VRT designs, manufactures and services power and space cooling solutions for data centers. The company is at the center of a large-scale IT infrastructure, becoming a larger player in the field of AI and cloud computing. The company opened a new manufacturing facility in South Carolina in September.

Vertiv increased its organic orders by 57% in the second quarter. It also raised its earnings expectations, with EPS growth of 46% expected for fiscal 2024 and 28% for fiscal 2025, to $3.31 per share. This is after VRT grew its bottom line by 230% last year.

It’s not surprising VRT shares have gained 114% this year – and they could grow more. Based on MAPsignals data, investors are betting heavily on the stock’s future performance.

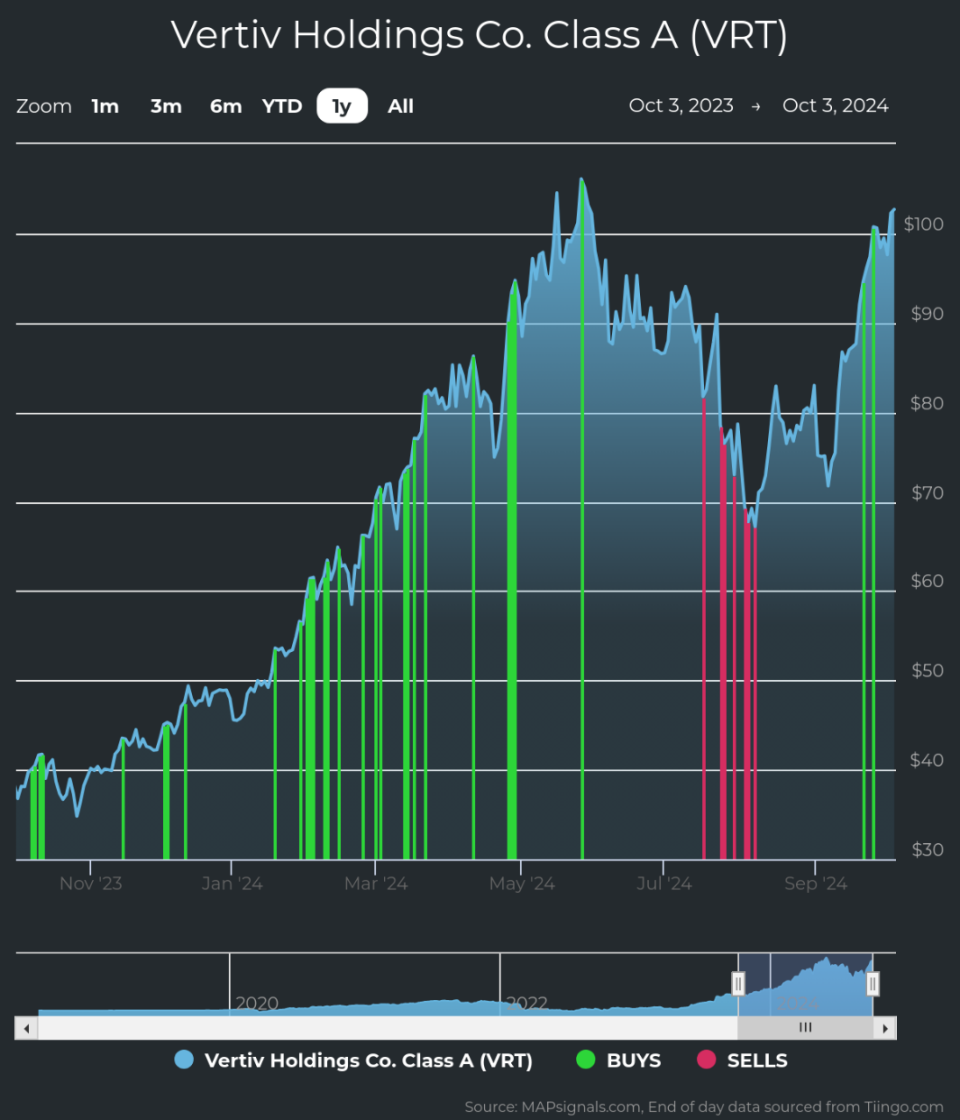

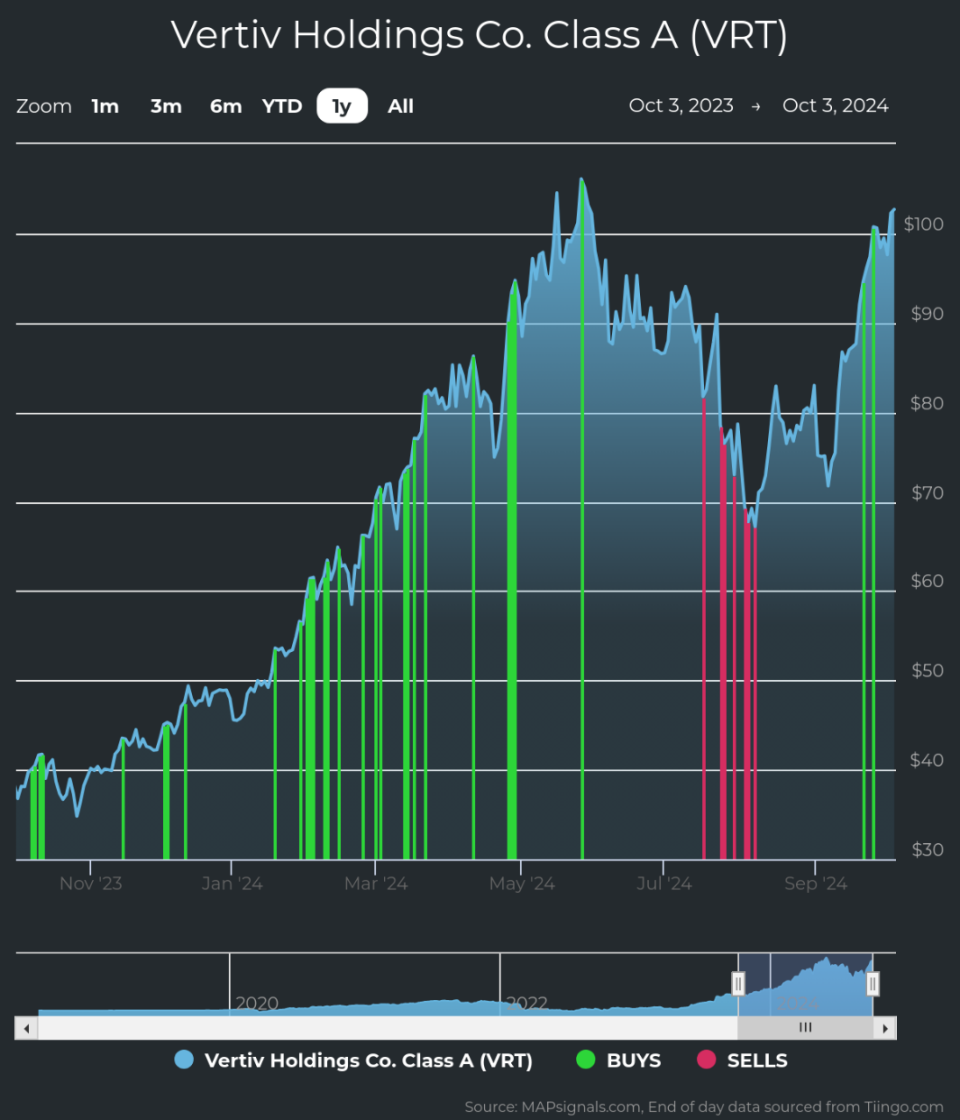

Big Money Buys Vertiv Stock

Institutional volumes reveal a lot. Over the past year, VRT has benefited from significant silver purchases, which we view as institutional accumulation.

Each of the green bars signals unusually large volumes in VRT stock, pushing the stock higher:

Many industrial names are currently being accumulated. But when you dive into the fundamentals, Vertiv enjoys a particular tailwind.

Fundamental analysis of Vertiv

Institutional support coupled with a healthy fundamental context makes this society worth studying. As you can see, VRT saw strong growth in sales and EPS:

Source: FactSet

The one-year EPS outlook is expected to increase by +28%.

