Officially, eight non-public companies have reached a market capitalization of $1 trillion. These include the “Magnificent Seven” technology companies and, more recently, Berkshire Hathawaywhich just crossed the threshold at the beginning of the month. Among these companies, only Tesla and Berkshire Hathaway are currently below the $1 trillion threshold.

Much of the wealth has been built by betting on Internet stocks and, at least in recent years, the growing demand for artificial intelligence (AI). A company with a market cap of just under $1 trillion is a huge beneficiary of AI, Nvidiathe country’s leading semiconductor supplier and the dominant player in its sector. And yet, it doesn’t enjoy the same hype as other AI companies.

This company is Semiconductor manufacturing in Taiwan (NYSE:TSM). Here’s why I predict the computer chip giant will be the next company to surpass $1 trillion in market cap.

Growth of AI

AI has seen an insatiable level of spending in recent years. Collectively, companies spend about $200 billion annually, and that figure is expected to reach more than $600 billion by 2028. Much of that spending is on semiconductor products like Nvidia and Advanced microdevices.

Taiwan Semiconductor (TSMC, for short) is the manufacturer that actually builds and assembles these semiconductors for third parties. It is one of the only companies in the world that can manufacture semiconductors with ultra-small transistor lengths, allowing for better speed when running complex AI calculations. In fact, it is currently the only company offering 3 nanometer technologies. semiconductors in production.

Technological superiority locks customers such as Nvidia onto the TSMC manufacturing platform. Last quarter, these types of advanced semiconductors accounted for the majority of TSMC’s revenue, with the high-performance computing segment growing sales 28% quarter-over-quarter. This is all due to the boom in AI spending. If the boom continues, it will lead to increased revenue growth for TSMC.

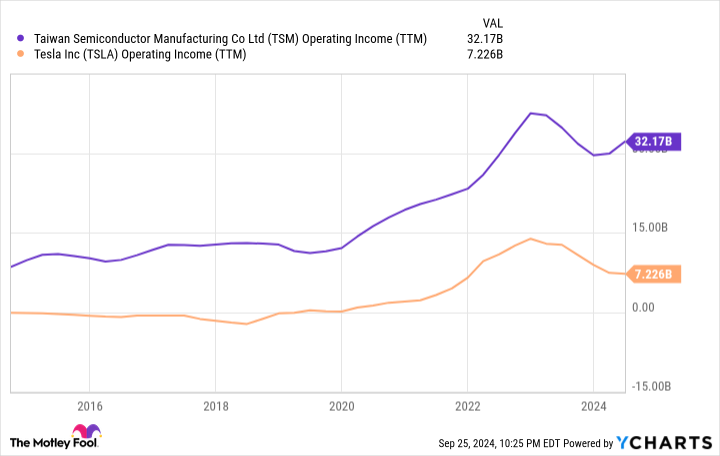

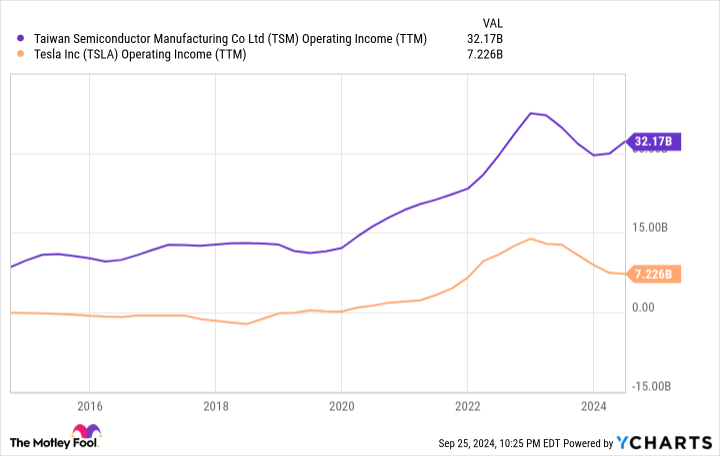

TSMC profits eclipse Tesla

The primary driver of market capitalization gains and long-term stock price appreciation is earnings growth, plain and simple. TSMC has grown its profits at a substantial pace over the past few years. Over the past 10 years, operating profit has increased by 277% and currently stands at $32 billion. This is four times the current profit of Teslaone of the few stocks to have surpassed a market capitalization of $1 trillion.

While this may say more about Tesla’s valuation than anything else, TSMC is certainly not a bubble stock. It currently has a price/earnings ratio (P/E) of 32.6, which is reasonable for a dominant company in a growing market. These benefits come from TSMC’s leadership position in advanced semiconductors. Among foundry manufacturers – those that make semiconductors for third parties – its market share is estimated at 60%.

TSM Operational Result (TTM) data by Y Charts

Watch profits grow and market cap will follow

As long as TSMC maintains its technological lead in semiconductor manufacturing, operating profit will increase in the long term. Demand for AI is growing, along with other industries that use semiconductors and computer chips in their processes. Since the invention of the transistor in 1947, spending on semiconductors has increased. This puts TSMC in a great position as a leading manufacturer of advanced semiconductors.

Today. TSMC has a market cap of $968 billion, which means its stock needs to rise about 3% to reach rarefied air and a market cap of $1 trillion. As its earnings continue to rise, I predict TSMC will be the next stock to take this step.

Should you invest $1,000 in semiconductor manufacturing in Taiwan right now?

Before buying Taiwan Semiconductor Manufacturing stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Taiwan Semiconductor Manufacturing was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $760,130!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns September 23, 2024

Brett Schaefer has no position in any of the stocks mentioned. The Motley Fool holds positions and recommends Advanced Micro Devices, Berkshire Hathaway, Nvidia, Taiwan Semiconductor Manufacturing and Tesla. The Mad Motley has a disclosure policy.

Prediction: This AI Stock Will Be the Next Company to Reach a Trillion-Dollar Market Cap was originally published by The Motley Fool