The evolution and adoption of AI (Artificial Intelligence) by the financial sector pose several risks to financial stability, warns the Financial Stability Report. Risks include enhanced interconnectivity through over-reliance on shared technologies, service providers and infrastructure.

In particular, there is a high risk of market concentration, both within the financial sector and among critical third-party service providers of cloud and AI services.

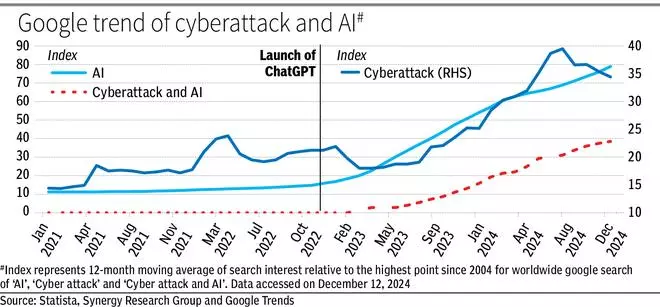

Additionally, the threat of cyber risk transforming into financial stability risk is high, as AI could help cyber attackers through sophisticated phishing attacks such as creating deepfakes using AI. Generative AI.

“With the widespread availability of AI services such as ChatGPTthere is growing concern that these services are being used for cyberattacks,” according to the report, which is a biannual publication, with contributions from all financial sector regulators.

AI in capital markets

The report refers to the IMF’s observations that increased adoption of AI in capital markets may create additional risks related to increased market speed and volatility during times of stress, particularly when business strategies using AI are becoming highly correlated.

Specifically, if these transactions are financed by leverage, any shock could amplify market tensions through fire selling and feedback loops.

Additionally, AI may encourage the migration of more activities to NBFIs (non-bank financial institutions), thereby increasing systemic opacity, according to the IMF.

The FSR, referring to the European Central Bank’s “Financial Stability Review”, warned that if technological penetration and market and supplier concentration are high, the transition of risk from individual companies to the financial system could be unreliable. linear and portend systemic risk.

The report notes that standard-setters and national regulators and supervisors should therefore take a balanced approach to reap the benefits of AI while protecting the financial system.

They need to update their skills and tools as well as proactively adapt their frameworks to identify and mitigate emerging risks related to this rapidly evolving technology, he adds.