(Bloomberg) — British regulators have imposed a series of restrictions on a financial technology company owned by Uruguay’s first billionaires, part of a widening crackdown on payments companies that process hundreds of millions of dollars in transactions each day.

Bloomberg’s most read articles

The Financial Conduct Authority (FCA) has banned Larstal Ltd. from providing payment services or accepting new customers without written approval from the watchdog, according to a message on the FCA’s website. The company, which operates as AstroPay and is part of a global payments empire overseen by Andrés Bzurovski Bay and Sergio Enrique Fogel Kaplan, specializes in processing transactions for high-risk customers, filings show.

The FCA is working to improve standards at e-money institutions, poorly regulated payment companies. The agency has licensed dozens of e-money institutions, including AstroPay, to operate in the UK in recent years, but it now fears the sector is rife with fraud and weak anti-crime controls.

In an emailed statement, Fogel said AstroPay and the FCA had “mutually agreed to voluntarily suspend” the company’s EMI license. The move followed discussions with the regulator and “the realization that the license held was not necessary to conduct its business at that time,” he said. An AstroPay spokesperson said separately that the company had “voluntarily imposed restrictions to improve its operational capabilities.”

An FCA spokesperson declined to comment.

The FCA imposed restrictions on AstroPay through a so-called voluntary undertaking, under which a firm commits to improving its operations.

“Voluntary initiatives of this nature are rarely initiated by the firm itself,” James Borley, a former FCA regulator and chief executive of Cosegic Ltd, said in an email. “Rather than putting the firm through a formal process that results in the issuance (and publication) of a formal oversight notice, the FCA will typically ‘persuade’ the firm itself to seek a restriction on its authorisation.”

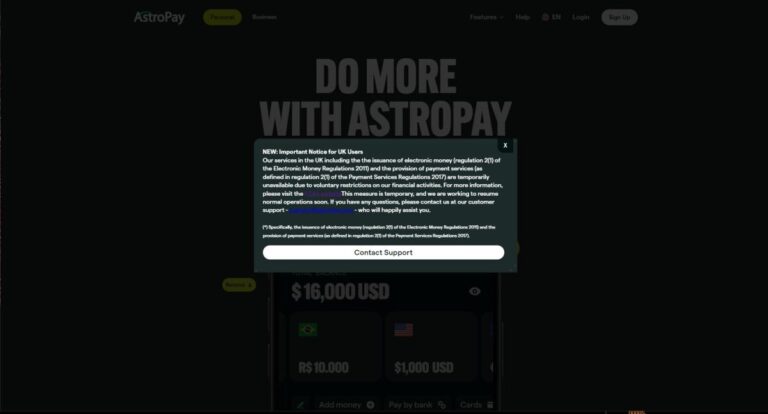

According to the filings, AstroPay owed its customers millions of dollars as of late 2022 and the company must also ensure that “all affected funds are adequately safeguarded,” according to the FCA. Services in the UK are “temporarily unavailable due to voluntary restrictions on our financial activities,” AstroPay said in a notice posted on its website.

The company, owned by Fogel and Bzurovski, processes transactions for clients in industries including online gambling, foreign exchange and adult entertainment, filings show. Much of its business is in emerging markets such as Brazil and India.

AstroPay is listed as a payment processor for several foreign exchange trading sites based in offshore countries such as Belize, Saint Lucia, and Saint Vincent and the Grenadines. Many of them claim that they allow customers to borrow hundreds or even thousands of times their initial deposit, a practice that UK and European regulators have banned for retail investors.

The company was also the title sponsor of Wolverhampton Wanderers — a Premier League football club known as Wolves — from 2022 until the end of the most recent season, according to the club’s website. AstroPay’s logo was featured on the front of players’ kits and it even introduced a Wolves-branded debit card. The team announced a new sponsor this week.

Fogel and Bzurovski became the first billionaires from their native Uruguay in 2021 when they spun off another part of their group, Montevideo-based dLocal Ltd., into a publicly traded company. Its market capitalization soared to more than $20 billion that year, but its shares have fallen some 88% from their peak following allegations of fraud by the notorious short-selling firm Muddy Waters LLC and a separate regulatory investigation in Argentina.

Fogel and Bzurovski remain dLocal’s largest shareholders and board members, and Fogel took on an expanded leadership role last year while also controlling AstroPay. According to dLocal’s latest annual report, dLocal still provides some payment services to AstroPay, but a company spokesperson said those payments will end in the first half of 2023. Former dLocal CEO Sebastián Kanovich previously held the same role at AstroPay.

A dLocal spokesperson said in an emailed statement that there was “no relationship” between the two companies “other than shareholders being investors in both companies.”

The complex patchwork of companies formed by the two firms is the subject of a 47-page report published in November 2022 by Muddy Waters, which called it “one of the most comprehensive catalogues of governance failures we can remember.” The investment firm, known for its high-profile bets against companies it accuses of wrongdoing, cited “previous and ongoing involvement” between dLocal and AstroPay.

The accusations, which dLocal denies, sent the company’s shares down 51% in a single day. The stock recovered much of its value last year, but has since fallen again.

(Updated with information on Wolves sponsorship deal in 11th paragraph.)

Bloomberg Businessweek’s Most Read Articles

©2024 Bloomberg LP