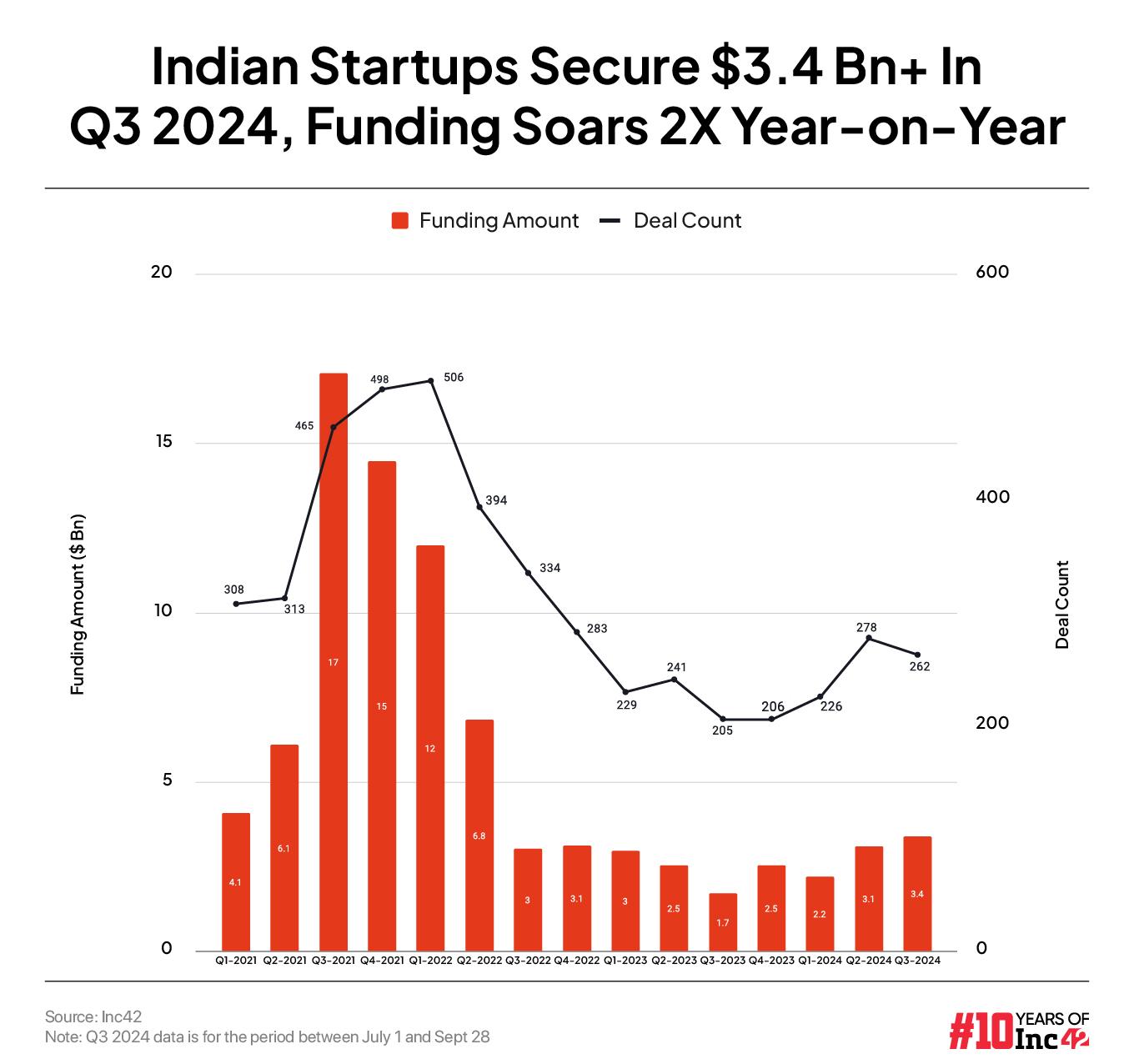

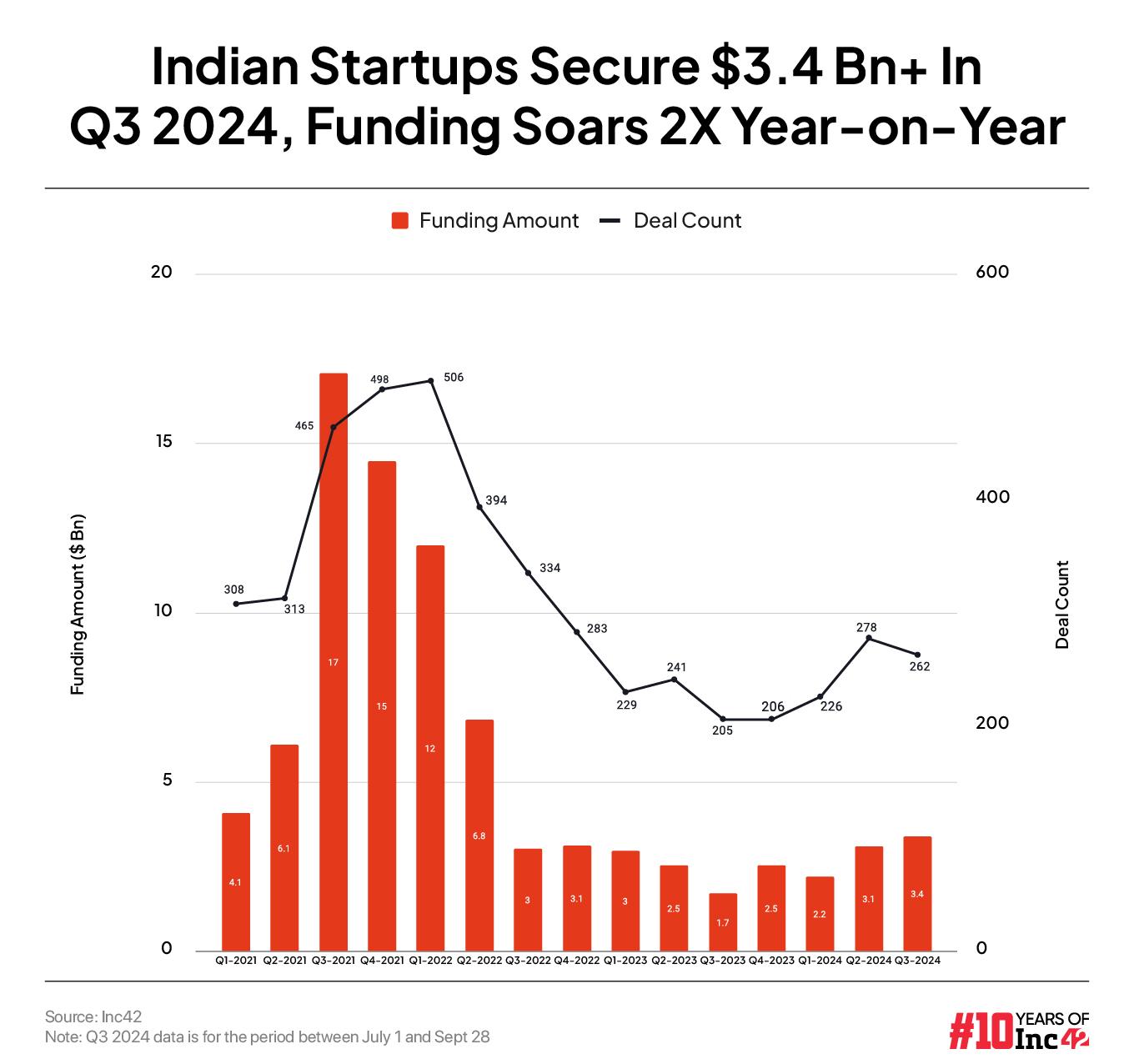

After a drought of almost two years, the Indian startup ecosystem is showing signs of the arrival of funding spring. Total funding raised by local startups doubled year-over-year (YoY) to $3.4 billion in the third quarter (Q3) of calendar year 2024 (CY24).

Indian startups raised around $1.7 billion in the corresponding period last year and nearly $3 billion in the third quarter of 2022.

The total number of transactions increased to 262 in the September 2024 quarter, an increase of almost 28% from the 205 transactions completed in the third quarter of 2023.

According to Inc42’s “Indian Tech Startup Funding Report, Q3 2024”, the median check size of transactions increased 142% to $2.9 million in Q3 2024, up from $1.2 million per year. last year, reflecting growing investor confidence in the Indian startup ecosystem.

Funding raised by Indian startups during the quarter under review was 10% higher than the $3.1 billion in Q2 2024 and 55% higher compared to $2.2 billion in Q1 2024.

However, mergers and acquisitions fell 33% year-on-year to 18 in the third quarter of 2024.

Mega deals are making a comeback

After a prolonged funding winter, the number of megadeals – funding rounds of more than $100 million – jumped to 10 in the September 2024 quarter, up from three in the third quarter of 2023 and four in the third quarter of 2022.

The number of megadeals stood at four and three in the June and March 2024 quarters, respectively.

