Flipkart co-founder Sachin Bansal’s Navi Finserv, a subsidiary of Navi Technologies-led fintech startup, witnessed a decline in its operating revenue and operating profit during the financial year 2023-24 (FY24), affected by a drop in its interest income and an increase in loan cancellations. .

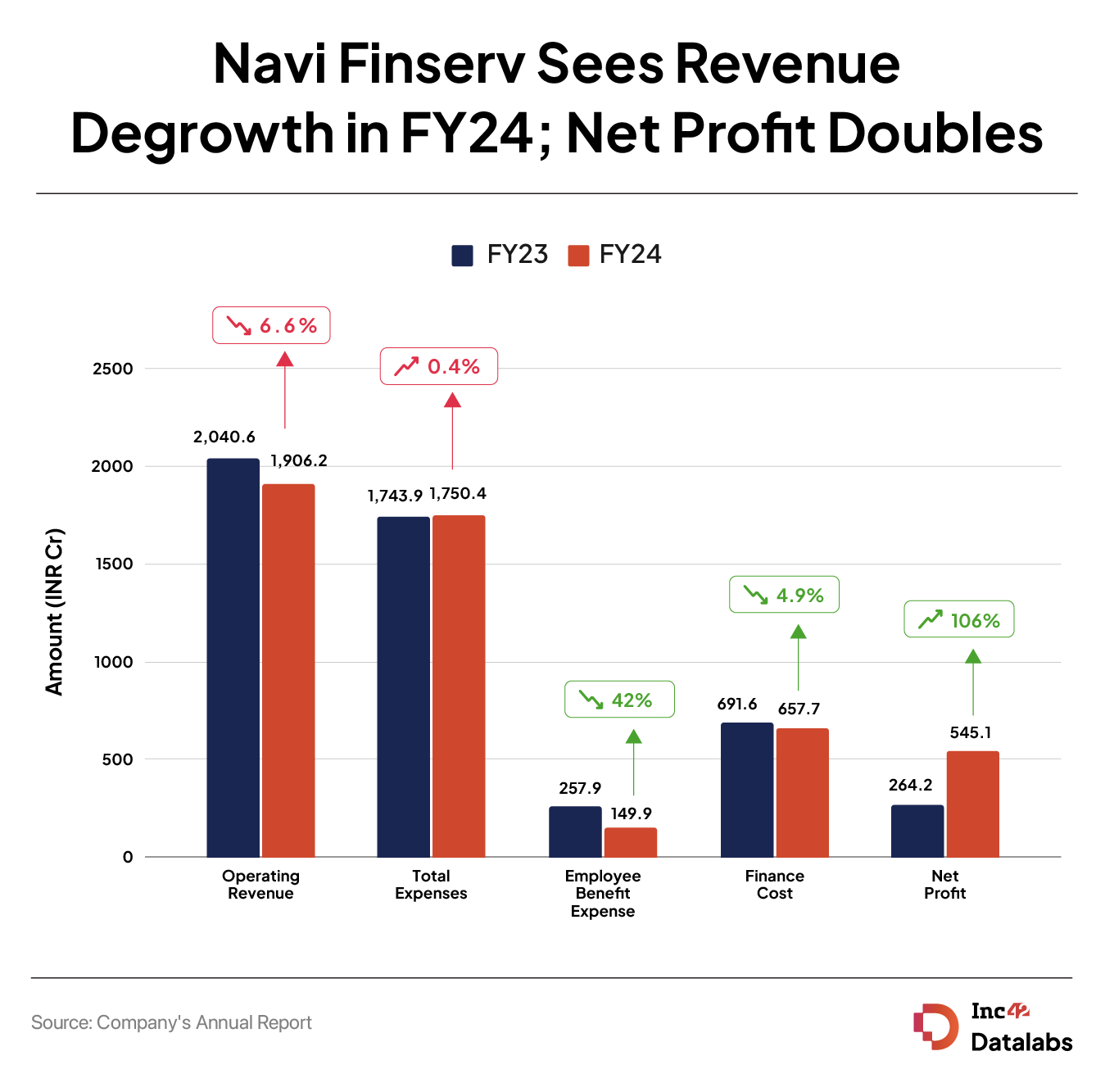

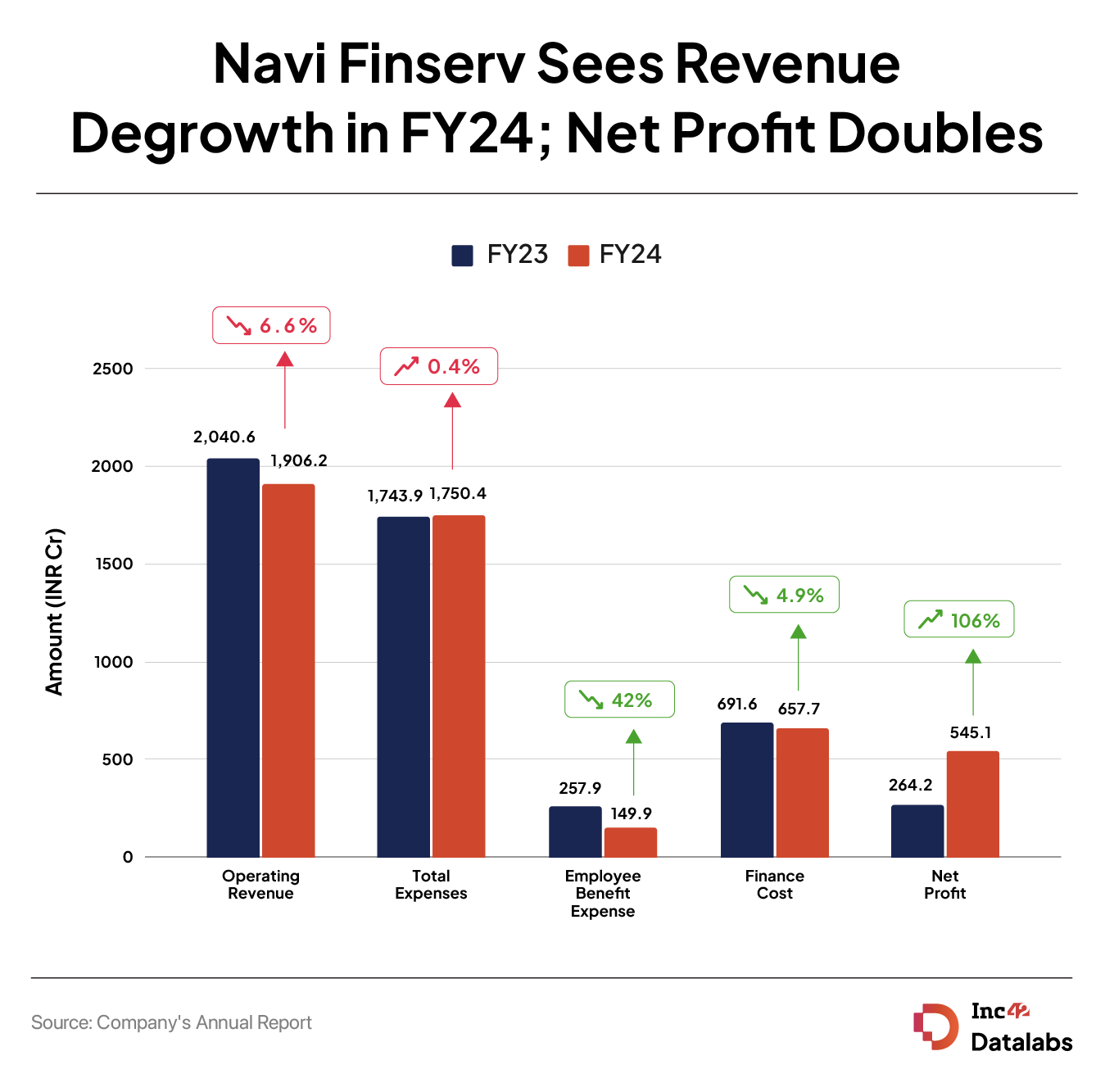

Navi Finserv’s consolidated operating revenue fell 6.6% to INR 1,906.2 Cr during the year under review from INR 2,040.6 Cr during FY23. decline in revenue, its Profit After Tax (PAT) from continuing operations also declined by 41% YoY (YoY) to INR 155.6 Cr in FY24.

However, the fintech major made significant gains by divesting its entire stake in its microfinance subsidiary Chaitanya India Fin Credit Private Limited. Including Navi Finserv’s profit from discontinued operations, Chaitanya, the startup’s net profit more than doubled to INR 545.1 Cr in FY24 from INR 264.2 Cr in the previous year.

It is pertinent to note that in August 2023, Svatantra Microfin Pvt Ltd, headed by Ananya Birla, signed an agreement definitive agreement to acquire Chaitanya for INR 1,479 Cr and finalized the acquisition in November 2023.

Previously, Bansal acquired Chaitanya Rural Intermediation Development Services (CRIDS) through BAC Acquisitions (now Navi Technologies) in 2019. CRIDS was later renamed Chaitanya India Fin Credit. The acquisition helped Navi acquire an NBFC license. However, the Reserve Bank of India (RBI) rejected Chaitanya India Fin Credit’s application for a universal banking license “at your fingertips” in 2022.

Navi Finserv was incorporated in 2012 and offers different types of loans, including personal, auto, and home loans. The majority of its revenue comes from interest income on loans, investments and deposits with banks.

