Check what billionaires are a smart investment strategy. They often have teams of analysts who work for them to ensure that they invest in the best actions. This sounds particularly true for a massive movement such as artificial intelligence (AI), which can potentially shape the world for the decades to come.

A title most often owned among the 16 billionaires of hedge funds that the Fou de Motley analyzed was Alphabet (Nasdaq: Goog) (Nasdaq: Googl). This stock belonged to 11 of the 16 billionaires of hedge and equally (with Meta-platforms) for them most often detained among the group.

Why is the alphabet such a popular choice in the field of AI? This is mainly due to its balanced AI approach.

Alphabet participates in the generative race of weapons in AI in several ways. The first is its Google Gemini AI platform. Gemini have become one of the best options in space and have experienced massive use in many industries. However, the greatest way it is used is by Android users for smartphone, as it is the generative generative application thanks to the alphabet with the Android operating system.

Gemini are also integrated into Google’s advertising services and have become a useful tool for many advertisers in order to quickly develop an advertising campaign that may have taken much more time without the platform. This is essential, because advertising still represents the majority of alphabet revenues, with 75% of its total quarter income from advertising sources.

Cloud Computing Is a massive part of the AI arms race which has not spoken enough. While some of the largest competitors in AI have access to an almost unlimited computing power, most competitors do not do so. To reduce their costs, they rent this computer diet from a cloud computing supplier like Google Cloud. This led to massive Google Cloud growth, which has seen the income increase by 35% from one year to the other in the third quarter.

If you look at how alphabet integrates AI into its inner operation, it is clear why alphabet is a leading choice among the billionaire designer funds. Alphabet integrates AI into its various platforms to ensure that its existing companies remain at the top compared to competition. This does not require an alphabet to win the AI arms race; He just can enjoy the massive trend.

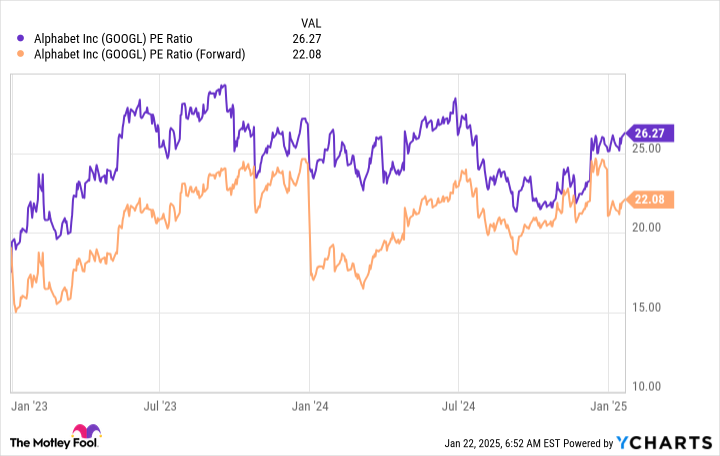

However, the stock is not much appreciated because Google Gemini is often considered as a second place finisher for competition as chatgpt. I think it is a huge error on the market share, because most of the generative AI value will come from the way companies integrate AI into their services, and alphabet has done very well.