Startups like Zepto, PhysicsWallah, and Rapido have led the way in mega-deals in Q3 2024.

Amid a rapid business boom, Zepto raised its second mega funding round this year in August, raking in $340 million from marquee investors such as Lightspeed Venture Partners, General Catalyst, and Dragon Fund, among others. The funding round took place just two months after the startup raised $665 million at a valuation of $1.4 billion.

At a time when edtech startups are facing a tough funding environment following BYJU’S woes, Alakh Pandey-led PhysicsWallah raised $210 million in the September quarter in a funding round led by Hornbill Capital.

Last month, Major Rapido became a unicorn after raising $200 million in its Series E financing round led by WestBridge Capital.

Other notable mega deals during the quarter included funding rounds for hotel major OYO and electric two-wheeler maker Ather Energy, which filed draft documents with market regulator SEBI for its Initial Public Offering (IPO) of INR 3,100 Cr.

Besides Rapido, Ather Energy and Moneyview joined the unicorn club in the September quarter. The world’s third-largest startup ecosystem has already created six unicorns in the first nine months of 2024, compared to just two unicorns for all of 2023.

Overall, funding raised by Indian startups approaches the $9 billion mark in the first nine months of 2024. Since the start of this year, Indian startups have raised a total of $8.7 billion, compared to $7.2 billion raised in all of 2023.

