Listen and subscribe to Opening Bid at Apple Podcasts, Spotify, YouTube or wherever you find your favorite podcasts.

The big hitters are clamoring for market share from chipmaker and artificial intelligence wunderkind Nvidia (NVDA), but they face an uphill battle.

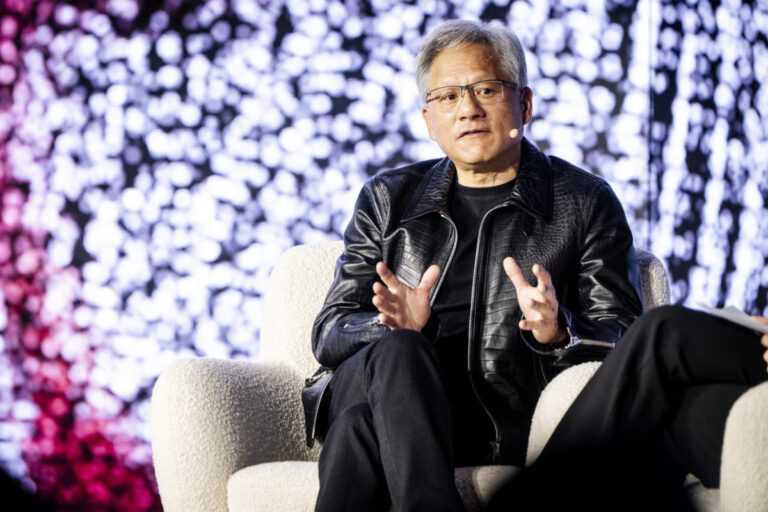

“(An Nvidia chip) is not just a chip,” the Bank of America analyst said. Vivek Arya in a conversation with the editor-in-chief of Yahoo Finance Brian Sozzi on the Opening offer podcast (see video above or listen below).

Arya is considered one of the top semiconductor analysts on Wall Street and has been bullish on Nvidia for a long time. One of Nvidia’s strengths is that it offers plans beyond simple Highly touted Blackwell chipArya said.

Learn more: Where is Wall Street on Nvidia in 2025

Arya noted that a few years ago, the technology buzzword was 5G (actually, high-speed telephone service). There’s no need to “worry about what might or might not happen in technology three years from now, in such a dynamic and evolving market,” he said.

With giants like Amazon (AMZN) announcing a $8 billion partnership with Anthropic to enter the AI and Google chip space (GOOG) drop a supercomputer with a AI chip called Willowit’s clear that big tech companies want in on the action.

Likewise, Broadcom (AVGO) and Marvell (MRVL) have launched advanced custom chips, but “there is no software expertise, no partners to meet enterprise demand,” Arya said. “This is Nvidia’s added value.”

In the middle of this technology package, Nvidia has room to grow.

The company expects data center sales to reach $110 billion in 2024, Arya said. Broadcom and Marvell expect data center sales to reach $12 billion and $700 million, respectively, for last year, according to Arya.

For 2025, Nvidia is expected to increase its data center sales to $200 billion, while Broadcom is expected to reach around $17 billion. Marvell will bring in between $2 billion and $4 billion, Arya estimates.

“When you look at Nvidia’s market share, no matter what happens, it’s going to be 80 to 85 percent in the next 12 to 18 months,” he said.

Learn more: Why Blackwell won the Yahoo Finance Product of the Year 2024 award

One reason the market favors Nvidia is that “in semiconductors, the scale of the incumbent company matters,” Arya said. “Unless the incumbent makes a mistake, it is very difficult to dislodge them from a market share perspective because they are the first to be called if there is a problem in the supply chain. supply.”

For example, if a company such as Taiwan Semiconductor (TSM) is unable to produce the next generation of chips, or if Hynix (000660.KS) or Micron (UM) don’t have enough memory, “who will be their first call?” » asked Arya.