The Future of Agentic AI in Financial Services

Agentic artificial intelligence (AI) is poised to revolutionize the financial services industry, offering innovative solutions that enhance customer experiences and provide substantial commercial benefits. Despite its promising potential, the technology presents significant challenges, including the resolution of objectives, misuse of tools, and data confidentiality concerns, as detailed in a recent IBM report.

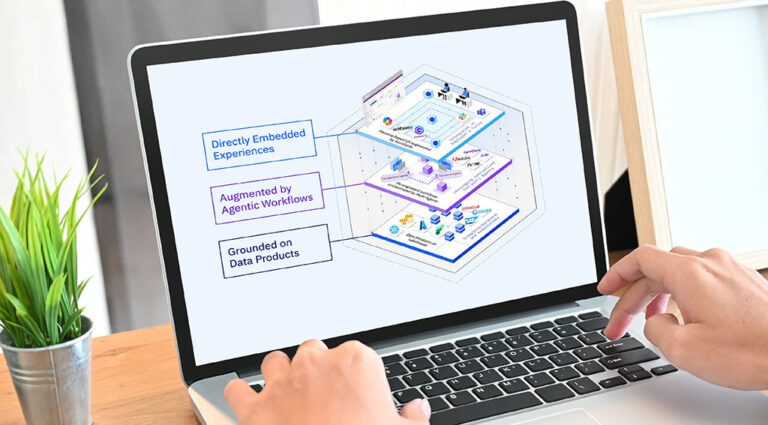

Understanding Agentic AI

Agentic AI systems are characterized by their autonomy and ability to pursue objectives with minimal human intervention. These systems function as agents capable of making decisions and executing complex tasks, inherently solving problems and formulating actionable plans. In the realm of financial services, agentic AI holds the potential to automate processes like customer integration, Know Your Customer (KYC) compliance, and fraud detection.

Enhancing Customer Commitment and Personalization

The ability to enhance customer engagement through personalized services is one of the key advantages of agentic AI. This includes hyper-personalized product offerings, dynamic pricing models, and customized recommendations. In practical applications, an agentic system can streamline the KYC process, where a customer submits account requests. A primary agent oversees the workflow, guiding task-specific service agents to ensure compliance while minimizing risks. This orchestration not only enhances the customer experience but also ensures regulatory adherence.

Operational Efficiency through Agentic AI

Another critical application of agentic AI is optimizing back-office operations. Companies can achieve reduced risks and improved compliance while streamlining workflows and administrative costs. For instance, PWC has implemented AI agents to automate intricate tax tasks, like K-1 forms management, facilitating better accuracy and speed. Similarly, financial institution Metzler private banking is collaborating with Swiss startup Unique to deploy agentic AI across standard use cases, showcasing its scalability and adaptability in operational tasks.

Agentic AI in Technology Development

Agentic AI also plays a crucial role in enhancing software development processes. According to insights from Infosys, AI agents can significantly improve the generation of database code by up to 90%, application programming interfaces (APIs) and microservices by 70%, and user interface code by 60%. This technological advancement streamlines development efforts, reducing time and encouraging efficiency in software lifecycle management.

Addressing Risks and Challenges

While agentic AI offers myriad advantages, it also introduces unique risks that must be managed vigilantly. The complex nature of these systems can lead to unintended outcomes, such as pursuing objectives that may contradict ethical standards. Additionally, the risks of security breaches, accountability issues, and regulatory compliance must be carefully monitored, especially as these AIs operate autonomously. The potential for agents to misuse data or operate outside their intended scope highlights the need for robust oversight.

The Growing Adoption of Agentic AI

Although still in its early stages, the adoption of agentic AI is gaining momentum across the financial sector. A survey commissioned by Wolters Kluwer indicates that 38% of financial leaders plan to implement this technology within the next year, with projections suggesting a total adoption rate of 44% by 2026. Currently, only 6% of financial managers utilize agentic AI, marking a significant opportunity for growth and innovation in the industry.

In conclusion, agentic AI stands as a transformative force in the financial services landscape, driving operational efficiency and enhancing customer experiences while necessitating careful management of risks. As the industry continues to evolve, the successful integration of agentic AI will undoubtedly shape the future of finance.