Rebound in seed, growth and late-stage investments

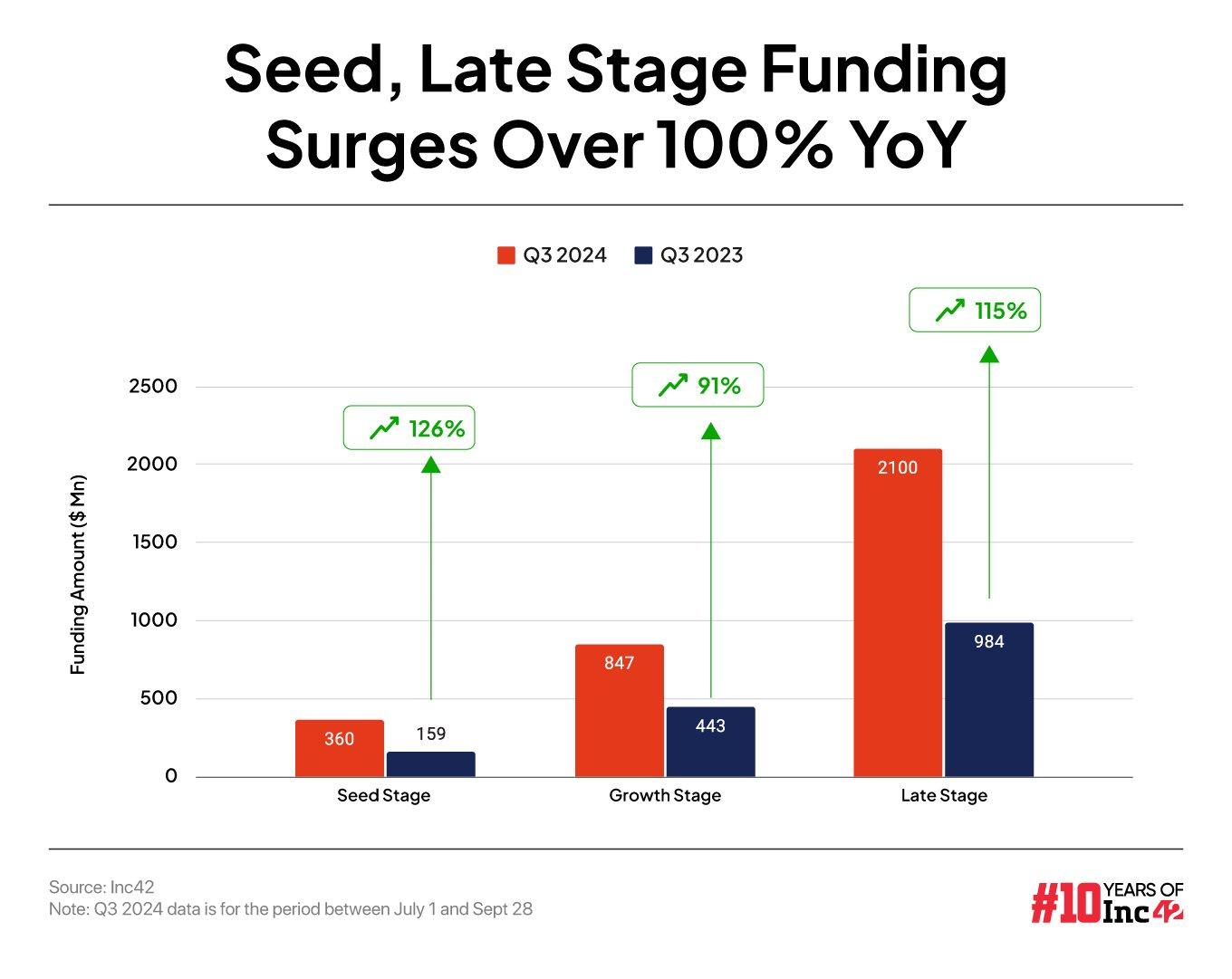

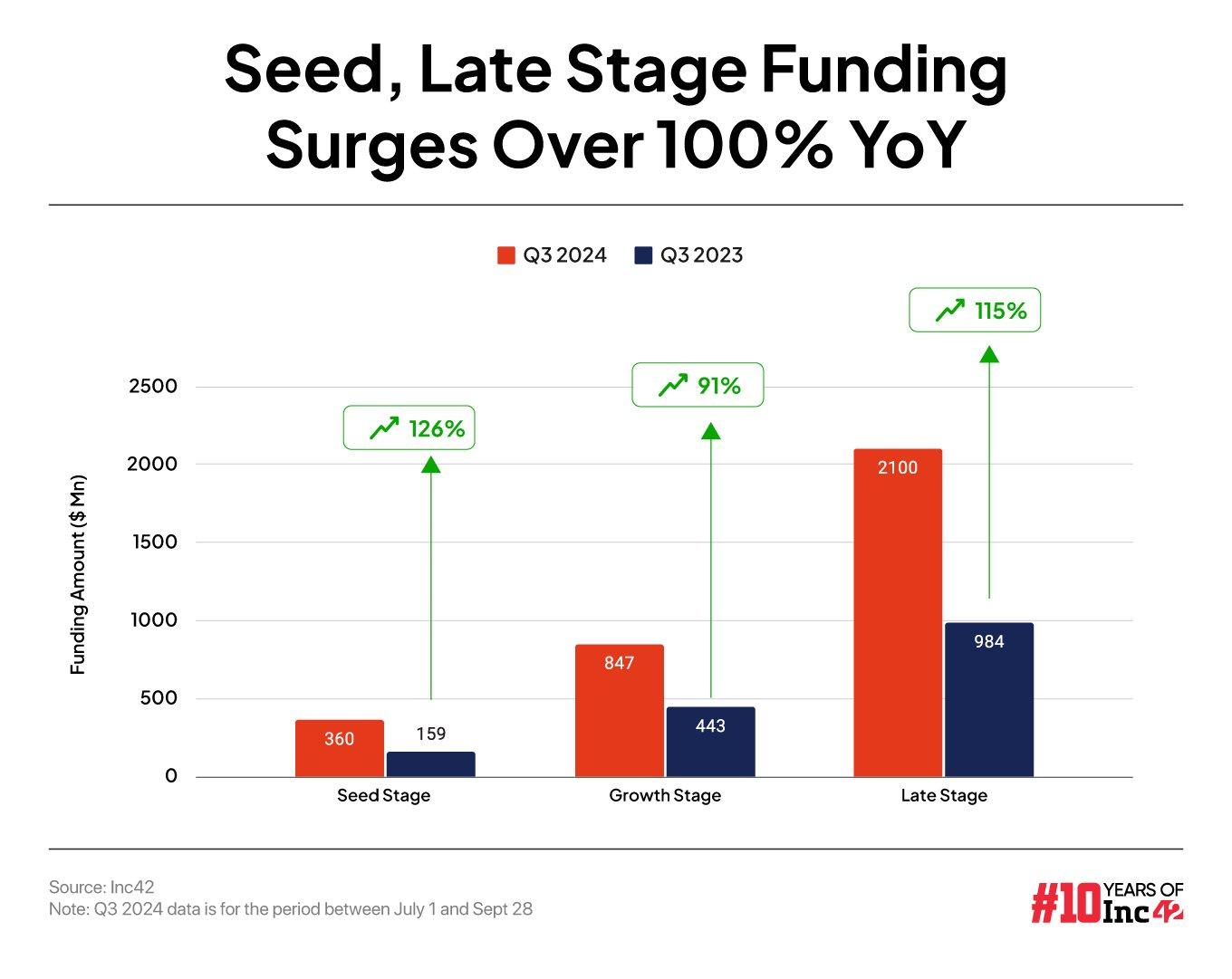

In line with overall funding trends, startups at all stages saw an increase in capital raised during the September quarter.

