Exploring the South African Fintech Market: Growth and Innovations

Market Overview

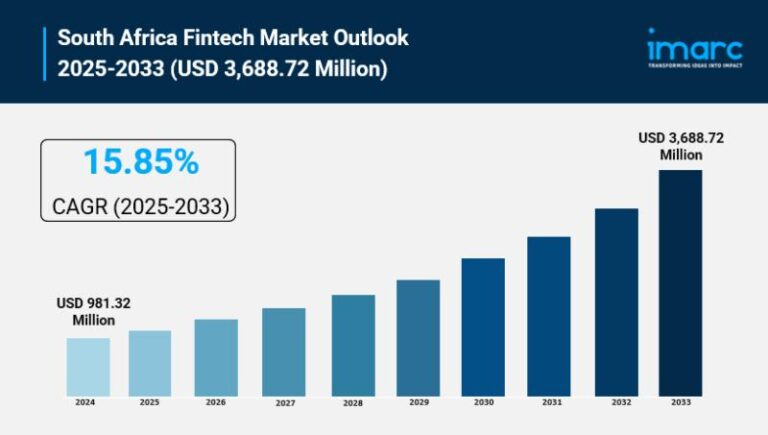

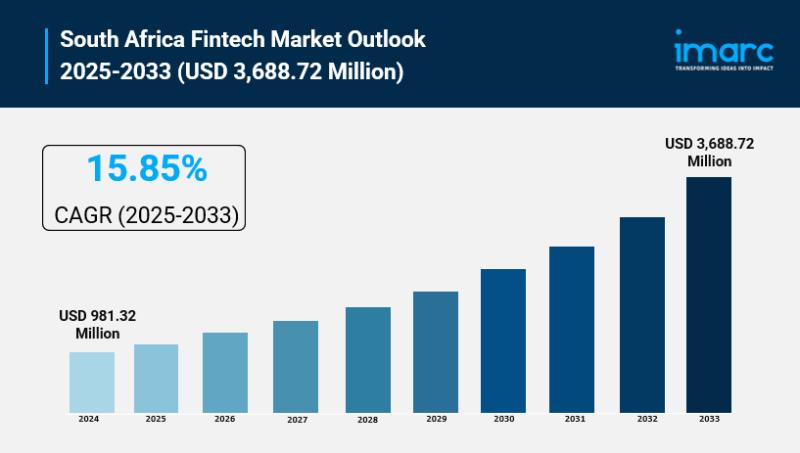

The South African fintech market is experiencing rapid expansion, with its market size projected to reach approximately $981.32 million by 2024 and an anticipated growth to $3,688.72 million by 2033. This growth trend indicates a significant compound annual growth rate (CAGR) of 15.85% from 2025 to 2033, reflecting the increasing adoption of innovative financial solutions.

The Role of Artificial Intelligence

Artificial intelligence (AI) is playing a pivotal role in reshaping the South African fintech landscape. AI-driven digital payment systems are enhancing the convenience and security of cashless transactions, benefiting both urban and rural populations. Moreover, automated AI underwriting is streamlining loan approvals on digital lending platforms, enabling access for underserved individuals and small to medium-sized businesses (SMBs).

Enhancing Financial Services Through AI

Integrating AI with open banking technologies is revolutionizing personalized financial services, as customer data is securely analyzed in compliance with existing regulations. Additionally, AI-powered fraud detection systems bolster trust among fintech companies, minimizing operational losses. Customer service is also transformed through AI chatbots and virtual assistants, which efficiently handle inquiries and transactions around the clock.

Market Growth Factors

The surge of mobile money and digital payments in South Africa can be attributed to a smartphone penetration rate exceeding 67% and a tech-savvy youth population representing nearly 60% of users. This demographic shift is fueling transaction volumes and providing essential support to the informal economy, which constitutes around 30% of the GDP. Innovations like digital wallets and contactless payments are expanding access to financial services across diverse communities.

Blockchain and Virtual Assets

As South Africa positions itself as a leading crypto hub within Africa, large-scale retail adoption of blockchain technology is on the horizon. This is bolstered by supportive regulations from countries such as Mauritius and Nigeria. The development of decentralized finance (DeFi) platforms is addressing high transfer fees while improving cybersecurity through the use of biometric data and regulatory technology tools.

Recent Developments in the Fintech Sector

Several noteworthy events have recently shaped the South African fintech landscape. In August 2025, fintech startup Street Wallet secured $350,000 to enhance its digital payment solutions for informal traders. Additionally, the acquisition of iKhokha by Nedbank reflects the ongoing collaboration between fintech firms and traditional banks, fostering increased financial inclusion for SMBs.

Conclusion and Future Outlook

The South African fintech market is poised for remarkable growth fueled by technological advancements and a favorable regulatory environment. With innovative solutions enhancing access to finance, the financial services sector is on a trajectory toward greater inclusivity and efficiency. Stakeholders keen on navigating this dynamic landscape will find significant opportunities for investment and collaboration.

For more in-depth insights and data, explore the full report available through IMARC Group or contact us for tailored market analysis.