GCC fintech market overview

Reference year: 2023

Historical years: 2018-2023

Forecast years: 2024-2032

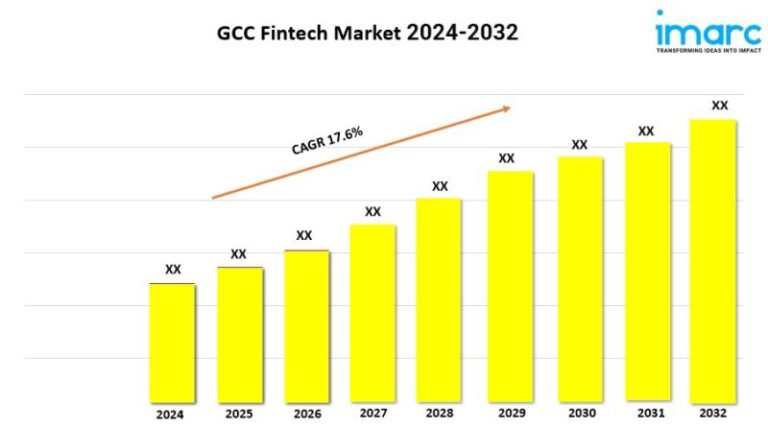

Market growth rate: 17.6% (2024-2032)

The GCC fintech market is growing due to digital transformation, growing adoption of mobile banking, regulatory support and growing investment opportunities. According to the latest report by IMARC Group, the market is expected to grow at a CAGR of 17.6% from 2024 to 2032.

GCC Fintech Market Trends and Drivers:

Growing digital transformation efforts along with a strong push towards cashless economies are the factors contributing to the growth of the GCC fintech market. Additionally, the market is booming as government authorities in the region prioritize financial inclusion and innovation, fueling the rise of fintech services such as mobile payments, digital banking and blockchain solutions. The growing adoption of smartphones and high internet penetration have further accelerated the use of fintech services, allowing consumers and businesses to access financial services more easily, thereby strengthening the market. Additionally, the COVID-19 pandemic has intensified the shift to digital payments and contactless transactions, making fintech a crucial part of the region’s financial ecosystem.

Rising regulatory frameworks and support from government authorities aimed at fostering innovation in the financial sector are increasing the GCC fintech market. Additionally, central banks and regulators are actively launching initiatives to encourage the growth of fintech startups, such as regulatory sandboxes and open banking frameworks. This environment attracts local and international fintech companies to the region. Furthermore, the growing demand for Islamic fintech solutions is accelerating, with the development of Shariah-compliant financial products and services becoming a key driver of market growth. As consumers look for more convenient, secure and efficient ways to manage their finances, the GCC fintech market is expected to grow in the coming years, with a focus on digital innovation, inclusion financial and favorable regulatory advances.

Request a free sample report: https://www.imarcgroup.com/gcc-fintech-market/requestsample

GCC Fintech Market Report Segmentation:

The report has segmented the market into the following categories:

Deployment mode information:

• On site

• Cloud-based

Technology Insights:

• Application programming interface

• Artificial intelligence

• Blockchain

• Robotic process automation

• Data analysis

• Others

Application information:

• Payment and fund transfer

• Loans

• Insurance and personal finance

• Asset management

• Others

End user information:

• Bank

• Insurance

• Titles

• Others

Country overviews:

• Saudi Arabia

• WATER

• Qatar

• Bahrain

• Kuwait

•Oman

Contact our analysts for brochure requests, customization and pre-purchase inquiries: https://www.imarcgroup.com/request?type=report&id=10530&flag=C

Competitive landscape:

The report offers an in-depth look at the competitive landscape. It includes an in-depth competitive analysis encompassing market structure, positioning of key players, key success strategies, competitive dashboard and business assessment quadrant.

Highlights of the report:

• Market performance (2018-2023)

• Market outlook (2024-2032)

• Impact of COVID-19 on the market

• Analysis of Porter’s five forces

• Strategic recommendations

• Historical, current and future market trends

• Market drivers and success factors

• SWOT analysis

• Market structure

• Value chain analysis

• Complete mapping of the competitive landscape

Note: If you require specific information that is not currently within the scope of the report, we can provide it to you as part of the customization.

Browse the latest research reports:

GCC Jewelry Market: https://www.imarcgroup.com/gcc-jewelry-market

UAE Facilities Management Market: https://www.imarcgroup.com/uae-facility-management-market

UAE Oil and Gas Market: https://www.imarcgroup.com/uae-oil-gas-market

UAE Paints and Coatings Market: https://www.imarcgroup.com/uae-paints-coatings-market

UAE Telecommunications Market: https://www.imarcgroup.com/uae-telecom-market

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, United States

Email: sales@imarcgroup.com

Telephone number: (D) +91 120 433 0800

United States: +1-631-791-1145

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers create lasting impact. The company offers a full range of market entry and expansion services. IMARC offerings include in-depth market assessment, feasibility studies, business formation assistance, factory setup assistance, regulatory approvals and licensing navigation, branding strategies, marketing and sales, competitive landscape analysis and benchmarking, pricing and cost research, and purchasing research.

This version was published on openPR.