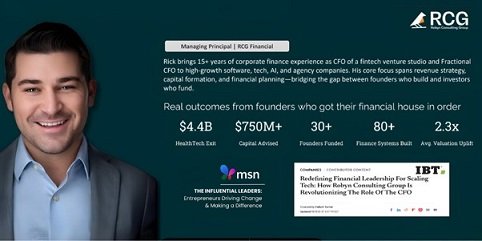

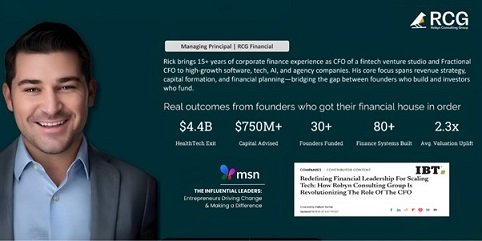

Photo credit: Richard Sánchez

The Shift Towards Predictive Finance

As we approach 2026, the landscape of finance is evolving rapidly. Businesses can no longer afford to let finance remain a passive function. The necessity for predictive finance, driven by advanced AI tools, has emerged as a vital need for forward-thinking companies.

Understanding the Evolution of Finance

Richard Sanchez, the CEO of Robyn Consulting Group, recognized the critical role of finance in startup success early on. His experiences with startup failures prompted him to rethink financial support for emerging businesses, leading to a model that anticipates future challenges rather than merely recording past events.

The Limitations of Traditional Financial Reporting

While historical financial reports provide context, they often struggle to assist in current decision-making. Traditional finance teams focus on past data but fail to deliver real-time insight into business operations. This lag can delay founders’ awareness of potential financial issues, hindering their ability to adapt and plan effectively.

The Modern CFO: A Strategic Partner

Today’s CFOs are transitioning from mere compliance officers to dynamic strategic advisors. They assess real-time scenarios and provide insights that drive product and operational decisions. This shift is evident in the practices at Robyn Consulting Group, where an emphasis on live forecasting and real-time input demonstrates the growing trend of Finance-as-a-Service.

Leveraging AI for Future Forecasting

AI technologies empower finance teams to create more accurate models by analyzing real-time data. Instead of waiting for regular reports, founders can access continuously updated insights into cash flow and other key metrics, allowing for more confident operational decisions.

The Importance of Swift Decision-Making

In today’s fast-paced business environment, the speed of decision-making can determine a company’s success. AI-driven finance tools minimize uncertainties, enabling founders to respond promptly to market changes. Particularly in sectors like SaaS and Fintech, where even minor adjustments can significantly impact financial performance, this agility is critical.

Predictive Finance: A Competitive Edge

Embracing AI-powered finance strategies can position companies favorably in a competitive market. By enhancing visibility and improving fiscal control, organizations can better position themselves to attract investors. Richard Sanchez emphasizes this on his LinkedIn, advocating for the power of strategic finance.

Preparing for 2026: Is Your Business Ready?

With rising expectations from investors and the competitive landscape, businesses must shift away from relying solely on historical data. Predictive finance provides a clear path forward, allowing founders to execute their growth strategies with confidence and clarity.

To dive deeper into the evolution of financial leadership, explore this insightful article on IBTimes. As companies adopt predictive finance, the real question is: How long can you afford to operate without it?