China’s Strategic Embrace of AI in Finance for the 15th Five-Year Plan

China is set to enhance the integration of artificial intelligence (AI) within its financial sector as part of its 15th Five-Year Plan (2026-2030). A central bank official emphasized the importance of a structured approach to harnessing AI technologies to support the development of a modern financial system aligned with the intelligent economy.

Recognizing AI’s Potential and Limitations

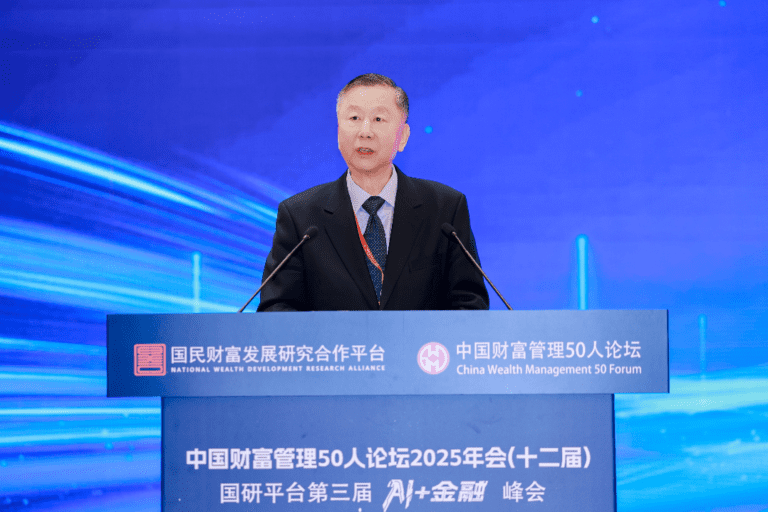

Li Wei, head of the technology department at the People’s Bank of China, highlighted the dual nature of AI capabilities at the recent China Wealth Management 50 Forum. He stated that while AI holds significant promise for revolutionizing financial services, its limitations must also be considered to ensure responsible implementation.

Developing a Comprehensive Fintech Strategy

During the upcoming Five-Year Plan, China plans to develop a comprehensive financial technology roadmap. This strategy will focus on expanding AI applications within finance, outlining clear policies for prudent AI use, and establishing national pilot bases to foster innovation while minimizing costs and barriers in the sector.

Setting Standards and Ethical Governance

As part of the initiative, Li mentioned that there will be efforts to create security standards for AI applications in finance. Alongside this, an ethical governance model for AI technologies will be developed to address potential risks, with a focus on systematically categorizing and managing high-risk applications.

Balancing Innovation with Regulation

Shang Fulin, chairman of the forum and a former top financial regulator, reiterated the need for a balance between innovation and regulation. He stressed the importance of encouraging financial institutions to explore AI in compliance with laws while simultaneously enhancing internal controls and risk management mechanisms.

Addressing Challenges in AI Implementation

Despite the potential benefits, the application of AI in finance comes with significant challenges. Shang noted that dependence on data and algorithms poses risks, especially if data sources are non-compliant. Additionally, the complexity of AI decision-making can create information asymmetries and new forms of risk.

Bridging the Digital Divide in Finance

Shang also warned of potential disparities created by the digital divide. While larger financial institutions can lead in AI adoption, regulators must ensure smaller entities are not left behind. A balanced approach to innovation and inclusivity in the financial sector is crucial.

At the conclusion of the conference, the formation of a financial investment alliance was announced to foster collaboration between finance and industry, aimed at channeling long-term investments into technological innovation. This initiative, supported by key financial and regulatory entities, marks a commitment to advancing China’s financial landscape.

For more insights on the future of AI in finance and China’s evolving financial ecosystem, stay tuned for updates.