Harnessing AI for Financial Growth: A 40-Year Legacy of Basware

Basware celebrates 40 years of innovation with a keen focus on integrating AI to enhance financial operations and investments.

Transformative Returns on AI Investments

According to recent findings, companies investing in AI within financial technology are witnessing remarkable returns, averaging a 136% return on investment. This translates to an impressive savings of over $1.36 million for every million dollars invested over three years. As organizations navigate economic challenges, AI emerges as a crucial factor in financial performance.

The Growing AI Market

The global AI market is projected to soar, expected to reach $4.8 trillion by 2033. This significant growth reflects the increasing reliance on AI technologies by businesses across various sectors, aiming to streamline operations and enhance financial outcomes.

Proven Benefits of AI Adoption

New research indicates that 82% of companies that significantly invest in AI report increased revenues. Furthermore, 53% acknowledge improvements in gross profits compared to those with minimal investment in AI technologies. These insights were revealed in a report conducted by Basware and Financial Times Longitude, surveying CFOs from 400 global companies.

Addressing Financial Challenges with AI

As financial teams grapple with persistent cash flow issues, increasing demands for efficiency compound their challenges. Companies employing AI solutions can mitigate these issues, improving data accuracy, fraud detection, and reducing process delays. Notably, 75% of respondents noted that AI enables their teams to focus on strategic initiatives, minimizing time spent on manual tasks.

Enhancing Invoice Management with InvoiceAI

Basware introduces InvoiceAI, an innovative tool that integrates AI into the invoice lifecycle, aimed at optimizing financial operations. With 16 new product developments on the horizon, the initial offerings include:

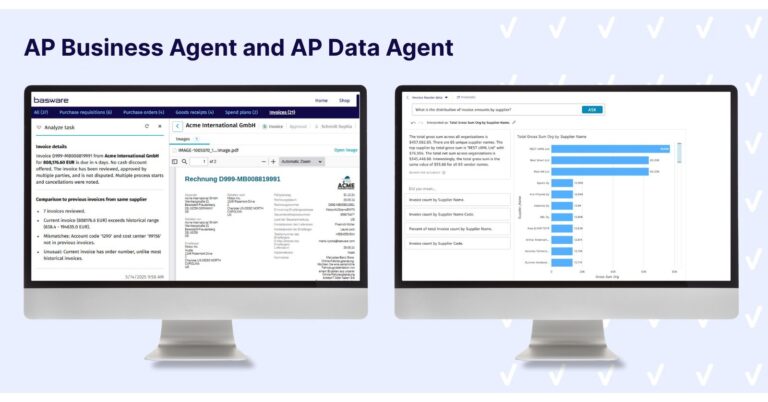

- AP Commercial Agent: An AI-powered tool that interprets invoice figures contextually, offering instant recommendations to streamline approval workflows.

- AP Data Agent: This tool allows users to engage in natural language queries regarding invoices, delivering clear insights and recommendations to enhance accounts payable processes.

40 Years of Expertise in Invoice Lifecycle Management

With four decades of experience, Basware has managed over $10.1 billion in corporate spending. Backed by real data trained on more than 2.3 billion invoices, Basware’s solutions are designed to yield significant returns on investment for financial teams.

The Future of Finance is AI-Driven

As financial leaders face unprecedented pressure, the integration of AI in financial management is not merely an option but a necessity for sustained growth. Basware stands at the forefront of this transformation, empowering businesses with the tools required to navigate the evolving financial landscape effectively. With AI embedded in its solutions, Basware is committed to helping organizations maintain total control over their invoicing processes.

Key Statistics Highlighting AI’s Impact on Finance

- 93% of respondents noted improved accuracy and coding in accounts payable.

- 92% reported faster identification of potential fraudulent activities.

- The primary goal driving financial transformation for executives is profitability (32%).

- Challenges such as change management, budget constraints, and lack of strategic vision hinder ROI potential.

This structured HTML article focuses on the impact of AI in financial operations as explained by Basware, using relevant keywords and engaging content to attract readers and improve SEO.