Author: Charitarth Sindhu, Fractional Business & AI Workflow Consultant

Valentine’s Day is built on trust. It is also built on urgency. Those two ingredients are exactly what scammers and fraudsters look for. If you want a clean Valentine-fintech theme that is not fluffy, it is this: the holiday is a trust stress test.

The background trend is not comforting. Reported fraud losses have been rising sharply. The Federal Trade Commission says consumers reported losing more than $12.5 billion to fraud in 2024, a 25% increase from the prior year. The FTC also notes that the increase was driven by a higher share of people losing money, rising from 27% to 38%.

That matters because it suggests fraud is not only “more noise”. It is hitting more people. It is converting more often.

The FTC data also shows where the biggest money is going. Consumers lost more to investment scams than any other category, at $5.7 billion in 2024. Imposter scams were second at $2.95 billion. Those categories point to a core mechanism: trust manipulation. Either the scam sells a story about profit, or it sells a story about authority. Both rely on getting the victim to believe and comply.

Valentine’s scams often lean into the trust manipulation side, even when the scam is not explicitly framed as “romance”. The holiday creates a social opening for strangers to connect. It creates a socially accepted reason for gifts, payments, and transfers. It creates urgency because the date is fixed. These conditions can make people more open to persuasion and more willing to act quickly.

Now bring fintech trends into the picture.

A key detail from the FTC is that consumers reported losing more money to scams where they paid via bank transfers or cryptocurrency than all other payment methods combined. That is a big clue about what scammers prefer. They prefer methods that are fast and hard to reverse.

That same pattern shows up in the growth of real-time payments and authorised push payment scams. Authorised push payment scams are trust-based manipulation where a victim is deceived into willingly transferring funds. The hard part is that the payment can look legitimate in the system, because the victim authorised it. The scam is social, not technical. Real-time rails can make this worse because the window to stop the transfer is shorter.

ACI’s Scamscope research ties this to the expansion of real-time payments and forecasts a significant rise in authorised push payment scam losses. It projects total authorised push payment scam losses will climb to $7.6 billion by 2028 across six leading real-time payment markets. It also projects real-time payment authorised push payment scam losses will grow to $6.1 billion by 2028, making up 80% of total authorised push payment scam values.

This is not a niche issue. It is a structural issue. As payments get faster, the value of trust signals and intervention logic rises.

For merchants, Valentine’s brings another trust-related problem: disputes and chargebacks. Gifting holidays can increase chargeback pressure for a few basic reasons that do not require fancy theory. Buyers purchase in a rush. They misread delivery times. They regret a purchase. They order from unfamiliar merchants. They send items to different addresses. All of this raises the chance of a “something went wrong” moment. Some disputes are legitimate. Some are “friendly fraud”, where a customer tries to reverse a transaction after receiving the product or after changing their mind.

For fintechs and payment providers, the financial point is risk-adjusted margin. Valentine’s can look like great growth in volume, but fraud and disputes can eat the profit fast. A seasonal surge is not pure upside. It is upside plus a concentrated risk window.

There is also a retention angle that matters for any financial institution. ACI reports that one in four scam victims will leave their current financial institution. Whether or not that feels “fair”, it is how customers behave. People judge you by the outcome, not by how the scam technically happened. If they feel unprotected, they leave.

So what does a trust-first Valentine strategy look like in fintech terms?

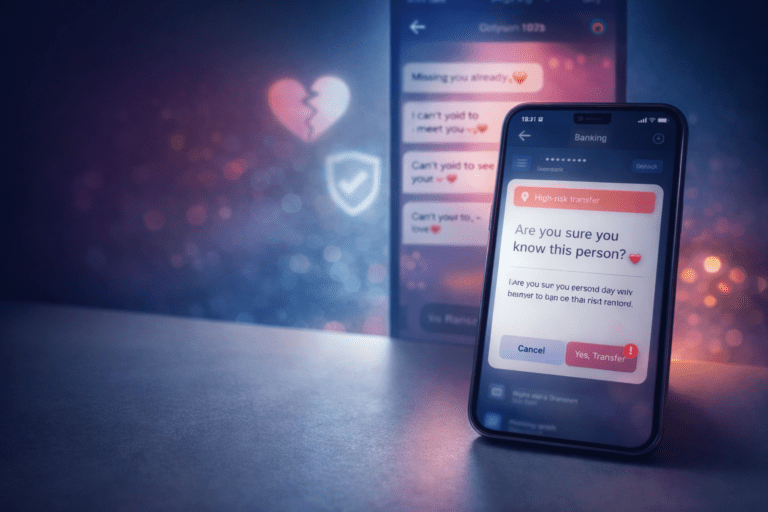

It starts with recognising that not all fraud is the same. Card theft and account takeover can be handled with traditional detection. Authorised push payment scams require different thinking because the victim is participating. That pushes product design toward proactive warnings, better verification in high-risk situations, and systems that can spot unusual behaviour patterns early enough to matter.

It also pushes banks and fintechs to be careful about what “speed” means. Speed is not only a feature. It is a trade-off. In a low-risk situation, speed is great. In a high-risk situation, a small pause can prevent a large loss. The best systems treat friction like a dial, not a constant. They add the smallest possible pause only when the risk is higher.

Valentine’s adds a final layer: emotion.

If your product messaging, your customer support, and your in-app warnings are cold or confusing, people ignore them. Under stress and urgency, people rely on simple cues. That is why trust tools must be clear and human. Otherwise, the moment passes and the scam wins.

The core conclusion is simple and grounded in the research points above.

Fraud losses are rising and affecting more people. Bank transfers and crypto are heavily represented in scam losses. Real-time payments increase the stakes because the window to stop bad transfers is shorter. Authorised push payment scam losses are forecast to grow materially in the coming years, and scam experiences drive customer churn. Valentine’s season is a predictable time when urgency and trust manipulation are more likely to work.

So yes, Valentine’s is about love. For fintech, it is also about keeping customers safe when they are most willing to act fast.