Powering the Future of Fintech – Innovate, Connect and Amplify with Tencent

HONG KONG, October 29, 2024 /PRNewswire/ — The 9th Hong Kong Fintech Week 2024 was held from October 28 to 29, 2024 at the Asia World-Expo in Hong Kong. This is the first time Tencent hosted an exhibition at the event, showcasing its fintech innovation capabilities, international businesses and brands under the theme “Powering the Future of Fintech: Innovate, Connect, And Amplify with Tencent.”

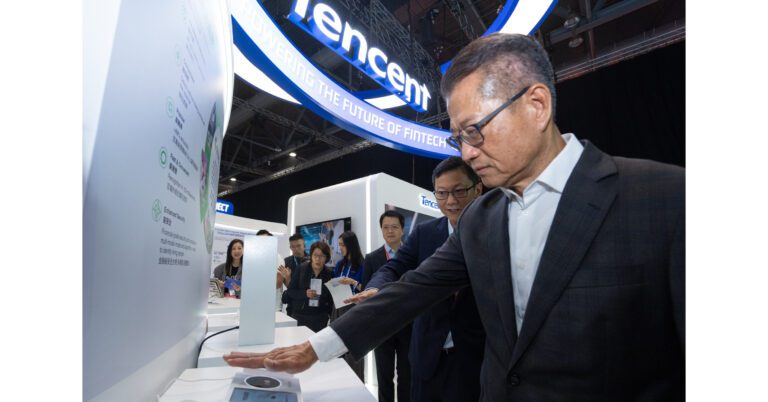

From day one, senior government officials and representatives of regulatory agencies, including Paul ChanFinancial Secretary of the Hong Kong SAR, Christopher HuiSecretary of Financial Services and Treasury, and Eddie YueDirector General of the Hong Kong Monetary Authority, visited the Tencent stand. They experienced Tencent’s innovative palm recognition technology following its introduction by Forest flaxvice president of Tencent and head of Tencent Financial technology.

This year’s Hong Kong Fintech Week attracted more than 30,000 industry executives from over 100 economies to discuss the future of fintech globally. Hong Kong, Asia and all over the world. Forest flaxvice president of Tencent and head of Tencent Financial Technology, was invited to share his ideas on the main stage. During a panel discussion on “The Practical Impact of Technology Adoption: Improving the Customer Experience,” he explained that technological innovation, at its core, aims to address equity issues. Weixin Pay’s innovative practices and solutions in China have significantly reduced merchant transaction costs and ensured user funds are secure thanks to risk control technologies such as AI, which have accelerated the ubiquity and inclusiveness of digital payments in China. One of the key missions of Tencent Fintech is about leveraging technology to make financial services more convenient, secure, affordable and accessible.

Daniel Hongvice president of Tencent Financial Technology, shared Tencent’s experience in interoperability of digital payment and funds transfer infrastructures. Tencent is committed to building a new open, diverse and inclusive global payment network covering various scenarios such as consumption, remittances, commerce, etc. For example, Tencent opened tens of millions of national merchant networks to amplify cross-border consumption and make it more practical for international travelers and Hong Kong residents. Tenpay Global cross-border money transfer services as well enable Overseas Chinese and WeChat pay Hong Kong users so they can easily pay salaries and alimony to their families. THE Mainland China.

Wenhui YangCEO of Tenpay Global (Singapore), Tencent’s cross-border payments platform, explained how digital wallets are reshaping the cross-border remittance experience. By partnering with over 50 global financial and remittance institutions and connecting to the Weixin ecosystem In In more than 100 countries and regions around the world, sending money is now as easy as sending a message.

In addition to cross-border remittances, Tenpay Global also enables businesses to expand globally by offering account management, global payment and collection, and foreign exchange services for e-commerce marketplaces, businesses import and export, standalone websites and B2B commerce sectors. Through innovative solutions, it ensures a seamless experience while remaining compliant and secure.

Tencent is at the forefront of digital innovation, particularly in the field of artificial intelligence. Over the past six years, Tencent invested 42 billion US dollars in R&D and now holds more than 5,000 AI-related patents. Based on Tencent’s proprietary Hunyuan foundation model, its Hunyuan Financial LLM is applied to its own financial scenarios, fostering innovation that creates value for both businesses and users.

SOURCE Tencent