Seed-stage startups raised funds worth $360 million in Q3 2024, a whopping 126% jump from last year’s $159 million. However, the number of deals fell 3% year-over-year to 125 at the seed stage. Nutrix AI’s $27.5 million funding round and Centricity’s $20 million funding round were among the largest seed-stage deals during the quarter under review.

Growth-stage startups secured $847 million in funding in Q3 2024, up 91% from $443 million in last year’s quarter. Investors made 65 bets on growth-stage startups in the reported quarter, up 103% from 32 in Q3 2023. Notable deals included the $30 million funding round dollars from Everest Fleet and $42 million from Redcliffe Labs.

Meanwhile, late-stage investments jumped 115% to surpass the $2.1 billion mark in the quarter under review, up from $984 million in Q3FY23, thanks in part to $175 million from OYO from a group of investors including Patient Capital, J&A Partners, InCred Wealth, among others. Late-stage startups participated in 40 funding rounds in the September 2024 quarter, up 135% from 17 last year.

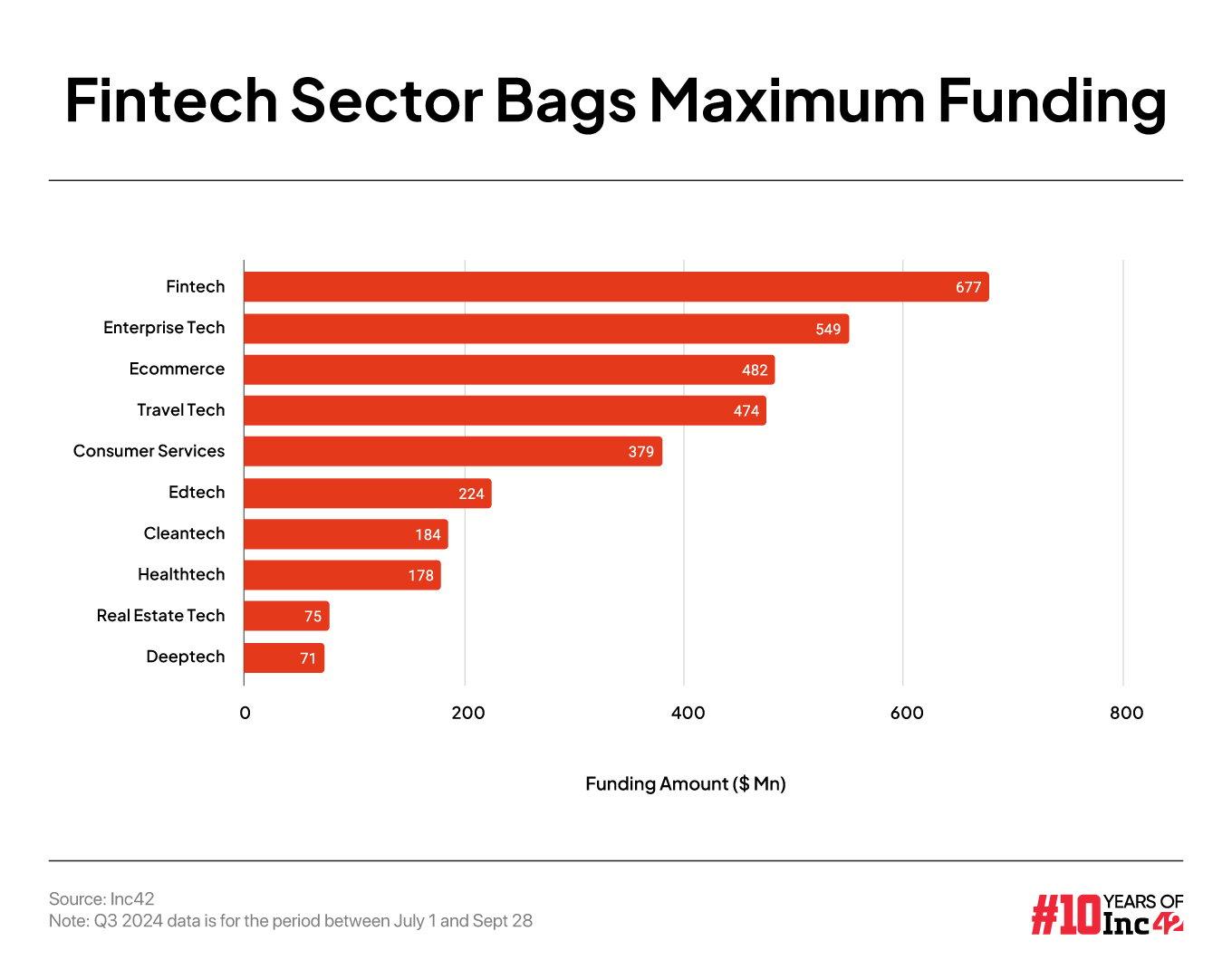

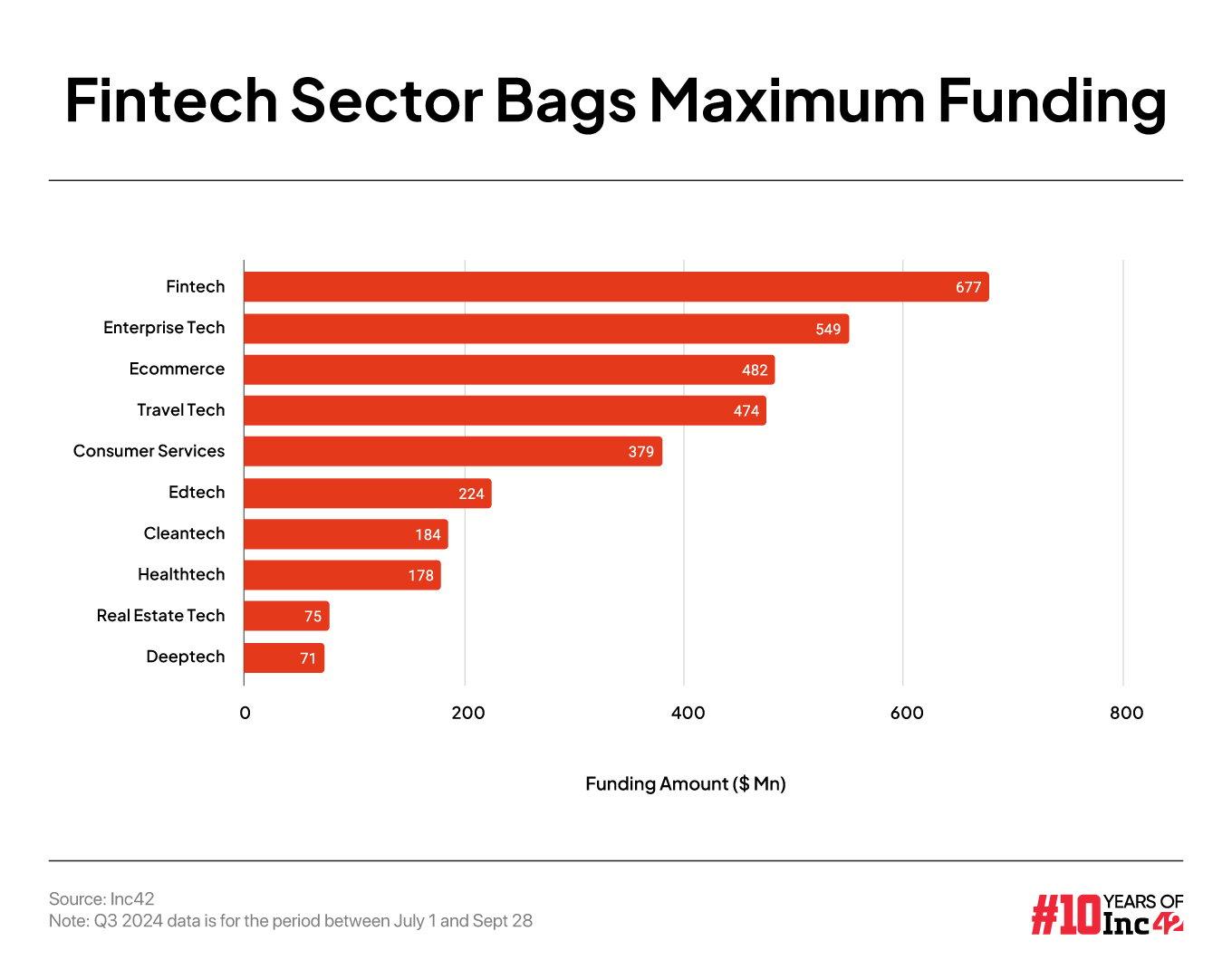

Fintech remains the darling of investors

The fintech sector continued to see maximum interest from investors, with fintech startups raking in $677 million across 45 deals in the third quarter of 2024. The September quarter saw several funding rounds notables in the Indian fintech space. For example, SaaS fintech startup M2P Fintech raised $101 million in its Series D funding round from investors like Helios Investment Partners and Flourish Venture.

