Singapore has launched a new financial technology center to strengthen its efforts in digital payments, tokenization, digital assets and artificial intelligence (AI).

Known as the Global Finance & Technology Network (GFTN), it will incubate startups and catalyze the growth of the country’s fintech sector. It replaces Elevandi, a non-profit organization established by the Monetary Authority of Singapore (MAS) to promote the growth of fintech in the Southeast Asian country. Elevandi was the organizer of the popular Singapore Fintech Festival.

Although it is one of the smallest nations in Asia, Singapore’s fintech sector has been thriving for decades. In 2023, the sector was estimated to be worth $35.2 billion and is expected to reach $63 billion by 2029. According to data of Singapore FinTech, the country accounted for two-thirds of all fintech funding over the ASEAN region.

MAS expects GFTN to boost this thriving sector and enable it to compete with regional leaders such as India, the Philippines and China.

GFTN is part of the second phase of MAS’s fintech growth initiative. During the first phase, the largest bank experimented with various technologies, most of which were carried out in a regulatory sandbox. Participants focused on AI, cross-border payments, digital assets and tokenization.

GFTN will continue the forums organized by Elevandi. It will also offer business advisory services to authorities and governments and develop a suite of digital platform services targeting SMEs and startups. Its financial arm will invest in fintech companies, while providing comprehensive support to help them launch into the market.

Ravi Menonformer managing director of MAS, will chair the board of directors of GFTN, while the bank’s current director of fintech, Sopnendu Mohantywill be the CEO.

At a press conference to announce the creation of the new center, Menon described GFTN as “Elevandi on steroids”. He believes the new center will “open sustainable and inclusive pathways that will serve communities around the world while strengthening Singapore’s global connectivity and its role as a financial technology hub”.

He pledged to support Singapore’s fintech innovators and highlighted that tokenization was particularly vital to Singapore’s growth. digital economy.

“After years of experimentation, the tokenization of financial assets has reached a critical point. Trillions of dollars of financial assets are on-chain today, but the promise of a tokenized financial system has yet to come to fruition. It’s still a work in progress and an experiment,” he said.

Tokenization has been a key sector for MAS. In a speech on November 4 at a side event ahead of this year’s Singapore FinTech Festival, MAS Deputy Managing Director Leong Sing Chiong praised tokenization like the future of finance.

Chiong identified four key pillars for developing tokenization: improving liquidity, developing fundamental digital infrastructure, formulating industry standards and regulations, and developing common settlement assets. Regarding the last pillar, MAS believes that a wholesale CBDC would be the ultimate solution and has launched a Singapore Dollar (SGD) Testnet for financial institutions.

“From a global perspective, we envision a possible future architecture of a globally scalable tokenized asset infrastructure that can enable interoperability between commercial networks, while powering tokenized asset transactions of transparent manner across borders and markets,” he concluded.

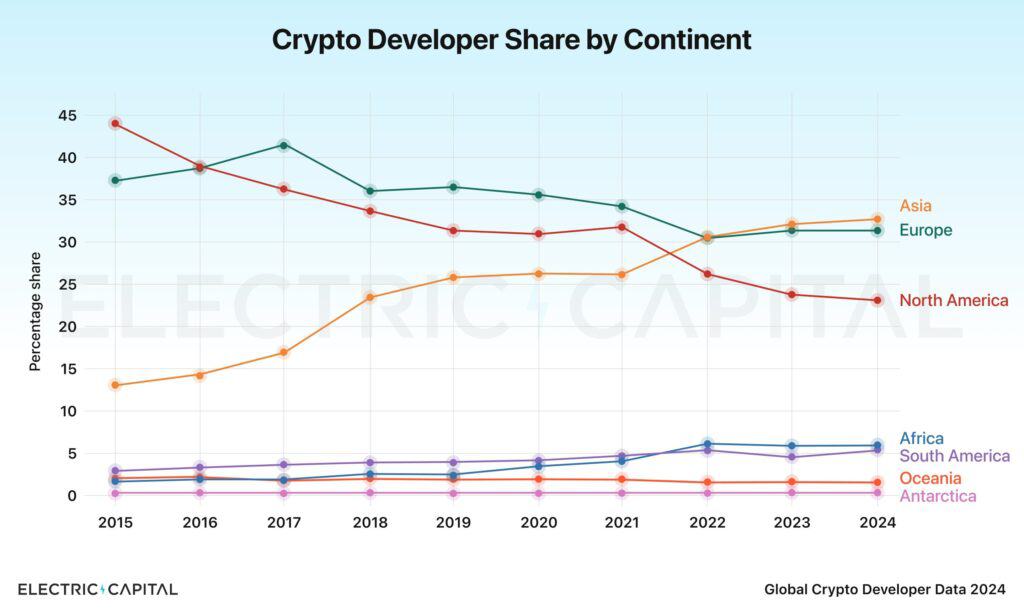

Asia overtakes US and Europe for blockchain developers

In other news, Asia is the world’s leading country for digital asset and blockchain developers, surpassing Europe and the United States, according to a new study.

Electric Capital, an early-stage venture capital firm focused on the blockchain sector, conducted the study. He analyzed more than 200 million linked to blockchain Git commits from over 110,000 developers over the last decade.

The study finds that Asia now accounts for 32% of all digital asset developers, up steadily from 13% in 2015. It has eclipsed North America in 2021 and Europe a year later .

Conversely, North America’s share has steadily declined, from 44% in 2015 to 24% this year. Europe has been the most dominant, topping the rankings from 2016 at 43% through 2022. However, it has since lost the top spot to Asia.

The study found that the United States remains the largest global hub for blockchain developers, at 18%. India and the United Kingdom follow suit with 11.8% and 4.2%.

Maria Shen, general partner at Electric Capital, Remarks“81% of crypto developers live outside the US, shaping the future of digital currency. This is a national security problem and an innovation drain for the United States. »

The study aligns with recent trends, where emerging markets have become the most active in the adoption of digital assets and blockchain. While the United States still dominates speculative trading, these markets have integrated digital assets into payments, remittances and blockchain to improve efficiency, reduce costs and increase transparency.

Additionally, regulators in these jurisdictions have supported blockchain innovation with positive and enabling regulations. Hong Kong, for example, implemented vital new laws that encouraged even traditional finance to explore blockchain applications. like tokenization.

Watch Fintech Revolution Summit 2023: Blockchain Technology Shaping the Future of Finance

title=”YouTube Video Player” frameborder=”0″ allow=”accelerometer; autoplay; write to clipboard; encrypted media; gyroscope; picture-in-picture; web sharing” referrerpolicy=”strict-origin-when- cross-origin”allowfullscreen=””>