For some time, the surrounding view Palantir Technologies (NYSE:PLTR) was stuck somewhere between a generational software developer or a “AI Imposter“, depending on who you ask. One of the main reasons for this polarizing view is that many investors simply don’t understand what Palantir actually does.

Juxtaposing buzzwords like “AI” and “data-driven insights” won’t get you far. At some point, a business must prove that its marketing tactics are working. And, in fact, over the past year, Palantir has experienced a new wave of growth thanks to its line of data analytics software platforms.

The company not only accelerated its revenue, but also steadily increased its profit margins and transformed itself from a cash-intensive business to a profitable business. Recently, Palantir became a member of the S&P500 and works closely with some of the largest historical players in the technology sector, including Microsoft And Oracle.

Today, another company in the sector is also worth a closer look: ServiceNow (NYSE: NOW). Have you ever heard of it? I’m going to detail how ServiceNow is quietly disrupting the world of enterprise software, much like what Palantir has done. Additionally, I will explore how AI is playing a major role in the company’s current growth trajectory and assess whether it is now a lucrative opportunity to acquire shares.

What does ServiceNow do?

About a year ago, ServiceNow CEO Bill McDermott spoke with David Rubenstein, a private equity investor and former policy advisor during President Jimmy Carter’s administration.

When asked what ServiceNow actually does, McDermott simply called the company an “IT backbone” for companies looking to build digital infrastructure. While I appreciate the metaphor here, I admit that this explanation is still a bit vague.

Let’s look at an example to better understand the ServiceNow platform. From finance, sales and marketing, operations, human resources and IT management, businesses have a separate department for just about everything. As a result, organizational workflows can be slow and employees can wait hours or even days for an optimal solution.

This is where ServiceNow comes in. The company offers a complete suite of SaaStechnology-based tools and services aimed at helping streamline generic inefficiencies within organizations. This helps employees and team members better track the status of important issues or projects, leading to higher productivity.

How does AI benefit ServiceNow?

Like many software companies, ServiceNow is looking to ride the AI wave. And on the surface, the company seems to be doing a good job. Since AI became a topic of conversation, ServiceNow has signed high-profile partnerships with Microsoft, IBMAnd Nvidiajust to name a few. But as I mentioned, marketing strategic alliances and conducting high-profile interviews is only part of the equation.

How is ServiceNow’s business really doing? Pretty solidly, if you ask me.

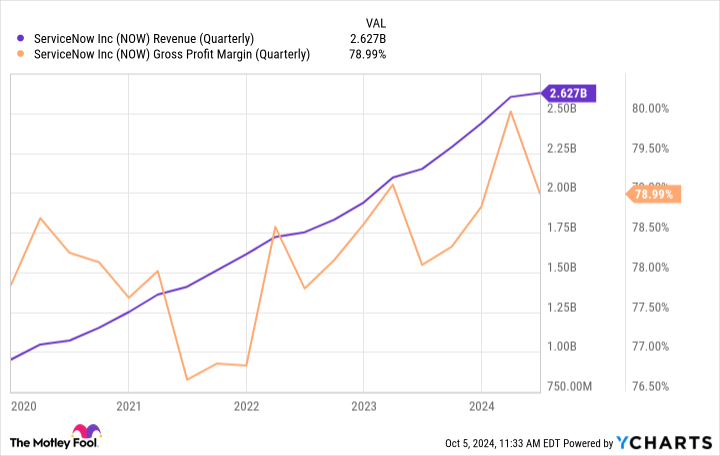

As the chart shows, ServiceNow’s revenue and gross profit margin have grown significantly over the past few years. Delving a little deeper, look at growth trends from 2023 – roughly the period in which AI started landing on more radars.

Over the last 20 months or so, ServiceNow’s revenue line has started to see a noticeably steeper slope, while profit margins have increased simultaneously. What’s even better is that the combination of accelerating sales and increasing margins leads to consistent profitability, both from a net profit and free cash flow perspective.

Is ServiceNow stock a buy right now?

Although ServiceNow is consistently profitable, the magnitude of its net income and cash flow fluctuates widely. Remember that ServiceNow is a growing company and is therefore constantly reinvesting its excess profits back into the business.

For this reason, using earnings-based valuation metrics, such as price-to-earnings (P/E) or price-to-free cash flow (P/FCF), are not entirely useful. Instead, I’ll look at the relationship between company value and revenue.

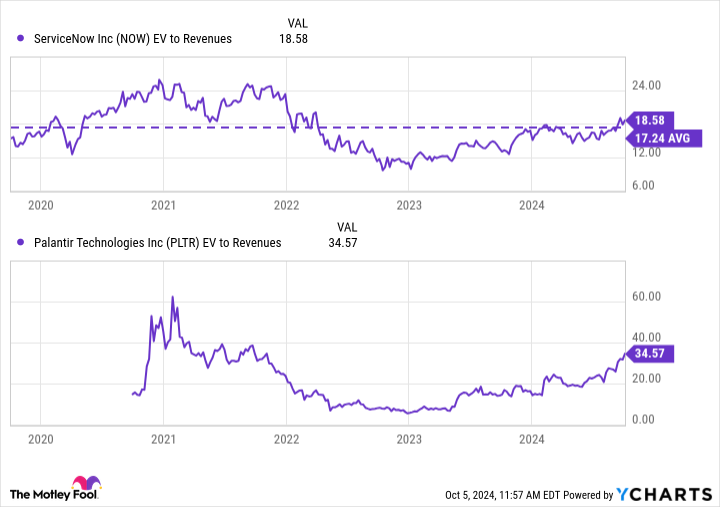

Currently, ServiceNow trades at an EV-to-sales multiple of 18.6, essentially in line with its five-year average. But if we take a closer look at the overall trends, we can glean a lot from these charts.

After a brief rise in 2020, the valuation multiples of ServiceNow and Palantir contracted quite significantly between 2021 and 2023. This was largely due to macroeconomic factors such as inflation and rising interest rates. interest, and their consequences on the enterprise software market as a whole.

However, as the dawn of AI appears around 2023, ServiceNow and Palantir have started to see some expansion in their valuations. What’s peculiar is that even with this valuation expansion, ServiceNow’s EV-to-revenue ratio has basically returned to what it was several years ago.

Considering the fact that ServiceNow is a much larger and profitable company today compared to 2020, I think there’s an argument to be made that the stock is undervalued – despite the gradual rise of valuation over the last two years.

To me, the market is starting to show interest in ServiceNow, more or less as it did with Palantir. However, I still think ServiceNow is not yet fully appreciated for its critical role at the intersection of AI and enterprise software.

For these reasons, I think now is a great time to buy ServiceNow stock, and I see the company following a very similar narrative and trajectory to Palantir as the AI narrative continues to take shape.

Should you invest $1,000 in ServiceNow right now?

Before buying shares in ServiceNow, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and ServiceNow was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $814,364!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns October 7, 2024

Adam Spatacco holds positions at Microsoft, Nvidia and Palantir Technologies. The Motley Fool ranks and recommends Microsoft, Nvidia, Oracle, Palantir Technologies, and ServiceNow. The Motley Fool recommends International Business Machines and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Prediction: This artificial intelligence (AI) software company could be the next Palantir was originally published by The Motley Fool