Transforming Finance: A Look at Ramp’s Innovations and Future

Cost Savings and Efficiency Gains

Ramp has revolutionized financial operations, helping businesses save an impressive $10 billion and over 27.5 million hours to date. This remarkable efficiency has attracted more than 40,000 companies, including major players like CBRE, Shopify, and the University of Tennessee Athletics Foundation. By handling an annualized purchase volume of $80 billion in card transactions and invoice payments, Ramp positions itself as a leader in the financial tech industry.

Innovative AI Solutions

In July, Ramp introduced its first Autonomous AI agents, which have already demonstrated the capacity to identify political violations with unmatched accuracy. This level of technological advancement underscores Ramp’s commitment to leveraging AI for improved compliance and operational efficiency.

Strong Financial Backing

Ramp’s growth trajectory includes raising a total of $1.9 billion in funding, with the company generating cash flow early this year. Will Petrie, Ramp’s Chief Financial Officer, emphasized the firm’s ambition and safety net in its evaluations, strengthening confidence in its accelerated business model.

A Vision for the Future

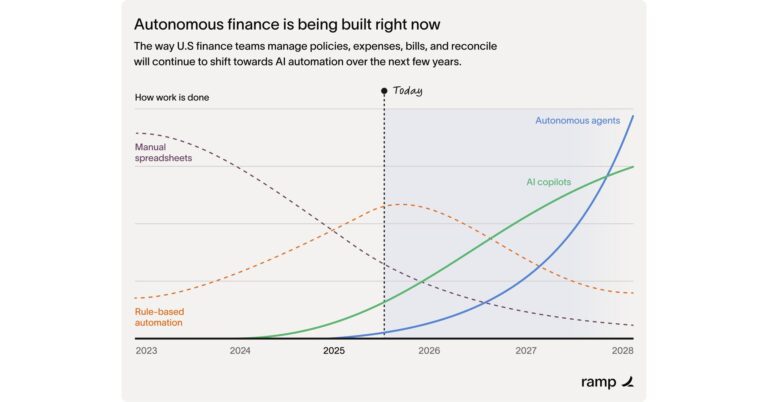

Co-founder and CEO Eric Glyman shared insights into Ramp’s ongoing mission and future goals in a recent letter. Glyman highlighted the significant changes the finance industry is experiencing, moving towards more automated solutions that relieve employees from tedious tasks. With the introduction of AI agents, financial teams across various industries are becoming more agile and responsive.

Shifting Paradigms in Financial Operations

As finance evolves, the traditional manual processes are becoming a relic of the past. Increasingly, companies are moving from reactive to proactive financial management strategies. The adoption of AI tools allows organizations to automate repetitive tasks and focus on strategic initiatives, enhancing their overall productivity and effectiveness.

The Role of Agents in Finance by 2026

By 2026, Ramp envisions its AI agents taking control of routine tasks, significantly reducing decision-making bottlenecks. For instance, simple transactions that traditionally consume time could be managed by AI, allowing teams to focus on more complex financial strategies. Ramp’s early adopters already report productivity boosts ranging from 10,000 transactions examined without human intervention to dramatic reductions in overall workload.

Looking Ahead to 2028 and Beyond

As Ramp continues its innovation, the concept of autonomous finance will become a reality. With AI driving many fundamental financial processes, human teams will be able to redirect their efforts toward high-value tasks. This evolution not only enhances organizational efficiency but also transforms workforce roles within financial departments.

Conclusion: Partnering for Financial Success

As Ramp strives to implement these innovative solutions, the potential for widespread impact is tremendous. While currently only servicing 1.5% of U.S. companies, the firm aims to extend its footprint across the financial landscape. As they forge ahead, Ramp remains committed to empowering organizations with time-saving, cost-effective tools designed for the future of finance.