a financial advisor at Northwestern Mutual. “I saw first -hand how people had trouble with budgeting, debt and financial behavior that continued to put me on their way. I wanted to build a tool that could act as a financial advisor in your pocket, but I quickly realized that technology was simply not there, however.

He continued:

“After leaving Divvy, I started a business focused on the construction of a vemo for international payments, built on our own blockchain for individuals and businesses in badly served regions with great immigration to the States today , but the challenges of regulations and compliance have made the scale difficult. Building SMP today.

Daniels embarked on financial planning because he saw him as way of helping the most people. “While I met tons and tons of people, rich, poor and middle class, I found that most people had not learned the finance rules. And it is not their fault or my fault. I grew up in a middle -class family and then poor for a while, like really poor. I helped pay the bills when I was young. I worked a paper in the morning before school. I was a concierge after school, then I did football and stuff. I learned very quickly that it is only a job, this thing, money. »»

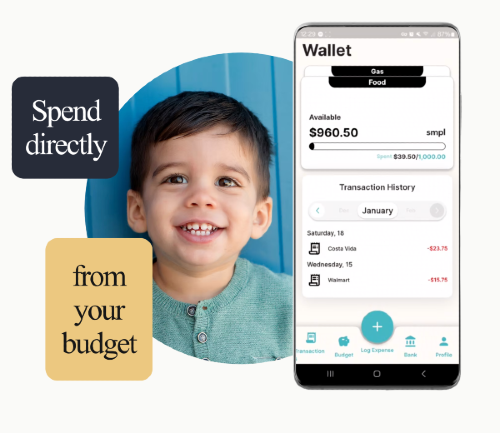

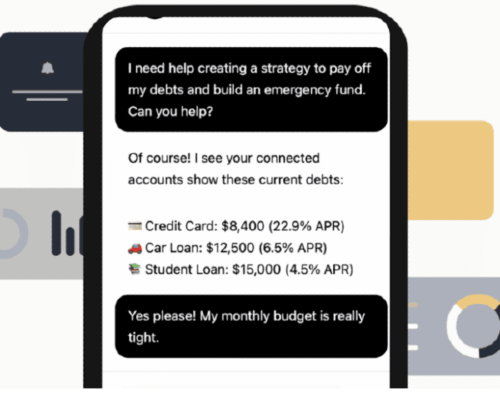

“I continued to see that there were three common obstacles at the start of financially: how can I build a budget that will be really correct, how to manage my finances and how can I align this on the real functioning of life? »» SMPL, the AI financial planner, makes the three of your pocket.

With recent developments in artificial intelligence, Daniels’ dream of providing a personal financial advisor in the pocket of each person had become operational. With SMPL, Daniels seized the opportunity and it aims to fill the gap in financial planning services for those who need it most – this living check.

“We are already live. We built it in a month. We have built what we call the five fundamentals: income, expenses, savings, debt, investments. Currently, we are building an AI financial planner who will take your data, then recommend the financial strategies that can help you in the planning of cash flows. We already have users, our next milestone is 10,000 users and the AI financial planner is built in the next three months. We will connect our entire platform to a banking system, so we will offer a debit and credit card. »»

“All in one place, that’s the goal.”

With its head office in Draper, SMPL is positioning itself as “a life -focused life -based business business to align behavior on values, objectives and priorities”, according to Daniels.

He continued:

“We will be the best budgetary application, but it is because we come to the root of what all these things really matter. It is the alignment of behavior on values, objectives and priorities. This is our goal. This is why we are a life business, a life management business, not just a budget. »»

SMPL has aroused the world’s interest in their beta product and adopted the slogan, “Simple Live”.

“The principles are the same, that you live in India or the United States, you want to become and you want to live simple. This is what “simple living” means: to become. The way you do so by the alignment of these behaviors with your objectives, values and priorities. »»

“I am Japanese / Jew with the family of Hawaii and Japan. I am a daltonian and I love life and hike, snowboarding, photography, football, golf, food, people and more food. “Said Daniels.

“My call in the life I learn to learn is to help other people to achieve their goals and to live their dreams. It is like a drug for me. SMPL is like a way for me to do it literally For millions, if not billions of people people.

The beta version of SMPL is live now.

For more information, visit https://www.smpl.life/ And https://www.instagram.com/smpl.become/

Share this article