AI Investment Boom: Navigating Opportunities and Risks

The AI industry has witnessed a significant surge in investment, with projections suggesting that the momentum will carry into 2026. With agreements totaling around 1 trillion dollars, major tech players like Oracle, Meta, Amazon, Microsoft, Google, and Nvidia are increasingly engaging in multibillion-dollar investments aimed at enhancing AI capabilities.

The Landscape of Circular Investments

These investments often take the form of circular deals, where tech giants funnel billions into AI chatbot companies, which in turn rely on substantial data centers to sustain their operations. These data centers demand an extensive amount of GPUs, the primary hardware for AI computational tasks. A recent study from McKinsey & Co. estimates that the global demand for data center infrastructure could reach a staggering $6.7 trillion, signaling that the current wave of investments could be merely the beginning.

Potential Risks for Investors

With such vast sums at stake, potential pitfalls loom large. One significant concern is the financial stability of hyperscalers, such as Microsoft, Oracle, and Amazon. Collectively, these companies form a substantial part of the S&P 500. Overextending their capital expenditures (CapEx) in a bid to dominate the AI landscape could jeopardize their financial health. Investment bank HSBC warns that OpenAI may remain unprofitable until at least 2030, despite a growing user base.

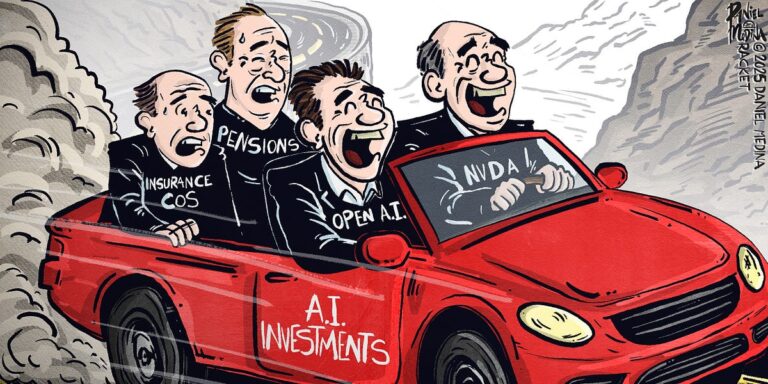

Interconnectivity and Systemic Risks

The complex interdependencies among hyperscalers, chatbot developers, and AI chip makers heighten systemic risks. A failure on the part of one major entity could consequently trigger a domino effect, impacting a wide array of shareholders, particularly those invested in retirement accounts and mutual funds linked to these giants.

Financing the AI Infrastructure

Much of the funding for this AI infrastructure will come from private credit sources. Hyperscalers are heavily reliant on borrowed capital to finance their aggressive expansion. Recent discussions indicate that while traditional corporate bond markets have become more restrictive, private equity firms are stepping in. Deals like Meta’s “Donut” agreement illustrate how innovative financing structures are evolving to support these monumental ventures.

The Future of Data Centers

The current boom in data centers might not sustain its upward trajectory indefinitely. Many data centers are being constructed in remote areas, which raises concerns regarding their future utility, especially if AI demand shifts or declines. Additionally, growing local opposition to new data centers, due to their environmental impact, could complicate expansion plans for major firms like Microsoft.

Conclusion: Tread Carefully in the AI Investment Landscape

As AI investments continue to proliferate, stakeholders must navigate a complicated landscape filled with both golden opportunities and substantial risks. Investors should proceed with caution, ensuring they understand the complexities involved in AI funding and the potential implications for their financial portfolios. The future of AI investment holds immense potential, but it also necessitates a profound understanding of the associated dynamics and threats.

This HTML structured article incorporates headings, relevant keywords, and presents the information in an engaging manner, while ensuring it is optimized for search engines.