The startup’s total interest income fell over 12% YoY to INR 1,611.1 Cr in FY24. Its net gain on derecognition of financial instruments under the amortized cost category also declined by 26.8% YoY to INR 102.4 Cr during the year.

Navi Finserv’s total assets under management (AUM) stood at INR 8,527.2 Cr in FY24, up from INR 6,791 Cr at the end of FY23. total loan disbursements worth INR 16,006 Cr in FY24 compared to INR 12,630 Cr in the previous year.

Focus on expenses

Navi Finserv’s total expenses saw a marginal increase to INR 1,750.4 Cr during the year under review from INR 1,743.9 Cr in FY23, with finance costs alone accounting for more 37% of its total expenses.

Financial cost: The startup’s finance cost decreased by around 5% to INR 657.7 Cr in FY24 from INR 691.6 Cr in the previous year.

Staff costs: Navi Finsev reduced its employee benefits spend by 42% to INR 149.9 Cr in FY24 from INR 257.9 Cr in the previous year.

It should be noted that the the company laid off around 200 employees in several departments in July last year.

It spent INR 120.3 Cr on salaries, wages and bonuses during the year under review, compared to INR 217.1 Cr in the previous year.

Loans written off: The company’s expenditure on loan waivers jumped to INR 406.2 Cr in FY24 from INR 125.4 Cr in the previous year.

Overall, its impairment on financial instruments stood at INR 495.6 Cr during the year, compared to INR 397.9 Cr during FY23.

Software support fees: Navi Finserv’s expenses on this head increased by over 50% YoY to INR 248.2 Cr in FY24.

Navi Finserv transformed into a public entity in March 2022. Its holding company Navi Technologies

In July this year, Navi Finserv finalized a $38 million personal loan securitization deal with JP Morgan.

Earlier this year, the company also raised INR 150 Cr via bond issue from several investors, including Dadachanji Group Chairman Kairus Shavak Dadachanji, Pervin Kairus Dadachanji and Rishad Kairus Dadachanji.