The Boom of European Startups and Unicorns in 2025

The European startup ecosystem is experiencing remarkable growth, characterized by a surge in unicorn companies. A recent report by Vestbee, a Polish platform connecting global investors with promising tech startups, reveals that since 2020, 606 companies across Europe have achieved unicorn status. This remarkable trend is attributed to heightened entrepreneurial ambition and vibrant investment activities throughout the continent.

Unicorn Growth Resurgence in Early 2025

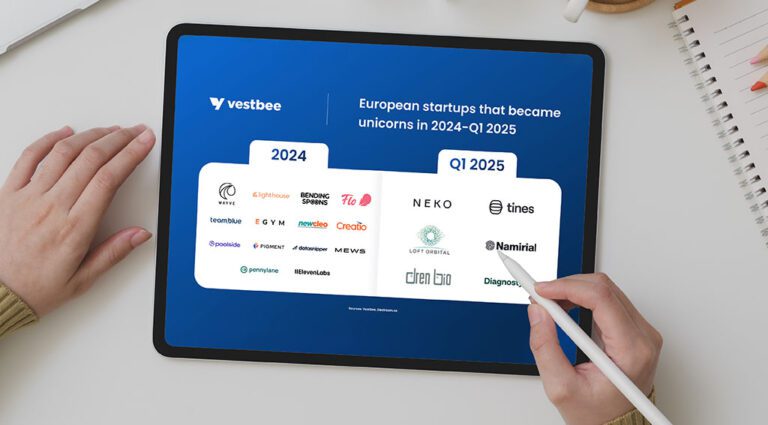

The report indicates a resurgence in unicorn creation, with six new companies achieving this status in the first quarter of 2025 alone, a significant uptick compared to the 16 unicorns created throughout 2024. This growth is fueled by increased late-stage investments, as European startups raised $3.6 billion via mega-rounds exceeding $250 million, accounting for 15% of the total capital raised in this period.

Geographic Distribution of Unicorns

The United Kingdom emerges as the leading contributor to Europe’s unicorn creation, with London recognized as the city that generates the most unicorns on the continent. To date, the UK has produced 185 unicorns, while Germany follows with 74, France boasts 60, Sweden has 46, and the Netherlands accounts for 34. Key hubs for unicorns include Berlin, Paris, and Stockholm, each with unique advantages driving their entrepreneurial success.

Sector Focus: Fintech Leads the Charge

Fintech stands out as the leading sector for unicorn creation in Europe, with 65 out of 198 European tech unicorns in Q1 2025 falling into this category—making up 32.8% of the total. Notably, the global Fintech sector represents 25.5% of all tech unicorns. Within Europe, London dominates this landscape, hosting six of the ten most valuable fintech companies.

Top Fintech Unicorns in Europe

Among the most valuable fintech startups in Europe during the first quarter of 2025 are:

- Revolut – £45 billion

- Klarna – £14.5 billion

- Checkout.com – £11 billion

- N26 – £9.23 billion

- Rapyda – £8.75 billion

- SumUp – £8.5 billion

- Blockchain.com – £7 billion

- Mollie – £6.5 billion

- Trade Republic – £5.36 billion

- Monzo – £5.9 billion

Challenges Facing European Startups

Despite this promising progress, European startups continue to face significant challenges. The Vestbee report highlights a financing gap at the growth stage, currently estimated at $375 billion. Since 2015, a limited number of follow-on rounds have left $300 billion in potential funding untapped, with European investors increasingly relying on American capital to fill a $75 billion deficit.

The Talent Shortage and Regulatory Hurdles

A pressing concern in the European startup landscape is the shortage of talent, particularly in fields like green technology and digital innovation. As global demand for expertise in AI and quantum technology rises, many top talents gravitate towards the U.S., creating a significant hurdle for European startups. Additionally, regulatory fragmentation across the continent complicates matters, as startups must navigate 27 different national systems, each with unique rules related to taxation, labor, and intellectual property—impacting operational efficiency and scaling efforts.

Conclusion

The landscape for European startups and unicorns in 2025 is thriving, yet it brings along a set of challenges that need addressing. By fostering a supportive environment for fundraising, talent acquisition, and regulation harmonization, Europe can enhance its position in the global startup ecosystem.