The biggest fintech event of 2024 so far is, without a doubt, the approval of 11 spot BTC ETFs on January 10. This marks a milestone in the history of digital assets, following years of turbulent battles between the SEC, asset managers and the industry. advocates and investors.

However, this historic event did not cause BTC prices to rise, but rather caused them to fall. From the highest price of nearly $50,000 during the rumor period leading up to January 10, the BTC spot price has fallen to around $40,000 as of today.

This is not the first time that seemingly positive events for the market turn out to be non-events or even negative events.

In 2021, when I was still at Strike, there were at least 2 events that should have shocked the market: one when El Salvador announced that it was becoming a BTC country – taking BTC as legal tender and reserves official, the other when Twitter (now X) announced the use of BTC Lightning Network to power its global tipping feature.

An event marked a new era in the history of the human monetary system, as the first modern country to recognize a non-sovereign currency as legal tender. The other signified the potential for mass adoption of BTC as a modern money transmission rail.

However, none of them moved BTC prices.

So this time, when it comes to the ETF, the difference is that there was a rumor period, and everyone bought the rumor but ultimately sold the news.

So what happened? And more importantly, where would the price of BTC go from there?

I will share some ideas from both walk and the macro points of view.

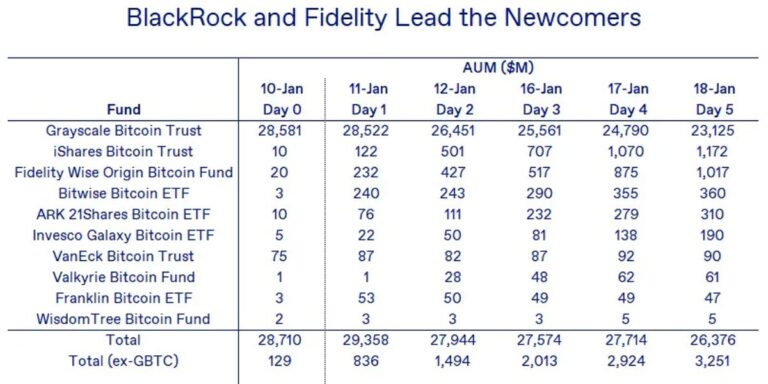

First of all, the launch of spot BTC ETFs did not cause as much inflow as expected.

During the first 5 days, the total net flow was only about $1.1 billion, or only about 50% of the $2 billion entry level of the Gold ETF (SPDR Gold Shares – GLD) within 5 days of its debut in 2004.

Compared to the total assets under management of all these asset managers – trillions of dollars from BlackRock, Fidelity, Invesco, Franklin Templeton, etc. – the influx of $1.1 billion didn’t shake things up as much.

Additionally, compared to the “starting point” of Day 0 – Grayscale’s $28.5 billion in its Bitcoin Trust, the total assets under management of the entire BTC Trust complex are now just $26 billion, actually lower than day 0. So net-net, the launch of ETFs actually caused more exits than entries. This is a clear sign of “buy the rumor, sell the information”.

Additionally, since BTC is often nicknamed “digital gold” and shares many characteristics (from an investment perspective), let’s compare it to the trajectory of GLD.

Since its launch in November 2004, it took about 10 months until September 2005 for its stock price (and the price of gold) to recover and start to increase quickly. We could therefore envisage the end of the price adjustment period between October and November, just around the time of the presidential election. Additionally, the BTC halving will take place in April 2024, adding another complication to price action.

Since the low point of around $16,000 in December 2022, BTC has already had a good year thanks to the dynamics of its “Layer 2” ecosystem, reaching $42,000 in December 2023. Thus he might run out of breathas some holders might look to take advantage of the upside, and the ETF’s launch couldn’t be a better time.

More importantly, from a broader macroeconomic perspective, the next two years may not be the best time for digital assets such as BTC. The real economy should regain the upper hand.

