Technological actions fell on Monday after the start-up of Chinese artificial intelligence Deepseek amazed the Silicon Valley with advances apparently made with much less computer power than American competitors.

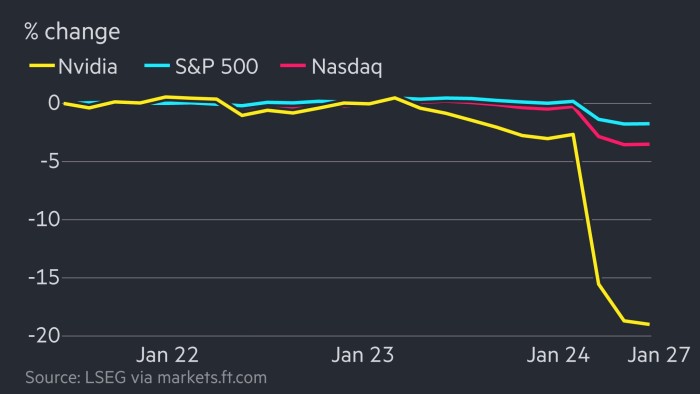

Actions in California NvidiaOne of the largest beneficiaries of expenses on AI fleas, plunged almost 17%, annihilating nearly $ 600 billion in market value, record loss for any business.

In depth Last week, published its latest model of Grande Language AI, which achieved a performance comparable to that of US Rival Openai, even if the company previously claimed to use much fewer Nvidia chips.

The venture capital investor Marc Andreessen described the new Chinese model of “Spoutnik moment of AI”, establishing a comparison with the way in which the Soviet Union shocked the United States by putting the first satellite in orbit.

The results sent a shock wave through the markets on Monday, while investors reassess the probable future investment in IA material.

The Nasdaq composite index rich in technologies dropped by 3.1%, while the S&P 500 index decreased by 1.5%. Microsoft fell 2.1%. Commercial activity was greater than a third party higher than usual for the actions listed on the American composite index S&P 1,500, as a sign of the way investors rushed to interpret how Deepseek will affect technological groups of Silicon Valley.

The rout extends far beyond traditional technology. Siemens Energy, which provides electrical equipment for IA infrastructure, plunged 20%. Schneider Electric, a French manufacturer of electrical products that has invested massively in services for data centers, dropped by 9.5%.

The traders asked for a shelter in the perceived paradise, with actions of basic consumption companies such as Johnson & Johnson, Coca-Cola, General Mills and Hershey displaying solid gains on Monday.

Apple, which is considered less exposed to the AI race than many rivals of large technologies, won 3.3%.

For some, the sale of companies making “choice and shovels” of the AI revolution has echoed the price of the Cisco computer equipment company when the Dotcom bubble broke out.

NVIDIA, Broadcom and other flea manufacturers benefited from the Silicon Valley race to build ever heavier clusters of token, than Sam Altman, like the boss of Xai Elon Musk and the Openai, argued to continue to continue Advance the capacities of AI.

NVIDIA’s chief executive, Jensen Huang and Hock Tan of Broadcom, have argued in recent weeks Continue until the end of the decade.

“This shows how vulnerable AI is vulnerable, like all trades that are consensus and based on the assumption of an unassailable advance,” said Luca Paolini, chief strategist at Pictet Asset Management.

But some Wall Street analysts and IA researchers have questioned the media threw surrounding the realization of Deepseek. “It seems categorically false that” China has duplicated Openai for $ 5 million “and we do not think it is really in depth discussion,” Bernstein analysts wrote in a note to customers.

Some researchers have even hypothesized that Deepseek was able to take shortcuts in its own training costs by taking advantage of the latest Openai models, suggesting that even if it has been able to reproduce the latest American developments very quickly, It will be more difficult for the Chinese company to take the lead.

Investment in AI by American technological companies with great capitalization reached $ 224 billion last year, according to UBS, which expects the total to reach $ 280 billion in 2025. OPENAI and SOFTBANK have Announced last week a plan to invest $ 500 billion in the next four years in the infrastructure of AI.

Even after the latest version of Deepseek, Meta-Chef Mark Zuckerberg said on Friday that he had planned to spend up to $ 65 billion on IA infrastructure this year.

Founded by the Hair Fund manager Liang Wenfeng, Deepseek last week published a detailed article explaining how to build a large language model that could automatically learn and improve.

“It seems that there is a little reality that China has not been inactive, even if these tariffs and these investment restrictions on technological companies have been implemented,” said Mitul Kotecha, manager in Asia of the Chief of emerging markets and foreign exchange strategy at Barclays.

The United States has imposed strict restrictions on flea exports to China under former President Joe Biden, prohibiting the sale of Nvidia’s most advanced models to the country.

Some analysts argued that Deepseek advances would finally prove to be positive for manufacturers of AI fleas such as Nvidia.

Dylan Patel, chief analyst of chip consultancy semiianalysis, said that the reduction in training costs and management of AI models would be in the longer term, which would facilitate companies and consumers to adopt AI applications easier and cheaper.

“The progress of the efficiency of training and inference allow an additional scale and proliferation of the AI,” said Patel. “This phenomenon has occurred in the semiconductive industry for decades, where Moore’s law has half of the costs every two years while the industry continued to grow and add more capacities to fleas. ”

Report by George Steer, Jennifer Hughes, Harriet Clarfelt and Will Schmitt in New York, Arjun Neil Alim in Hong Kong, Leo Lewis in Tokyo, Eleanor Olott in Beijing and Tim Bradshaw and Ian Smith in London in London