The new product will allow users and merchants to make or receive payments directly in chats

The integrated payment solution will offer users multiple payment modes including credit cards, debit cards, UPI as well as wallet payments

On the B2B side, MobiKwik believes that the integration will enable MSMEs to reach a wider customer base through WhatsApp’s user network.

Zaakpay, the payment gateway arm of fintech startup MobiKwik, has partnered with social media giant Meta to offer in-app payments on WhatsApp.

The new product will allow users to make payments directly in chats, while merchants will also be able to receive payments directly in WhatsApp.

“Zaakpay’s payment gateway, within a single chat window, enhances the security of its users by centralizing all transactions in a secure interface. By integrating advanced encryption protocols, Zaakpay ensures customer convenience and transaction security,” MobiKwik

Available to both end consumers and businesses, the integrated payment solution will offer users multiple payment modes including credit cards, debit cards, UPI as well as wallet payments.

On the B2B side, the fintech startup said the integration will enable MSMEs to reach a wider customer base through WhatsApp’s user network, especially in tier II and III cities.

In a statement, MobiKwik said the new offering will provide flexibility and convenience to users and improve business efficiency for merchants. The new product line will aim to leverage the growing demand for conversational commerce and integrate payments into the core application stack.

“By combining Zaakpay’s secure payment gateway with WhatsApp’s vast user base, we aim to tap into the immense potential in the Indian hinterland. We are creating an ecosystem where shopping, payments and business relationships happen seamlessly in one place…”, said Harvinder Singh Chadha, Chief Business Officer, ZaakPay.

Commenting on the collaboration, Ravi Garg, Director, Commerce Messaging, Meta India added, “…This integration with Zaakpay is another step in creating a more seamless shopping experience, enabling people to make payments using their preferred payment method for a product or service they wish to purchase from a business right within their WhatsApp chat.”

The move comes nearly a year after MobiKwik-owned Zaakpay received in-principle approval from the Reserve Bank of India (RBI) to operate as an online payment aggregator (PA). The license has opened the doors for the company to offer payment aggregation services and onboard new merchants.

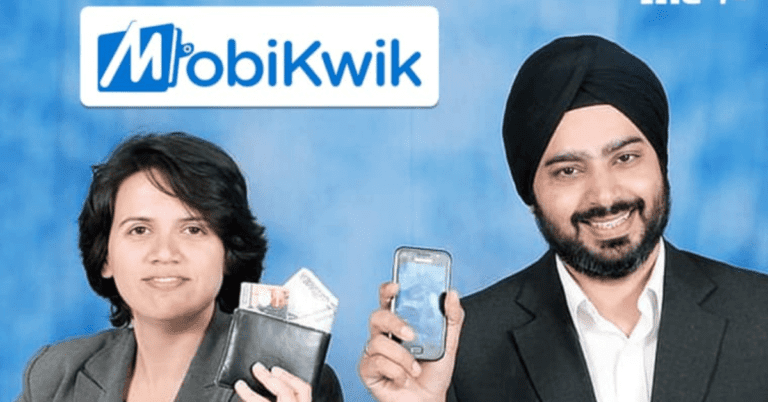

Founded in 2009 by Bipin Preet Singh and Taku, MobiKwik, which is set to go public, offers a range of financial products for consumers and merchants, including payments, digital credit and investments. It became a unicorn in October 2021 after a secondary sale of its employees’ stock options pushed its valuation above the $1 billion mark.

The Delhi NCR-based company turned profitable in the financial year 2023-24 (FY24) and reported a net profit of INR 14.1 crore against a net loss of INR 83.19 crore in the previous financial year. At the same time, operating revenue jumped 62% to INR 875 crore in the financial year ended March 2024, compared to INR 539.5 crore in FY23.

THE The fintech startup has resubmitted its draft “red herring” prospectus earlier this year to raise INR 700 crore through its initial public offering (IPO), which will comprise only a fresh issue of shares without any offer for sale element.