-

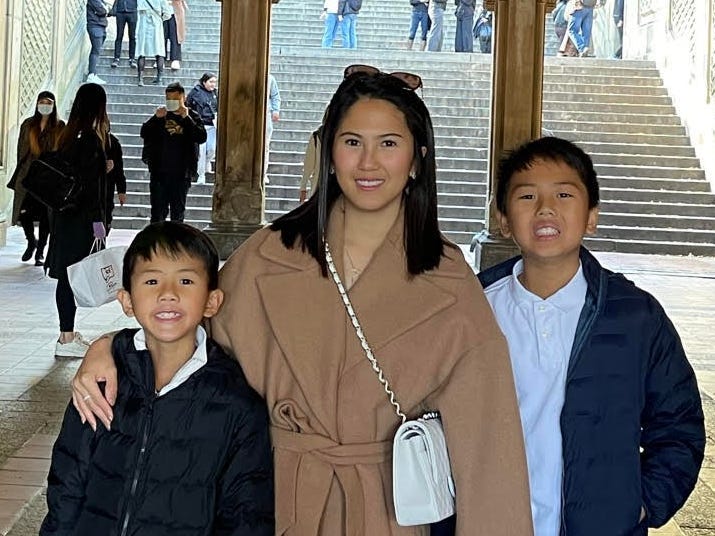

Jeanne Pastrano quit her $200,000-a-year job in New York after feeling burned out.

-

After a six-month break, she said she feels rejuvenated and ready to return to work.

-

She disclosed her sabbatical on her LinkedIn profile – and still found it easy to find a new job.

This essay as told is based on a conversation with Jeanne Pastrano, a 37-year-old mom based in New Jersey. Pastrano quit his job in April after feeling exhausted. This story has been edited for length and clarity. Business Insider reviewed compensation documents for his previous job and his current job as a strategic account manager at Sardine.

People always told me: “It’s thanks to you that being a working mom It looks so easy.” Maybe I did it – but that doesn’t mean it was easy.

I am 37 years old and I have two boys aged 10 and 12. I was an account manager at Adyena financial technology company until April. I loved my job and made about $200,000 a year. We lived in New Jersey and I worked in New York.

As a working mother, you put on a strong face, because if you don’t, a lot of things will fall apart. The only way to stay together is to be very organized and stay on top of things all the time – and that’s what I did. But that doesn’t mean I wasn’t exhausted at the end of the day.

I felt like I was stretching too much. When I was at home, I thought about work. When I was at work, I was also thinking about a million things I needed to do for the kids’ house. Over time, this feeling of inadequacy in both abilities built up.

For most of my career, I was the primary breadwinner, so my family depended on my income. There was this weight of everything that depended on me that I wanted to free myself from. Even when my husband’s career took a turn and he started taking over the majority of things financially, I just wanted to enjoy the break. I also wanted to become a full-time mother.

Quit my job was not an easy decision. I was in a good place professionally in a very stable company. This required months and months of planning and financial preparation. But I knew that if I didn’t take a break, I would always feel like I was missing the opportunity to take one.

I had a hard time slowing down during my sabbatical

The first day out of work actually slapped me in the face. During my first three months of unemployment, I was still running. I had been on the hamster wheel for too long.

I had household projects and volunteer work. I am very active in church. I had to do more work at home with the kids.

I never really slowed down and always felt overwhelmed. The chores and to-do lists were still piling up. Three months later, I wondered how I was still so busy after quitting my job. And I realized it was my fault. I didn’t know how not to work.

Eventually I was able to slow down a little more. I could be with the kids more in the summer and we could travel. It was my first time traveling without work, where there’s always that anxiety of checking email and the stress that once I get back to the office there will be a million fires to put out. So it was very refreshing.

I thought about leaving for good, but for those six months, I enjoyed the 9 to 5 job. Sometimes we love something but we just need to breathe.

I never thought I would be so ready to return to work or able to rekindle the enthusiasm I had at the start of my career, but I felt like I was already there after six months of sabbatical.

Some people work 20 to 30 years without a real break. I can’t imagine. Now I see myself working for another five to ten years, with just a vacation here and there.

Returning to the job market was easier than expected

About five months into my sabbatical, I started interviewing and was looking for the same type of role as before. I knew I wanted a fully remote job.

I know it seems like it can be difficult to return to work, but I was pleasantly surprised that that wasn’t the case for me. After six weeks of interviewing, I received an offer from a fintech startup – doing pretty much the same thing as before, with more equity opportunities.

I have been very transparent about my career break on LinkedIn and in interviews. The investigators were positive about it and completely understood. I explained exactly why I was taking a break, which seemed to interest them. It seemed like everyone knew what I was talking about because they also felt burned out at some point in their career.

If you are financially able and have reached a point in your career where you just need a break, I would absolutely recommend a sabbatical. I feel like this is why some companies offer a formal sabbatical.

I am so grateful that I was able to take this break and refresh myself before ending up with the dream job I was looking for.

Read the original article on Business Insider