Dublin, February 15, 2024 (GLOBE NEWSWIRE) — The “Indian Fintech Market Competition, Forecast and Opportunities, 2028” the report has been added to ResearchAndMarkets.com offer.

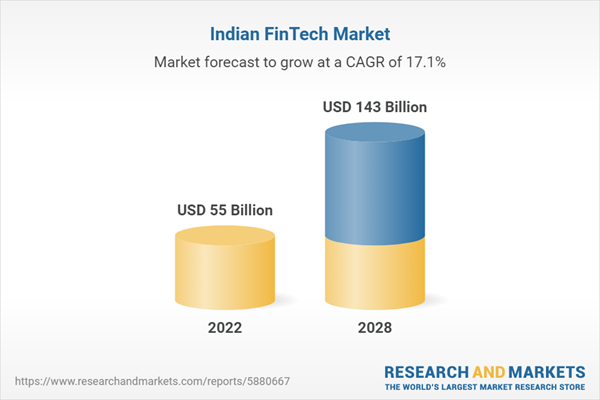

The Indian FinTech market is expected to continue its significant growth trajectory, supported by the pervasive trend towards online payment methods and the upsurge in digital transaction platforms. Government initiatives to foster the FinTech ecosystem, along with the emerging wave of FinTech startups, are the key factors envisaged to propel the expansion of the Indian FinTech sector through 2028, reaching a projected size of USD 143 billion with a CAGR by 17.1%.

Using technology to elevate and streamline financial service offerings is the foundation of FinTech businesses. Specialized software and algorithms on various platforms are contributing to this technological financial revolution. Market segments include PayTech, InsurTech, LendTech and WealthTech, each addressing a different facet of financial technology, from payments to insurance, lending and wealth management. Within these segments, PayTech, in particular, is seeing growing demand following the country’s post-demonetization push for online payments, highlighting a crucial shift towards digital transactions.

Indian fintech market growth supported by substantial smartphone and internet penetration

The rise in smartphone usage and internet penetration is paving the way for accelerated growth in the FinTech market. The National Investment Promotion and Facilitation Agency of India has identified that India has the second largest number of smartphone users in the world and is expected to become the second largest smartphone user market. Internet by 2026. The sharp increase in the number of households connected to the Internet further underlines the importance of the market. enormous potential. Innovations such as Bharat QR, introduced by the National Payments Corporation of India (NPCI), are instrumental in driving the country towards a cashless economy. Bharat QR interoperability is part of the country’s grand vision to adopt innovative and secure financial solutions.

Increase in online payments and government initiatives fuel market dynamics

The impressive growth trend in the Indian FinTech market is closely linked to the escalation of online payments. NPCI data reveals that a staggering number of transactions were facilitated through UPI over the past year, reflecting the deep penetration of digital payments in the country following government measures such as demonetization. Government schemes such as the Pradhan Mantri Jan Dhan Yojana (PMJDY) are instrumental in expanding financial inclusion, fostering a hospitable environment for FinTech companies to innovate technologically and meet the needs of the broad base of Indian consumers.

Market Trends: Startup Ecosystem and Emergence of the “Unicorn” in Indian FinTech

The FinTech startup landscape in India is booming, with a considerable number of companies achieving ‘unicorn status’. Government initiatives such as ‘Startup India’ incubate entrepreneurial businesses, contributing significantly to the country’s economic dynamism and job market.

- PayTech

- AssurTech

- ReadyTech

- Wealth Technology

Market Challenges and Opportunities in the Indian FinTech Landscape

Despite promising growth, challenges such as data security, user experience, regulatory frameworks and integration with existing banking systems pose obstacles for the FinTech sector. Nonetheless, the growing middle class and untapped markets in tier II and III cities present substantial opportunities for market players.

Regional market overview and key market players

The Indian FinTech market analysis encompasses different regional markets including North, South, East and West of the country. The report offers an in-depth insight into the key market players, setting the benchmark for excellence and innovation in the FinTech space. In conclusion, as the Indian FinTech market strives to reach unprecedented heights by 2028, it is set to transform the financial services landscape in India, supported by technological advancements, booming investments and government support, ensuring a more inclusive financial future.

Key attributes

| Report attribute | Details |

| Number of pages | 72 |

| Forecast period | 2022-2028 |

| Estimated market value (USD) in 2022 | $55 billion |

| Projected Market Value (USD) by 2028 | $143 billion |

| Compound annual growth rate | 17.1% |

| Regions covered | India |

A selection of companies mentioned in this report include:

- One97 Communications Limited (Paytm)

- Lendingkart Technologies Private Limited

- PhonePe Private Limited

- Google India Private Limited (Google Pay)

- Razorpay Software Private Limited

- Pine Labs Private Limited

- Policybazaar Insurance Brokers Private Limited

- Zerodha Broking Ltd

- InCred Financial Services Limited

- A MobiKwik Systems Limited (MobiKwik)

For more information on this report, visit https://www.researchandmarkets.com/r/jt7vwr

About ResearchAndMarkets.com

ResearchAndMarkets.com is the world’s leading source of market research reports and international market data. We provide you with the latest data on international and regional markets, key industries, largest companies, new products and latest trends.