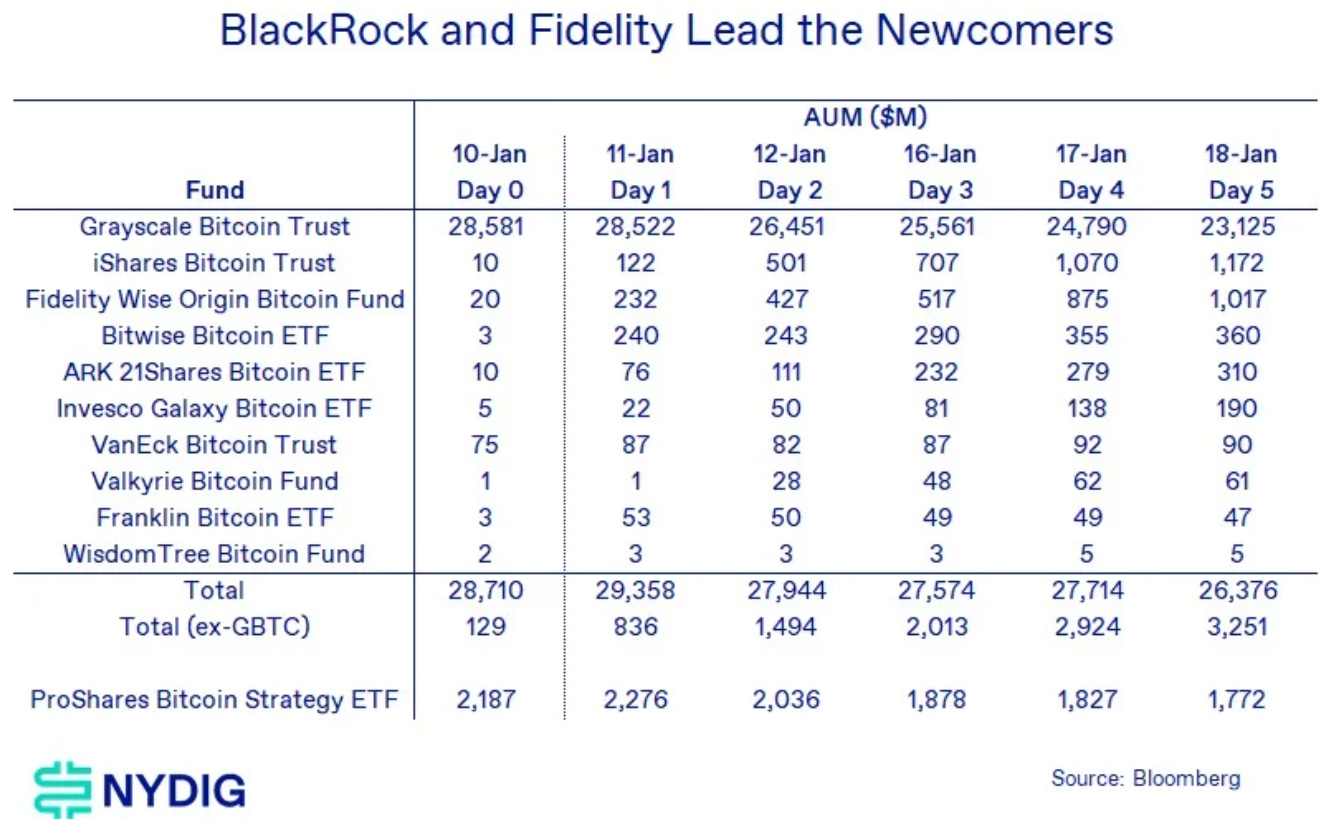

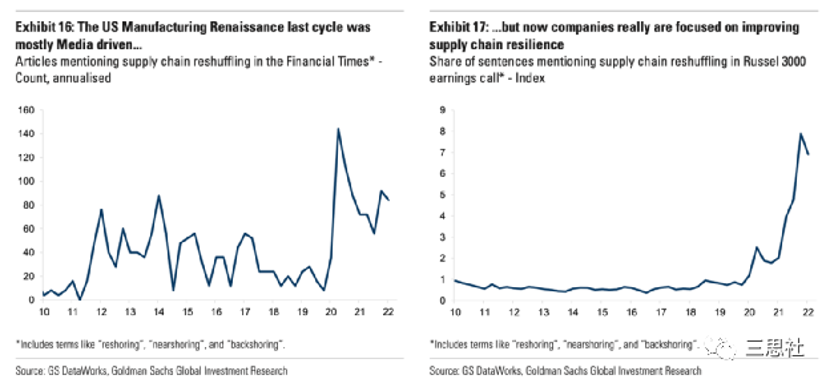

Post-COVID and as US-China rivalry intensifies, US investment in manufacturing, energy, supply chain and of course artificial intelligence enters a new period of boom.

For example, Goldman Sachs analysts attribute the past “American manufacturing renaissance” in 2020-2021 to a media boost and only the current renaissance since 2022 to a “real” investment boom.

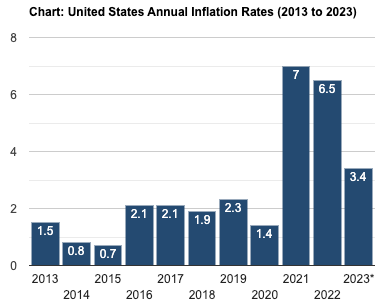

Meanwhile, although lower than the COVID monetary easing period of around 6-7%, US inflation is still at the historically high level of 3.4%. Even during elections, we shouldn’t expect the Fed to be too dovish with too many rate cutsand it is therefore unlikely that the digital asset casino will see many new tokens.

Therefore, based on these market and macro observations, it is understandable that the price of BTC fell after the approval of the ETF, and it is difficult to expect the price of BTC to increase by significantly this year, even with another halving in April.

I will end with a warning: 2024 is a complicated year. More than 50 countries will have general elections, including 7 of the 10 most populous countries, and more than 2 billion people are expected to vote. So be prepared for a lot of noise from the media that could distort the market.