The rise of Africa’s fintech sector has had a positive impact on financial inclusion, helping to give individuals and small and medium-sized enterprises (SMEs) better access to traditional financial services.

Although the exponential growth of fintech has not been without risks and challenges, it has arguably also led to a considerable improvement in the lives of people on the continent.

However, the journey of many African fintech entrepreneurs has by no means been easy. In fact, according to a study by the Boston Consulting Group, only 8% of startups make it to the Series B funding stage, and many of them close their doors before their potential can even be reached.

Last year alone saw the demise of fintech startups such as the Ghanaian Payments Interoperability Platform. DashNigerian financial services platform PivotUK and Nigerian cross-border remittance aggregation platform Zazu and Kenyan business-to-business e-commerce platform Zumi.

A number of Nigerian cryptocurrency platforms also shut down last year, including Laserpay, Africa Bundle And Vibrator.

This year has so far seen the closure of a Nigerian wealth tech startup Cova and Nigerian fintech The peerwhile the Kenyan mobile commerce platform Global copy laid off more than 1,000 employees in May and is facing liquidation.

This has raised questions about the challenges facing fintech startups in the region, as well as the regulatory and policy environment and whether it is sufficiently supportive for fintech development.

There are a myriad of reasons why a startup fails, but funding tops the list

According to Danielle du Toit, operations director of the Fintech Association of South Africa, African fintech startups face many challenges.

These include weak infrastructure and deficits, shortage of talent for key positions within startups, and high costs and expenses. However, the most important of these remains access to financing.

Financing challenges and high financing costs for entrepreneurs are major contributors to startup failures in the region, as new businesses struggle with limited sources of financing compared to other regions.

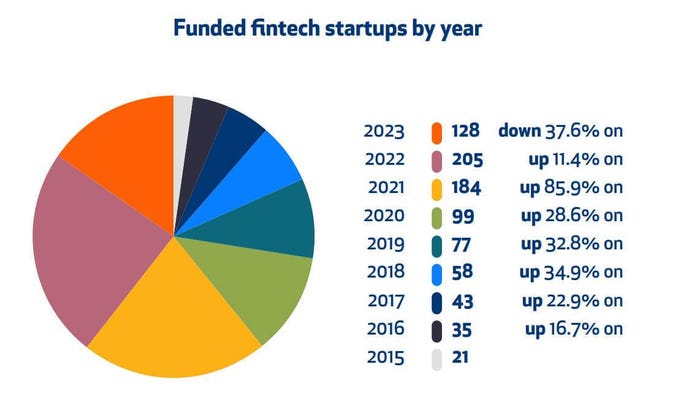

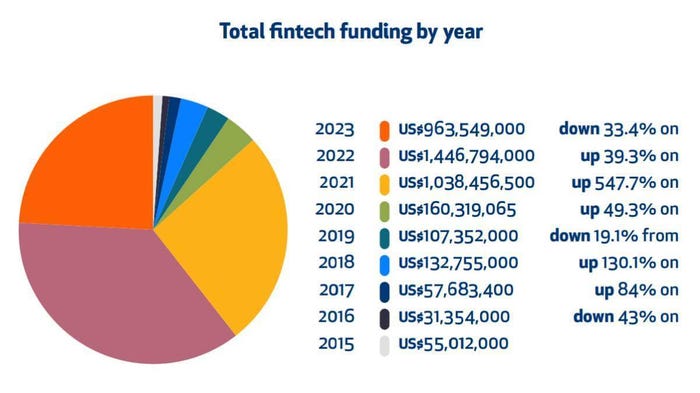

According to Disrupt Africa, the situation has worsened due to a global shortage of capital in 2023, putting the region in a difficult situation. “finance winter”.

(Source: Disrupt Africa, African Tech Startup Financing Report 2023)

Du Toit noted that entrepreneurs face limited financing opportunities from sources such as venture capital and private equity funds, due to the latter’s perception of high risks associated with investing in region.

Barry Ryan, an Africa-based fintech investor, added that high borrowing costs from traditional financial institutions are also a challenge. With these institutions, contractors are often required to provide higher levels of collateral and accept higher interest rates.

“In the West, availability and access to funds is much easier. You can borrow against an asset, like a home equity loan, whereas this is prohibitively expensive in Africa,” Ryan said.

