The Crypto Market’s Resurgence and Rising M&A Activity

The cryptocurrency market rebounded strongly in Q4 2024, with Bitcoin reaching a historic $100,000 on December 5. This growth was fueled by multiple factors, including:

- Donald Trump’s election victory, which raised expectations for pro-crypto regulatory policies.

- South Korea’s trading surge, where altcoin trading pushed volumes on Upbit and Bithumb to $254 billion, a 294% month-over-month increase.

- Record-breaking trading activity, with combined spot and derivatives trading surpassing $10 billion in November 2024.

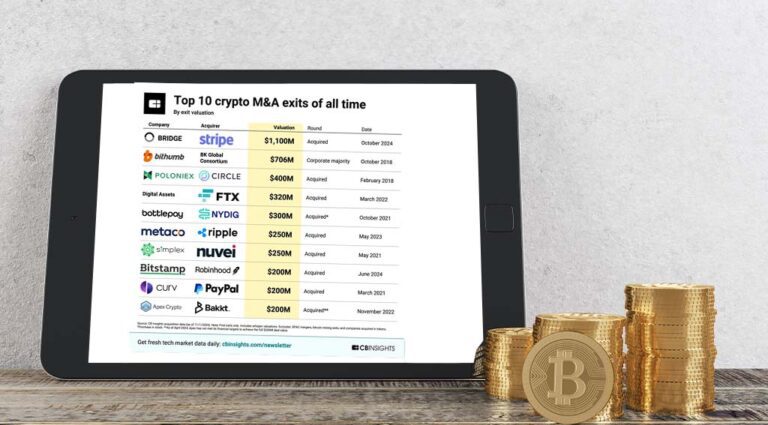

Amidst this recovery, the crypto M&A market witnessed significant acquisition activity, with companies seeking strategic expansion. CB Insights compiled a list of the top 10 largest crypto acquisitions based on exit valuations. Here’s a closer look at these landmark deals.

Top 10 Largest Crypto Acquisitions in FinTech

1. Bridge – $1.1 Billion (October 2024)

Acquirer: Stripe

Industry Focus: Stablecoin Payments

Stripe completed the largest crypto acquisition to date by acquiring Bridge, a stablecoin payment platform, for $1.1 billion. Founded by Zach Abrams and Sean Yu, Bridge provides an API for businesses to accept stablecoins, counting SpaceX and Coinbase among its clients.

This acquisition aligns with Stripe’s renewed focus on crypto payments, following its reintroduction of crypto transactions for U.S. businesses.

2. Bithumb – $706 Million (October 2018)

Acquirer: BK Global Consortium

Industry Focus: Cryptocurrency Exchange

South Korea’s second-largest exchange, Bithumb, was acquired by BK Global Consortium for $706 million in 2018. The Singapore-based investment firm aimed to establish the Exchange Alliance Blockchain (BXA), targeting a potential listing on the New York Stock Exchange or Nasdaq.

3. Poloniex – $400 Million (February 2018)

Acquirer: Circle

Industry Focus: Crypto Trading

Circle acquired Poloniex for $400 million, envisioning it as a marketplace for tokenized assets across various industries. However, Poloniex spun off from Circle in 2019, backed by an undisclosed Asian investment firm.

4. Digital Assets – $320 Million (March 2022)

Acquirer: FTX

Industry Focus: Crypto Trading & Tokenization

FTX acquired Digital Assets Technologies AG, a Swiss-based firm, to launch FTX Europe in 2022. The deal was valued at $320 million, expanding FTX’s presence in European markets before its collapse later that year.

5. Bottlepay – $300 Million (November 2021)

Acquirer: NYDIG

Industry Focus: Bitcoin Payments

Bottlepay, a real-time Bitcoin payment app, was acquired by NYDIG for $300 million. The deal integrated Lightning Network infrastructure into NYDIG’s Bitcoin platform, enabling financial institutions to offer crypto payment solutions.

6. Metaco – $250 Million (May 2023)

Acquirer: Ripple

Industry Focus: Crypto Custody

Ripple acquired Metaco, a Swiss-based digital asset custody firm, for $250 million in cash and Ripple equity. This acquisition strengthened Ripple’s institutional crypto services, integrating solutions used by Citi, BNP Paribas, and Société Générale.

7. Simplex – $250 Million (May 2021)

Acquirer: Nuvei

Industry Focus: Fiat-to-Crypto Payments

Canadian payment firm Nuvei acquired Simplex, an EU-licensed fiat-to-crypto payments provider, for $250 million. The acquisition enhanced Nuvei’s ability to convert 100+ fiat currencies into 160+ cryptocurrencies.

8. Bitstamp – $200 Million (June 2024)

Acquirer: Robinhood

Industry Focus: Crypto Exchange

Robinhood expanded its global crypto operations by acquiring Bitstamp for $200 million. Bitstamp, founded in 2011, operates in Europe, the UK, the U.S., and Asia, holding over 50 active regulatory licenses.

9. CURV – $200 Million (March 2021)

Acquirer: PayPal

Industry Focus: Digital Asset Security

PayPal acquired CURV, a cloud-based digital asset security provider, for $200 million. The acquisition bolstered PayPal’s crypto custody solutions, allowing secure crypto transactions on PayPal and Venmo.

10. Apex Crypto – $200 Million (November 2022)

Acquirer: Bakkt

Industry Focus: Institutional Crypto Trading

Bakkt acquired Apex Crypto, a trading infrastructure provider for fintech firms, for $200 million. The deal expanded Bakkt’s reach in crypto execution, settlement, and tax services.

Market Trends Driving Crypto Acquisitions

Several key trends are fueling M&A activity in the crypto FinTech space:

- Regulatory Clarity: Governments worldwide are introducing crypto regulations, making the sector more attractive to institutional investors.

- Stablecoin Growth: Companies are acquiring stablecoin payment solutions to improve cross-border transactions.

- Institutional Expansion: Firms like Robinhood and PayPal are strengthening their crypto offerings through acquisitions.

- Tech Innovation: AI, blockchain, and tokenization are transforming crypto infrastructure, driving demand for advanced solutions.

Conclusion: The Future of Crypto M&A

The crypto industry is entering a new phase of institutional adoption, with major players investing in trading platforms, custody services, and blockchain technology. As regulations evolve and new technologies emerge, strategic acquisitions will continue to shape the industry’s future.