As 2024 draws to a close, the Indian startup ecosystem finds itself at a crossroads. This year has been a journey of resilience and reinvention, where businesses have faced economic headwinds, adopted cutting-edge technologies, and moved toward sustainable growth.

One of the notable events of the year was the growing maturity of the Indian initial public offering (IPO) market. Companies with strong unit economics and profitability now see a clear path to listing on public markets, signaling a new era of opportunity for founders and investors.

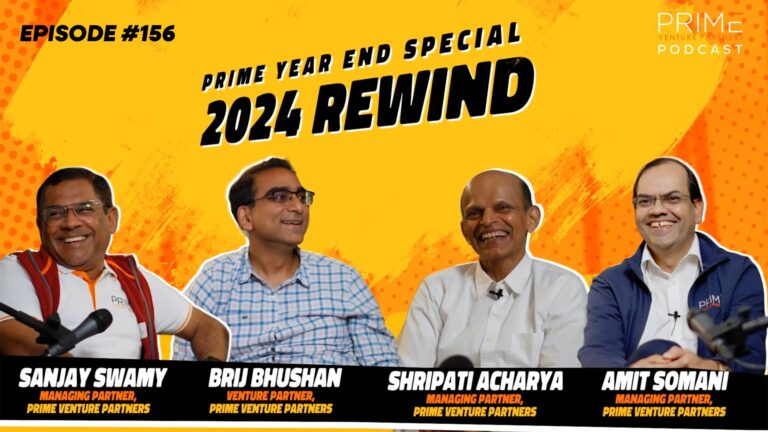

At Prime Venture Partners (PvP) End of year podcast all partners, Sanjay Swamy, Shripati Acharya, Amit Somani and Brij Bhushan reflected on the defining moments of the year.

From the rise of AI and the continued evolution of fintech to the challenges and opportunities of rapid commerce and IPO readiness, their candid views paint a vivid picture of the future of Indian startups.

This article outlines the key takeaways, actionable lessons, and bold predictions shared during the discussion. Whether you are an entrepreneur, investor, or tech enthusiast, 2024 Thoughts offers valuable lessons for navigating the ever-changing landscape of the Indian startup ecosystem.

AI goes from buzzword to business essential

“AI has become second nature to consumers and businesses,” remarked Shripati Acharya, highlighting how startups are integrating AI not just as a tool but as an essential part of their operations.

Sharing a personal anecdote, he said: “Last week, my daughter used ChatGPT to find out about her compensation rights after a flight delay. It’s no longer a novelty, it’s a utility.

For startups like Quizizz, AI has been a game changer. “They have used AI to extend its usefulness to both teachers and students,” Acharya noted. Features like dynamic layouts enable personalized assessments, making learning more inclusive and impactful.

Looking ahead, Acharya highlighted, “AI opens up new avenues for innovation, especially in solving India-specific problems. The scope of what we can solve with technology is expanding exponentially and is highly inclusive.

Indian IPOs: A new era for startup exits

A milestone for 2024 was the clarity of IPO pathways for Indian startups. Sanjay Swamy shared, “For years, the founders wondered where the exits would come from. Today, companies with $50-70 million in revenue, strong unit economics and profitability can realistically target IPOs in the Indian public markets.

This development has boosted the confidence of entrepreneurs and investors, creating a tangible goal for business growth. “It’s no longer just about building great businesses, it’s about building publicly sustainable businesses,” Swamy added.

Fast trading: bubble or long-term opportunity?

Fast commerce has sparked debate throughout 2024. While it has undeniably reshaped consumer behavior, questions around profitability persist.

Brij Bhushan summed it up best: “If you deliver something that took three days in 10 minutes, consumers will love it. But profitability will require deep pockets and disciplined execution.

The challenges extend beyond consumer-facing services and extend to the backbone of fast commerce: supply chains and logistics.

“It’s not just about delivering in 10 minutes,” Bhushan said. “Startups are completely rethinking supply chains, creating opportunities for new infrastructure and platforms to emerge. »

The third coming of Edtech

After a turbulent phase, edtech is making a comeback. “Edtech and healthcare will be needed even in 500 years,” noted Amit Somani.

Startups like PlanetSpark have led the way with profitable and scalable models. “They showed that focusing on the fundamentals – unit economics and creating value for learners – can create sustainable businesses,” Somani explained.

The integration of AI in education has further boosted the sector. “Companies like Quizizz are leading by example in using AI to transform learning experiences,” Acharya said.

Somani predicted that the next wave of edtech would focus on personalized and inclusive learning. “There is a growing awareness that online learning is not just an alternative: it is a way to bridge gaps in access and quality. »

Fintech: the gift that keeps on giving

Although a well-established sector, fintech continues to evolve. As Swamy observed, “India remains massively credit deprived. It’s a space where the opportunities are endless, provided startups stay within regulatory boundaries.

Startups like Freo illustrate this disciplined approach. “They have demonstrated extraordinary discipline in acquiring low-cost customers while maintaining tight control over NPAs,” Swamy said.

Acharya added a caveat: “The best fintech entrepreneurs understand not only the letter of the regulations but also the spirit behind them. Building businesses that align with this ethos is what differentiates long-term winners.

Profitability: the cornerstone of 2024

If one theme defined 2024, it was profitability. From consumer startups to SaaS companies, the focus has shifted to sustainable growth.

“MyGate is a great example,” Swamy said. “They achieved profitability by combining advertising revenue, SaaS and innovative products like MyGate locks. It’s about getting back to basics and staying focused on customer needs.

Somani highlighted another dimension of profitability: leadership. “Investing in high-quality management teams and embracing coaching has been transformative for our portfolio companies. This is the sign of a fully maturing ecosystem.

What’s next for 2025?

At the end of the podcast, each speaker shared their predictions for the year ahead.

Acharya highlighted the democratization of technology: “Voice technology will make innovation accessible to everyone. Imagine interacting with software in your native language: it’s the future.

Somani predicts a resurgence in edtech, fueled by sustainable models and AI-driven personalization.

“We are entering the third coming of edtech, and this time it is here to stay.”

Swamy turned to the convergence of IoT and AI: “IoT with AI is going to be extraordinarily exciting. The intersection of these technologies will create entirely new categories of startups.

Bhushan summed it up: “2025 will be the year for startups to solve specific, high-impact problems with integrated solutions. It’s not just about innovation, it’s about relevance and execution.

As we approach 2025, the Indian startup ecosystem is stronger, more mature and more innovative than ever. For entrepreneurs, the message is clear: focus on the fundamentals, embrace technology and build with purpose.