Enterprise technology remained the second most funded sector, with startups in the sector raising a total of $549 million in 52 deals in the third quarter. The business technology sector received a boost last month when B2B SaaS startup Whatfix raised $125 million in its Series E funding round with participation from Warburg Pincus and SoftBank.

In a reversal of trend at the sector level, the September quarter saw consumer services lose its title as the third most funded sector to the e-commerce sector. E-commerce startups raised funds worth $482 million during the period in 57 deals. The main fundraisings in the sector, including that of Purplle of 120 million dollars and that of BlueStone of 107 million dollars.

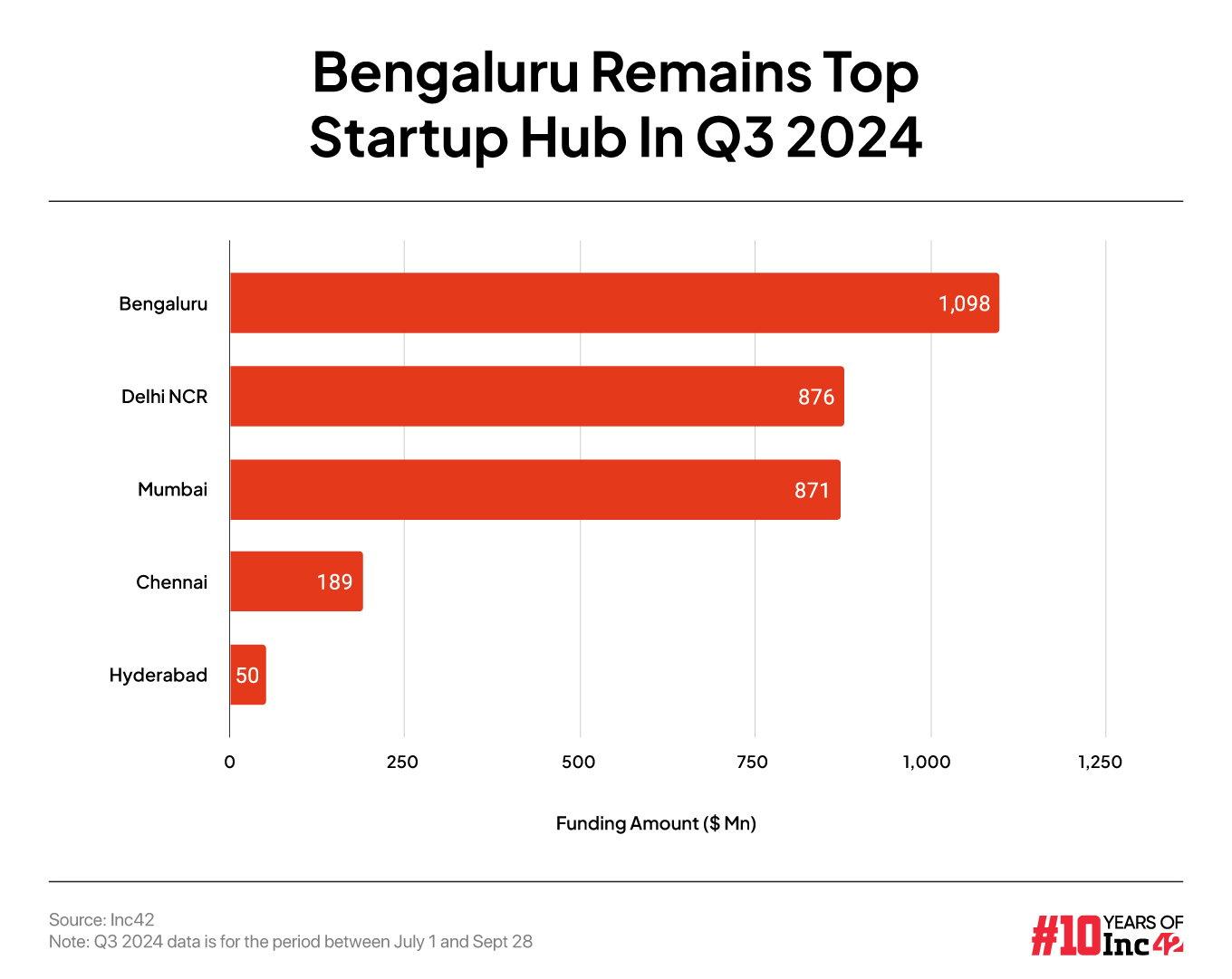

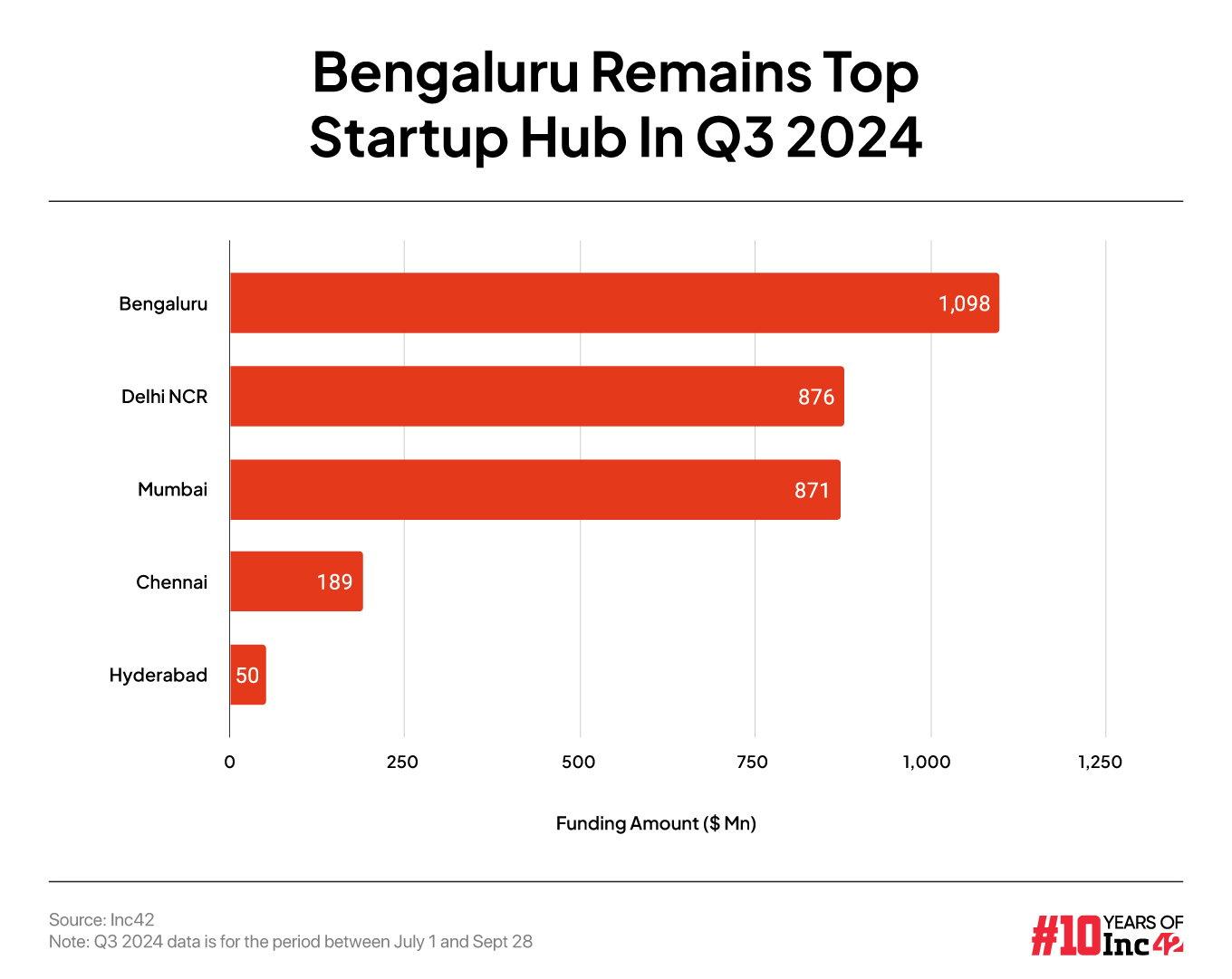

Bengaluru retains first place

While Bangalore retained its title as India’s startup hub, Delhi NCR overtook Mumbai to become the second most funded startup hub.

Startups based in India’s Silicon Valley raised $1.1 billion in 81 deals in the third quarter of 2024. Bengaluru was followed by Delhi NCR, with startups based in the National Capital Region raising $876 million in 59 deals. In third place is the country’s financial capital, with Mumbai-based startups raking in $871 million across 47 deals during the period.

Chennai retained the fourth spot in the third quarter of 2024, with startups based outside the city securing $189 million in funding across nine deals. For comparison, investors made 8 bets on Hyderabad-based startups during the quarter under review, worth $50 million.