NVIDIA’s Annual AI Report Unveils Trends in Financial Services

NVIDIA has published its sixth annual report titled “NVIDIA: State of AI in Financial Services”, based on a survey conducted with over 800 industry professionals from around the globe. This report not only highlights areas of AI growth that one might expect from a leading AI chipmaker but also emphasizes significant use cases where major institutional players within the financial services sector are achieving efficiencies and return on investment (ROI).

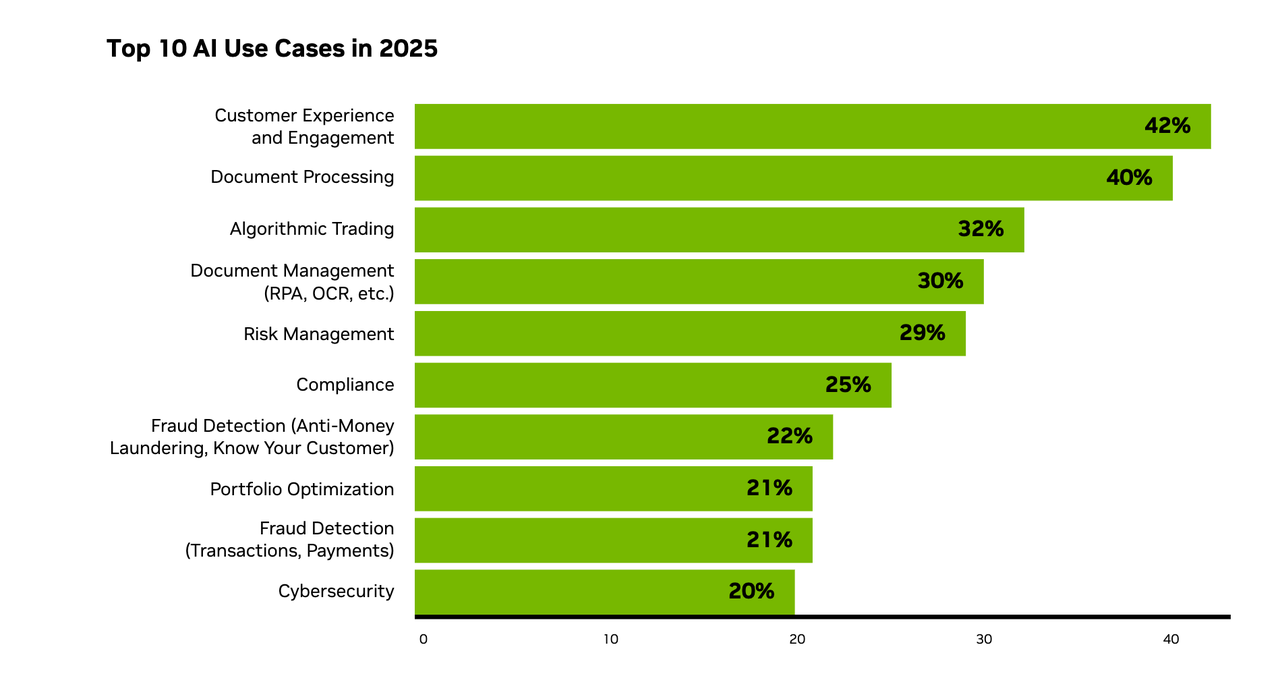

Among the notable applications of AI in finance, areas such as fraud detection, risk management, and customer service have taken center stage. These are commonly discussed instances where AI is proving beneficial. Respondents reported a consistent trend: nearly all participants indicated there would be no decline in AI budgets, with expectations for budgets to either increase or remain stable over the coming year. Overall, the implementation of AI technologies is evident, with 65% of respondents stating their companies are actively leveraging AI, up from 45% in the previous year’s findings.

Delving deeper into types of AI adoption, the report found that 61% of industry respondents are utilizing or assessing generative AI, a notable rise from 52% year-over-year. Interestingly, 42% are also exploring agentic AI, with 21% reporting they have already deployed AI agents. Furthermore, 84% acknowledged that open-source models and software play an essential role in their AI strategies.

The report outlined several challenges associated with agentic AI. Performance reliability issues, including concerns over accuracy and unpredictability, were cited by 34% of the respondents. Others highlighted a lack of in-house expertise (33%), data privacy and sovereignty issues (30%), implementation difficulties (28%), and regulatory and ethical considerations (28%). These insights prompt reflection on the evolving landscape of AI in financial services advisory technology.

Emerging AI Solutions in Advisor Prospecting

As competition intensifies within the emerging realm of AI-driven advisor prospecting platforms, notable advancements are being made. Recently, DataLign Consulting announced the beta launch of Relationship AI. This feature aims to identify significant monetary events that might signal pivotal moments in prospects’ lives, a functionality reminiscent of competitors like Aidentified and FINNY.

Relationship AI will offer advisors concise briefings that can be scanned in 30 seconds, providing key insights across various topics relevant to prospects, dubbed “Conversation Starters.” Additionally, it will inform advisors about prospects’ outreach preferences and relevant wealth indicators, such as recent life changes like job transitions or property purchases.

Partnering for Innovation and Growth

This week also saw a significant partnership between Jump’s automation platform and Focus Financial Partners, marking an expansion in Jump’s client base and further embedding AI technology in wealth management. Focus has recently undergone a reorganization, consolidating assets under its Focus Partners Wealth division, which currently oversees around $500 billion in client assets. The collaboration with Jump positions Focus as a leader in integrating AI solutions for enhanced advisor productivity.

As the financial services landscape continues to evolve, tracking these technological advancements and understanding the adoption challenges will be crucial. AI is set to become an integral component in driving efficiencies and insights, heralding a new era for the industry.