Seapoint Secures $3 Million in Pre-Series Funding for European Startups

Seapoint, a groundbreaking financial platform designed for European startups, has successfully raised $3 million in pre-series funding. The funding round was led by First-line Ventures, with additional participation from TAPESTRY VC and notable former leaders from the bands Revolt, Tide, and Teeth.

A Unified Financial Solution

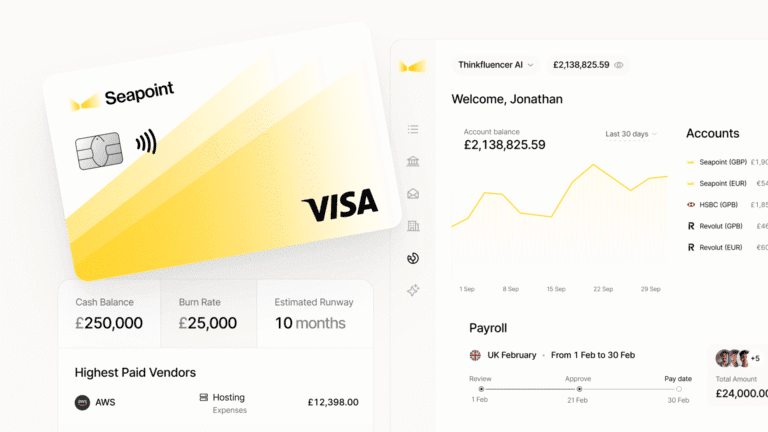

Seapoint aims to revolutionize the way European companies manage their finances by offering a unified platform that integrates business accounts, corporate cards, payment processing, and treasury management into a single interface. Leveraging artificial intelligence, it automates traditionally time-consuming tasks such as email bill processing, payroll management, expense categorization, and report generation. This innovative approach significantly reduces the time and effort required to manage finances.

Bridging a Market Gap

The platform addresses a critical gap in the market, particularly for mid-sized companies with 10 to 250 employees. These businesses often find themselves caught between consumer-focused neobanks and traditional banking services, which may not cater to their specific needs. Seapoint provides a tailored solution for these companies, ensuring they receive the financial services necessary for growth.

Insights from Founders

Through interviews with over 50 venture capital-backed founders, Seapoint identified that many companies face fragmented, manual, and costly financial processes. Typically, businesses have to juggle four to six different tools and multiple bank accounts while relying heavily on accountants and earning minimal interest on their deposits. By consolidating these tools and automating workflows, Seapoint aims to lower costs, enhance clarity, and maximize earnings from deposits.

Leadership with Experience

Leading the charge is Seapoint’s Founder and CEO, Sean Mullaney, who previously served as the CIO for Europe at Stripe and CTO at AI unicorn Algolia. Mullaney is joined by former colleagues from the Stripe payment team and leaders from Tide. The collective experience of the team, many of whom are former founders, equips them with firsthand knowledge of the challenges startups face with financial management.

The Power of AI in Financial Management

“AI can transform the finances of companies at scale. In just a few minutes, Seapoint connects to a company’s bank accounts, accounting software, and emails. This capability allows us to provide a real-time view of the business and automate tasks like accounts payable and payroll management. Seapoint is not only broader but also more powerful than traditional banking services, empowering founders to take control of their finances,” commented Mullaney.

Private Beta Now Available

Following nine months of dedicated development, Seapoint has launched a private beta version already being utilized by dozens of venture-backed startups. Interested UK and European startups are invited to register for the beta program at Seapoint.co.

Conclusion

As Seapoint continues to innovate in the financial technology space, its unified platform has the potential to transform how European startups manage their finances. With a strong leadership team and a clear focus on the needs of mid-sized companies, Seapoint is poised for significant growth in the evolving fintech landscape.