(Source: Disrupt Africa, African Tech Startup Financing Report 2023)

Forward-looking policy and collaboration needed

However, African fintech companies have successfully raised funds. According to the World Economic Forum, 92% of African investments in technology are made by just four countries: Nigeria, Egypt, Kenya and South Africa.

These four countries are considered forerunners in the region’s fintech journey. Du Toit called them the “usual suspects,” highlighting the four, as well as Rwanda, for their progressive policies and strong political will in favor of tech startups.

Du Toit believes that in these countries, government support for the technology sector has taken the form of establishing initiatives such as technology hubs, incubators and accelerators, as well as a general commitment to encouraging ecosystems technologies that support innovation, collaboration and growth. of startups.

“It’s not about what they do differently but rather a question of focus. They have focused a lot on driving innovation within start-up environments and promoting growth…the passion lies in seeking growth and being able to enable it. That’s the secret,” Du Toit explained.

The region’s well-established financial services companies and tech giants are also taking a more active role in the sector, from fintech investments and partnerships to the development of accelerator hubs.

Visa notably opened its first African innovation hub in Kenya in 2022, before launching its financial technology accelerator program on the continent in 2023.

Mastercard, meanwhile, has been active in the fintech space, capping this with its August 2024 partnership with Scale, an issuer orchestration partner, to reduce market barriers for businesses focused on payments in Africa and the Middle East.

Ryan also looks positively open banking system as a way to catalyze the sector and promote the longevity of fintech startups.

This is an initiative through which financial institutions open their application programming interfaces (APIs) to third parties.

Ryan believes that such measures can encourage the development of the African fintech market, with solutions adequately tailored to market needs.

The role of regulation in supporting fintechs

Regulatory compliance can also be a major hurdle for many startups as they face regulatory and political uncertainty in the countries in which they operate.

More and more African policymakers and regulators are engaging in a range of approaches aimed at creating an enabling regulatory environment.

“Regulations are important to protect the market and provide guides to startups. However, early regulation could stifle the emergence of new companies, especially in the technology sector,” Ryan said.

In this regard, fintech sandboxes can provide some relief. These aim to provide an enabling environment with regulatory oversight for startups to test new products, services or solutions.

Sandboxes provide these companies with temporary flexibility to expand their operations, while promoting safe and ethical innovation, consumer protection and reducing the risk of non-compliance, for example.

Experts say African startups face challenges such as weak infrastructure and deficits, shortage of talent for key positions, and high costs and expenses. (Source: Image from freepik)

Some countries have even gone further by creating standalone legislation in the form of Startup Acts. In 2018, Tunisia became the first country to introduce a Startup Act, followed by Senegal in 2019.

Since then, other countries have followed suit, such as Nigeria and the Democratic Republic of Congo, while Rwanda, Ghana and Ethiopia, for example, have started preparing this legislation.

Ryan urged regulators to also focus on mitigating “sticking points” that can arise when starting a business, such as business registration processes.

“By closing these gaps, African countries can create a stronger and more inclusive environment in which startups can thrive and contribute significantly to economic growth,” du Toit added.

The future of African fintech is still bright

Overall, the outlook for the African fintech sector is very positive, with the main driver being the rapid growth of a very young and increasingly tech-savvy population.

In addition to providing a broad target customer base, the region’s youth can also be a talent pool for startups – if the fundamentals related to education and technological skills development can be addressed.

Du Toit also highlighted the tailwinds of trends such as the rise of tech sectors, pan-African expansions, impact investing and increased collaboration between corporate giants and startups.

However, more funds will need to be pumped into this sector, and Ryan discouraged them from using rigid approaches to financing measures.

The funds should take into account “Africa’s challenges and opportunities and should not apply the precise models used in the West”, he said.

“We all know about the global companies that dominate the technology sector, but these are not necessarily responding to African opportunities,” continued Ryan.

Du Toit said the individuals who make up Africa’s startup scene demonstrate an “entrepreneurial spirit that was last seen during the last disruption, when the internet entered the economy “.

“There are so many opportunities for startups to rise to the occasion… Startups will succeed in Africa if they continue. Hard work and patience will be rewarded,” she concluded.

— Chiti Mbizule Mutati, correspondent, special to Connect Africa