It now makes sense that the stock has reached new highs. VRT is progressing thanks to its solid financial performance.

Combining great fundamentals with our proprietary software has made it possible to find great winning stocks over the long term.

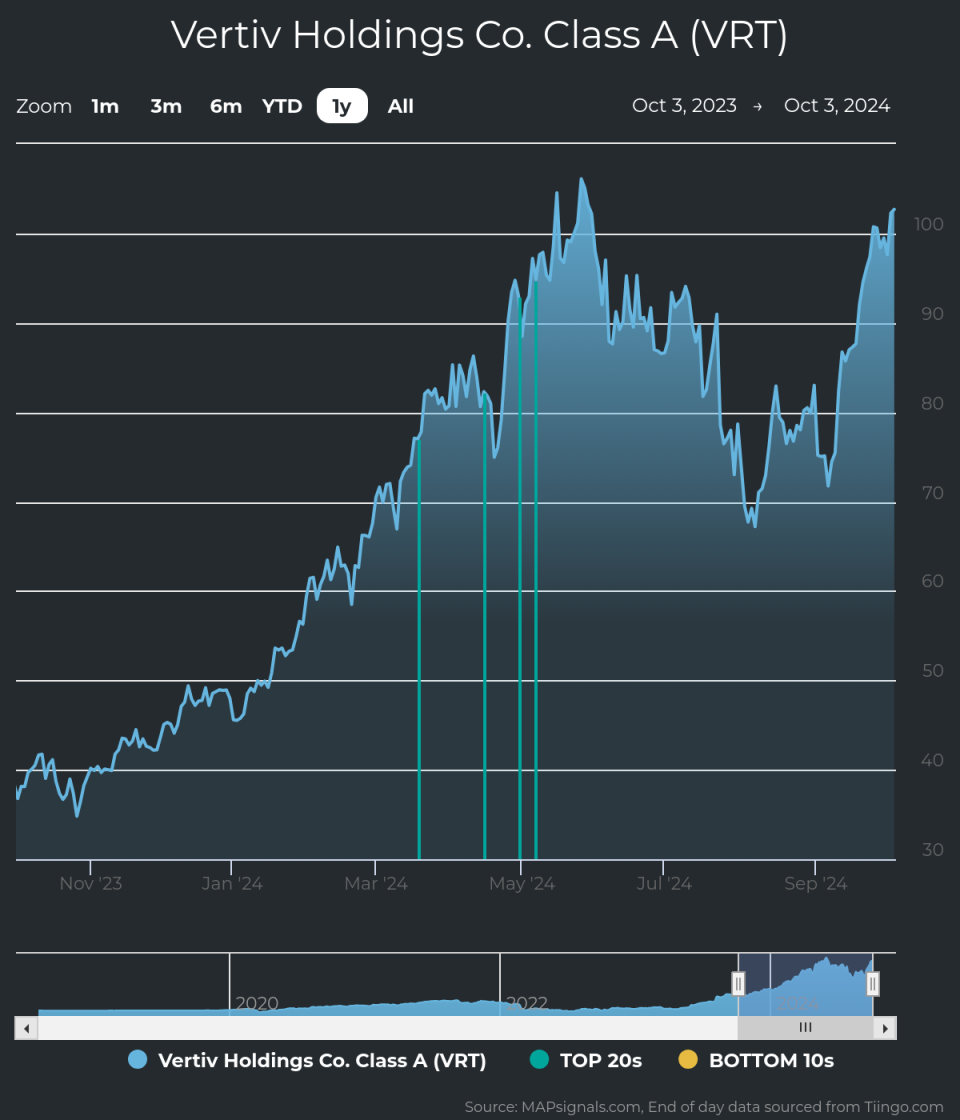

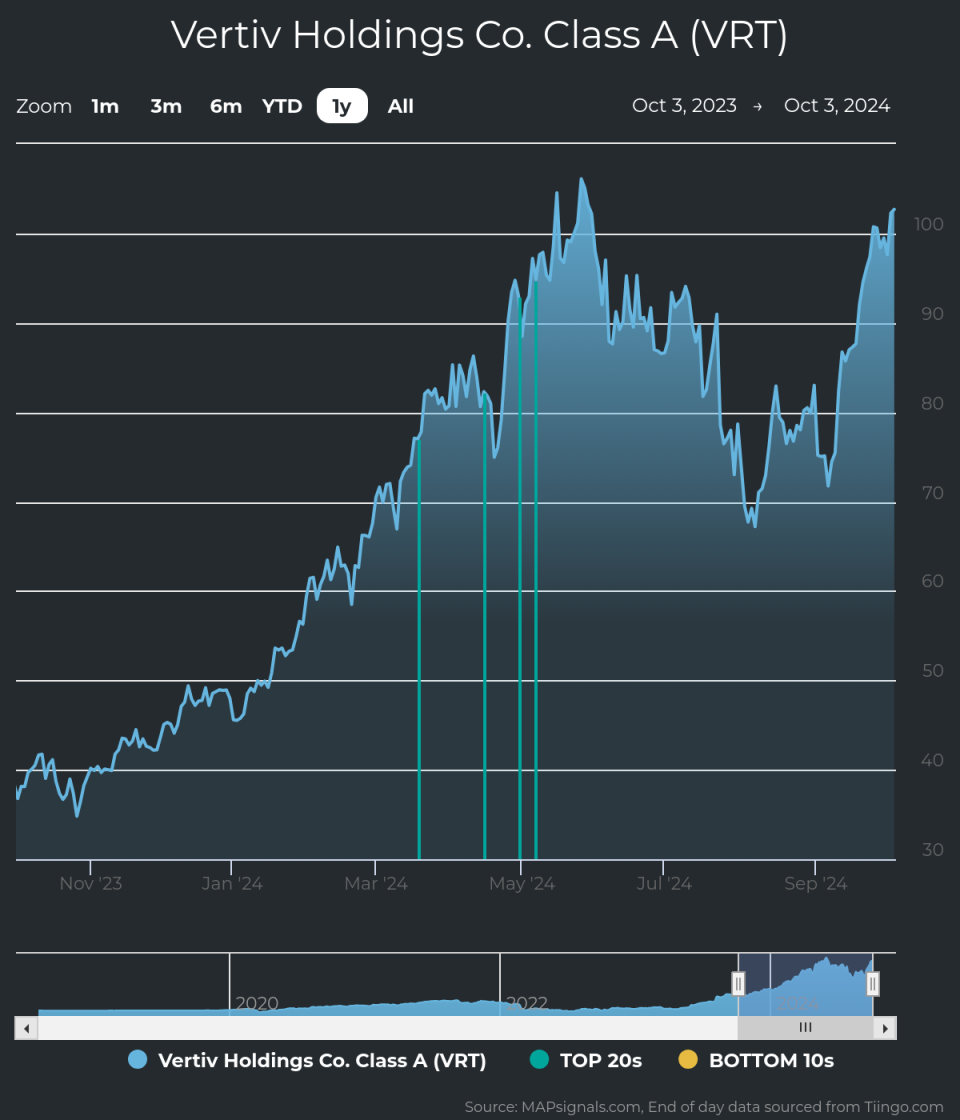

VRT has long been one of the top-rated stocks at MAPsignals. This means the stock is experiencing unusual buying pressure and growing fundamentals. We have a ranking process that features stocks like this on a weekly basis.

He has been featured in the rare Top 20 report several times over the past year. The blue bars below show when VRT was a top pick… gaining value over time.

Tracking unusual volumes reveals the power of financial flows.

This is a trait that most superstar actions exhibit. Today’s financial flows often reveal tomorrow’s leaders.

Vertiv Price Prediction

VRT rallying is not new at all. Buying stocks with large amounts of money indicates that this should be taken note of. Given the stock’s historic price gains and strong fundamentals, this stock could be worth a place in a diversified portfolio.

Disclosure: The author does not hold any position within VRT at the time of publication.

If you are a Registered Investment Advisor (RIA) or serious investor looking to take your investing to the next level, learn more about MAP Signals Process Here.

This article was originally published on FX Empire