Kayko Secures $1.2 Million Seed Funding to Transform SME Financing in Rwanda

Rwandan fintech startup Kayko has successfully raised $1.2 million in seed funding. This investment will help the company in its mission to utilize data to improve access to financing for small and medium-sized enterprises (SMEs) across Rwanda.

About Kayko

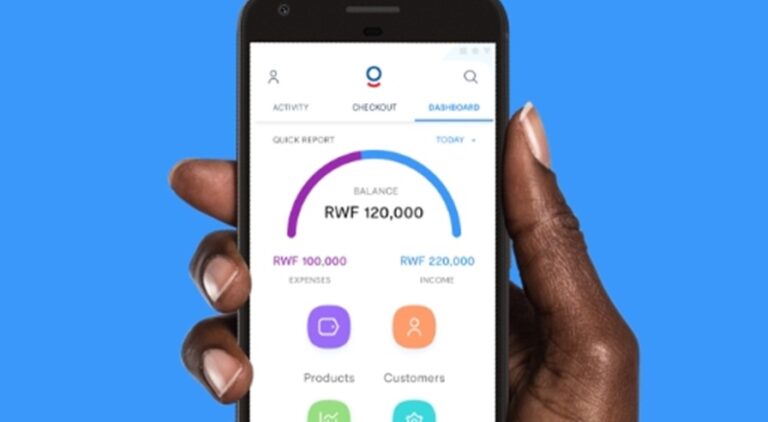

Founded in 2021 by the Crépin brothers and Kevin Kayisire, Kayko offers a versatile platform that enables users to process sales through a Point of Sale (PoS) system, monitor inventory, manage expenses, and facilitate payments seamlessly.

Addressing a Critical Need

“We created Kayko to tackle a pressing challenge,” the founders stated. “Millions of SMEs in Africa operate daily but lack actionable financial data to grow, obtain loans, or scale their operations. While cash flows, sales, and tax payments are happening, banks still struggle to ‘see’ the business.”

Rapid Adoption by SMEs

Kayko has already made significant strides, with over 8,500 SMEs using its platform for accounting, inventory management, and tax compliance on a daily basis. Following a successful funding round, the startup is poised for further expansion.

Investment Partners

The recent funding round saw participation from prominent investors including Burrow Capital, the Luxembourg Development Agency, BRD’s Hanga Ignite, and develoPPP Ventures. This financial backing sets the stage for Kayko’s ambitious growth plans.

Building a Micro-ERP System

According to the founders, “Kayko functions as a micro-ERP and data layer for SMBs, capturing vital metrics like sales, spending, inventory, and compliance signals. This data can facilitate credit scoring, working capital improvements, and more intelligent financial products.” The newly acquired funding will be instrumental in driving these advancements.

Future Goals and Objectives

Looking ahead, Kayko aims to enhance its infrastructure and expand its data-driven lending and credit scoring capabilities. The startup envisions transforming everyday business activities into substantial access to capital for SMEs, thereby reshaping the financial landscape for small businesses in Rwanda.