The State of European FinTech Investments in 2025

In 2025, the European FinTech landscape experienced a notable downturn, marked by an 11% year-on-year decrease in investments. This contraction, driven by fluctuating market conditions, raises questions about the future of FinTech funding in Europe.

Key Investment Figures

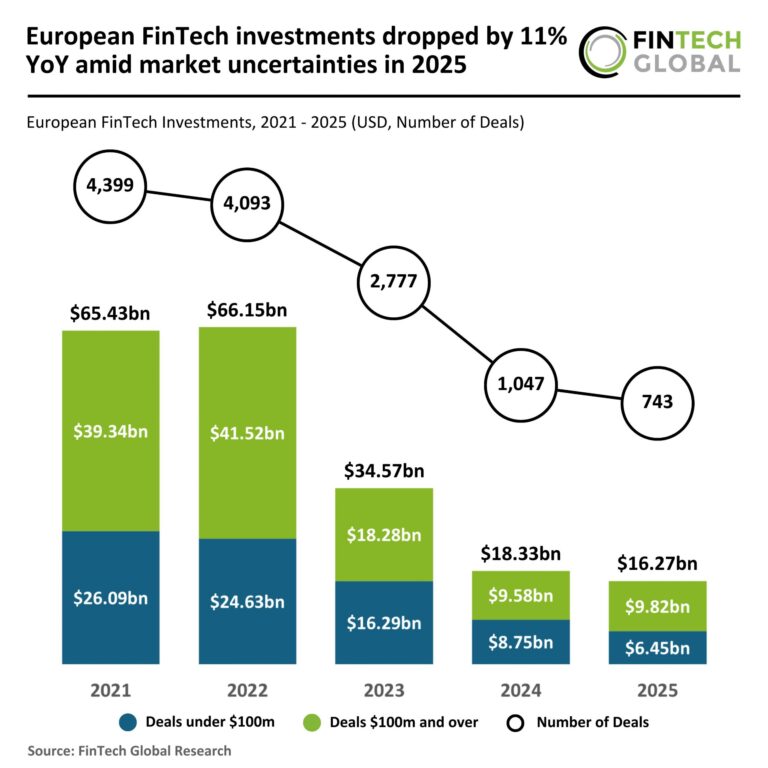

Total funding in European FinTech reached $16.3 billion across 743 deals in 2025, a significant drop from $18.3 billion across 1,047 deals in 2024. In stark contrast, 2021 saw a peak of $65.4 billion across 4,399 transactions, reflecting a staggering 72% decline in funding compared to the record highs of just a few years back.

Average Deal Size and Trends

Despite the downturn in funding, average deal sizes have seen an upward trend. The average deal size climbed from $14.9 million in 2021 to $21.9 million in 2025. This suggests a strategic shift where investors are focusing on fewer but larger transactions, indicating a preference for scaling established firms with proven revenue models.

Transactions Under $100 Million

The caution among investors is evident in the decline of transactions valued at less than $100 million, which fell by 26% to $6.5 billion in 2025. This number is significantly lower than the $8.8 billion recorded in 2024 and 67% down from $26.1 billion in 2021. In contrast, larger deals, those worth $100 million or more, reached $9.8 billion—a slight increase from the previous year but still down 76% compared to 2021 figures.

The Role of FNZ in European FinTech

Amid this evolving landscape, FNZ—a global end-to-end technology platform—emerged as a key player by securing a $500 million equity investment from its institutional backers. This investment not only bolsters FNZ’s financial infrastructure but also enhances its ability to innovate within the wealth management sector. The investment underscores investors’ trust in FNZ’s strategy to lead digital wealth transformation.

Strategic Growth and Future Outlook

FNZ’s recent financial activities highlight a strong commitment to expanding its capabilities and market reach. With ongoing strategic financing initiatives, FNZ is well-positioned to meet the demands of a rapidly changing financial environment. This reflects a profound confidence in the company’s long-term growth potential and its ability to adapt to the dynamic European FinTech landscape.

Conclusion

The year 2025 has been a defining moment for the European FinTech sector, showcasing a blend of challenges and opportunities. As investment patterns evolve, stakeholders must stay attuned to market trends and adapt their strategies accordingly. For continual insights into FinTech research and trends, stay connected with industry updates.

Copyright © 2026 FinTech Global