Breakfast News: AI Revolutionizes Tax Planning in Finance

February 11, 2026

Market Overview

| Tuesday Markets |

|---|

| S&P500: 6,942 (-0.33%) |

| Nasdaq: 23,102 (-0.59%) |

| Dow: 50,188 (+0.1%) |

| Bitcoin: $68,442 (-2.19%) |

AI Transforming Tax Planning

The financial services industry experienced significant upheaval with the introduction of Altruist’s latest AI-driven tax planning tool. This innovative solution, part of the Hazel AI platform, analyzes a variety of financial data, allowing advisors to create tax strategies for their clients in just minutes. As AI continues to penetrate the finance sector, the impact on traditional financial firms has been palpable.

Market Reactions

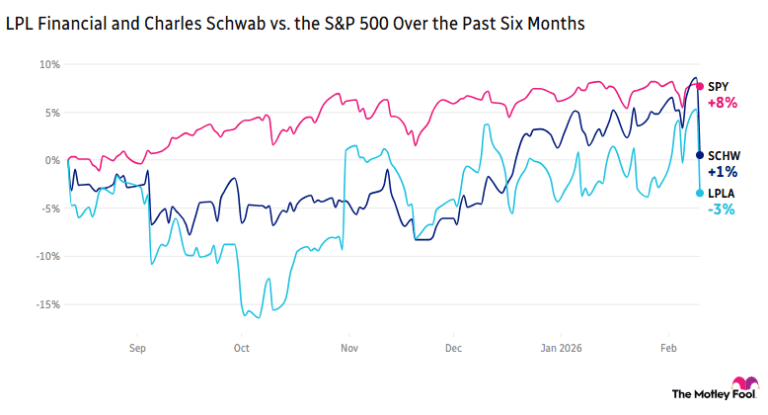

The announcement caused a notable decline in shares of established financial firms. LPL Financial saw its stock drop by over 8%, while Charles Schwab experienced a decrease of 7.4%. Jason Wenk, CEO of Altruist, emphasized that Hazel not only streamlines tax planning but also amplifies the capacity of individual advisors to serve more clients effectively.

After-Hours Earnings: Noteworthy Performers

In the latest earnings reports, Cloudflare reported a remarkable 34% year-over-year revenue increase, causing its stock to surge by 14% in after-hours trading. Conversely, Upstart’s stock saw minimal movement despite a 35% increase in revenue, as its profits fell short of expectations. Gilead Sciences reported a modest 5% revenue increase, leading to a slight decline in its stock value.

Biggest Decliners of the Day

Several companies faced steep declines, with Mattel’s shares plunging 30% following disappointing Q3 earnings. Moderna also encountered setbacks as the FDA rejected its mRNA seasonal flu vaccine application, resulting in a 9% drop in premarket trading. Meanwhile, Hims & Hers continued to struggle, falling 11% as it withdrew its Wegovy competitor due to legal challenges.

Quarterly Results from Popular Stocks

Shopify showcased impressive growth with a 30% increase in full-year revenue, propelling its stock by over 10% premarket. Unity Software, despite surpassing revenue expectations, faced a decline of around 20% in early trading due to a substantial quarterly net loss.

Looking Ahead

As AI technologies increasingly shape the finance world, companies must adapt or face the repercussions of innovation. As we await more quarterly results, the market’s response to these changes will be critical. Investors should keep an eye on how traditional financial firms respond to AI advancements and the ongoing earnings seasons from tech giants.

Your Thoughts

With Hims & Hers down 65% over the past six months, many investors are left wondering which companies might pivot successfully. Share your confidence in a struggling public company and discuss why you believe it can turn things around with those around you, or join the conversation online.