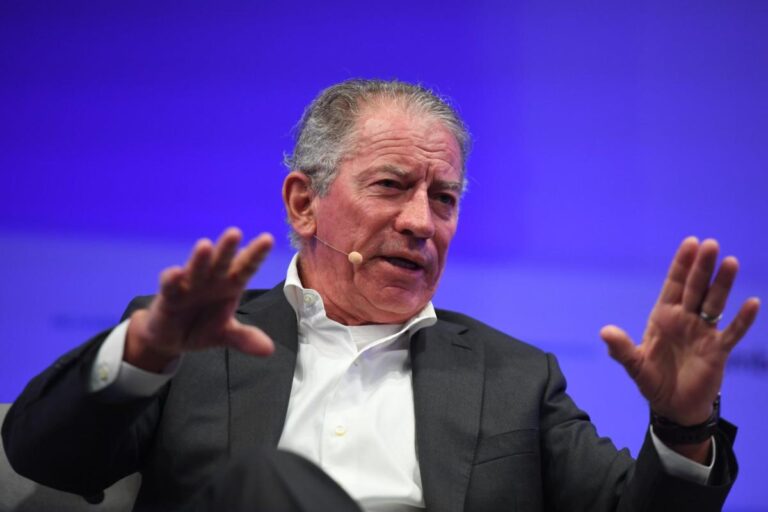

Everywhere CEO of C3.ai Tom Siebel will he answer the same question about the future of AI.

“Everyone asks me, ‘Is there a bubble here?’ »There is absolutely a bubble. It’s huge,” he said. Fortune in an exclusive interview at C3.ai’s New York offices in Midtown We work.

Over the past two years, analysts have thoughtful whether AI companies, both public and private, could possibly be up to the task to their high evaluations. Tom Siebel, who built his career in Silicon Valley as a sales executive at Oracle before leaving to create his own business which he finally sold to his former employer for $5.8 billion, the current state of AI reminded him of the Internet bubble. Even then, a great and wonderful technology – the Internet – could not prevent a multitude of businesses from collapsing.

“So we have this similar phenomenon with generative AI that we saw with previous technologies,” Siebel said. “The market is grossly overvalued.”

Technical analysts who Fortune The interviewees generally agreed with Siebel’s view that valuations across the sector were inflated. “For now, virtually every notable AI company enjoys some degree of investor hype,” said Sandeep Rao, principal researcher at Leverage Shares, an ETP provider.

C3.ai specializes in enterprise AI applications that help companies with various business functions such as optimizing their supply chain, predictive maintenance, and monitoring their sales process. It also has a string of lucrative government contracts with the likes of the US Department of Defense and the US Air Force. Among its largest private sector clients are the oil and gas giant Shell and energy company Baker Hughes (whose contract is to renew Soon).

Earlier this week, C3.ai added another premier partner to its ranks when it announcement a partnership with Microsoft. FortuneSiebel’s interview was conducted before the partnership was publicly revealed.

Siebel notably targeted OpenAI, the startup closely linked to Microsoft and it is perhaps the one most closely associated with the AI revolution. OpenAI currently has a Valuation of $157 billion following a funding round in October in which it raised $6 billion. Siebel was not impressed by this assessment.

“No one would be surprised if this company disappeared next Monday,” he said.

When Fortune Venturing that industry observers would be surprised, Siebel responded that he “disappeared” on Thanksgiving, a reference to the brief expulsion from OpenAI CEO Sam Altman in 2023.

“If it disappeared, it wouldn’t make a difference in the world,” Siebel said of OpenAI. “Nothing would change. I mean, no one’s life would change. No business would change. Microsoft would find something else to power Copilot. There are about 10 other products available that would do just as well.