Malta: A Fintech Hub in Europe

Malta has emerged as a leading fintech destination in Europe, offering a robust ecosystem that fosters innovation and growth in the finance technology sector. With its impressive technological infrastructure, highly educated workforce, and a progressive regulatory framework, Malta is a prime location for entrepreneurs looking to scale their fintech ventures within the region.

Government Initiatives Supporting Fintech Growth

The Maltese government recognizes fintech as a critical growth area and has implemented a variety of policies to support this sector. The Malta Financial Services Authority (MFSA) has developed a comprehensive Fintech Strategy based on six strategic pillars: regulation, ecosystem, architecture, international links, knowledge, and security. This initiative aims to establish Malta as a global leader in financial technology.

Innovative Programs: Fintech Regulatory Sandbox

Part of the MFSA’s strategy includes the launch of the Fintech Regulatory Sandbox in 2020. This program allows startups to pilot their solutions under real-world conditions, receiving guided feedback and regulatory oversight. The MFSA also manages the Office of Innovation, which assists fintech startups in navigating regulatory landscapes and identifying opportunities for growth.

Supporting Digital Innovation: Malta Digital Innovation Authority

Another cornerstone of Malta’s fintech ecosystem is the Malta Digital Innovation Authority (MDIA), established in 2018. The MDIA provides crucial advisory support aimed at fostering the adoption of digital technologies. It operates the Digital Innovation Center (DiHubMT), which offers essential resources for startups and small to medium-sized enterprises (SMEs).

Regulatory Framework for Cryptocurrencies

Malta is a trailblazer in the regulation of cryptocurrencies, having introduced the Virtual Financial Assets Act (VFA) in 2018. This regulatory initiative is set to transition to the Markets in Crypto-Assets Act (MCAA) by 2024, aligning local laws with the EU’s MiCA regulations.

Financing Opportunities for Startups

To strengthen its fintech landscape, Malta also offers a range of financing programs designed to support emerging businesses. Notable initiatives include:

- The Startup Finance Scheme, providing up to €1.5 million per startup;

- The Seed Investment Scheme, offering tax credits of up to 35% to angel investors;

- The Malta Venture Capital Fund, launched in 2024 with €10 million dedicated to high-growth companies.

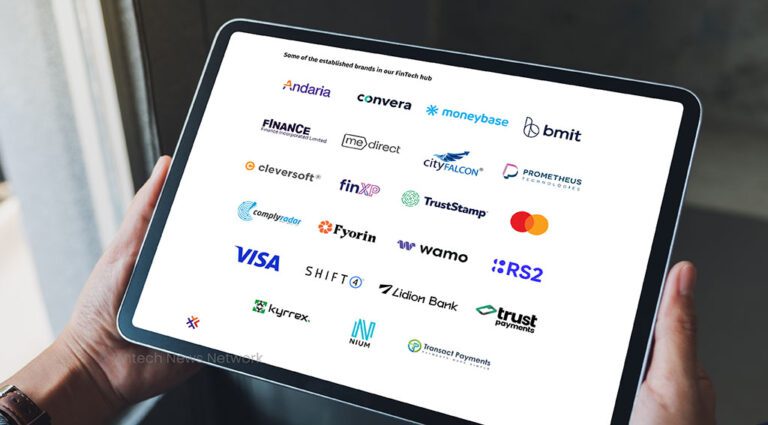

A Thriving Fintech Community

Malta’s favorable regulatory environment has attracted a diverse array of fintech companies, from large corporations to emerging startups. With more than 36 electronic money institutions (EMIs) and over 30 payment service providers (PSPs) operating within its borders, Malta’s payment sector is among the most advanced in Europe. Key players include Papaya, SysPay, and Truevo Payments, all of whom contribute significantly to the local fintech economy.

Foreign Investment and International Expansion

As a testament to its appeal, several international fintech firms have established their European headquarters in Malta. Notable examples include Gemini and OKX, both of which recognize Malta’s advantageous position for compliance and regulatory clarity in the blockchain and cryptocurrency sectors. Additionally, Malta’s diplomatic ties, especially with African nations, offer unique opportunities for expansion into fast-growing markets.

In conclusion, Malta’s dynamic fintech ecosystem is supported by a robust financial services sector. In 2025, the industry accounted for 8.2% of the country’s real gross value added (GVA), employing over 14,700 people, which highlights the vital role fintech plays in Malta’s economy. With continuous growth and investment in this sector, Malta is poised to remain a leader in the fintech landscape for years to come.