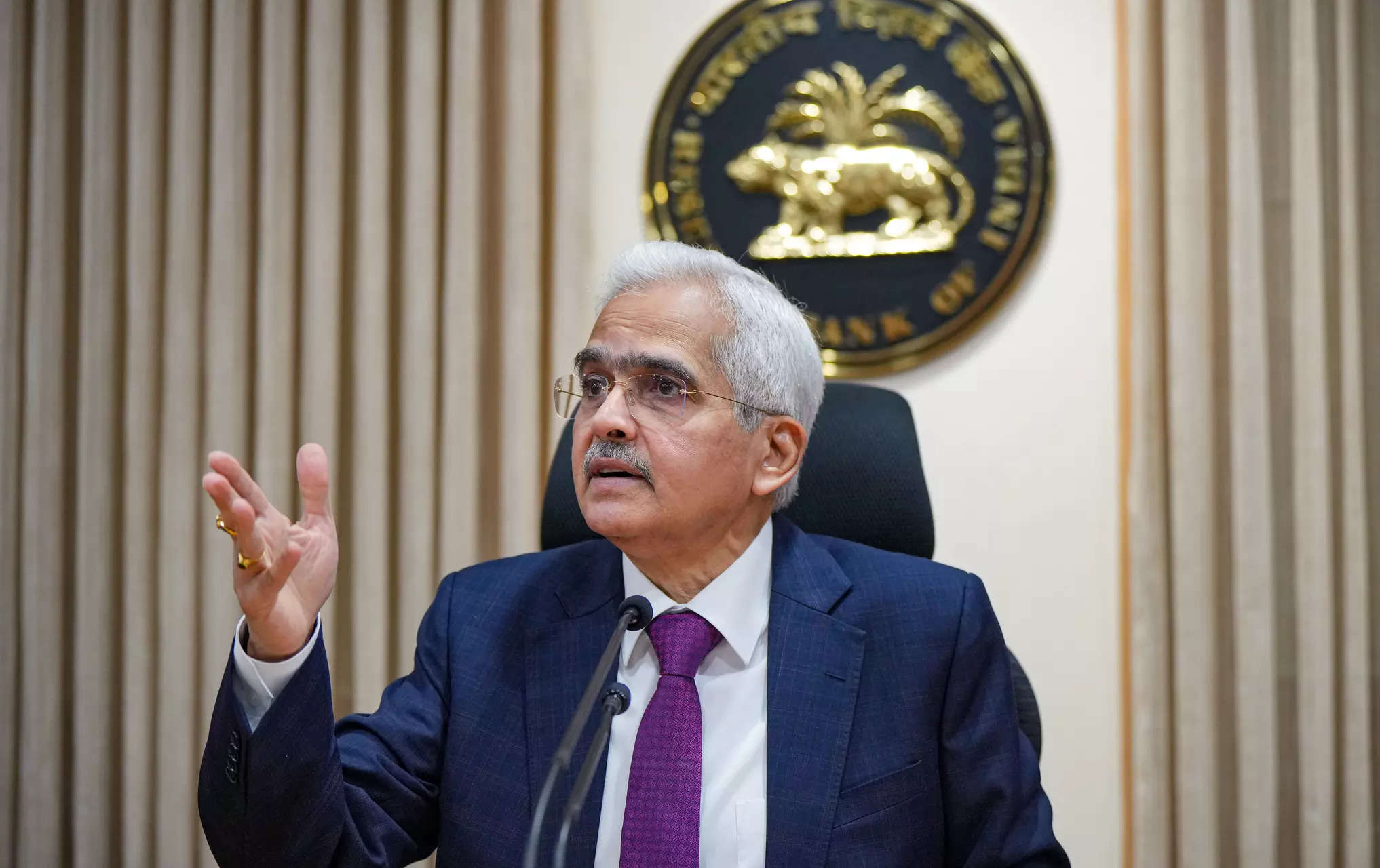

Shaktikanta Das, Governor, RBI

Shaktikanta Das, Governor, RBITHE Reserve Bank of India released its final guidelines on Thursday for financial technology companies create a self-regulatory organization (SRO) aimed at enforcing regulatory standards and promote transparency in the sector.

The guidelines come at a time when financial technology The Indian industry is growing at a breakneck pace due to growing demand for digital payments and borrowing, raising concerns over customer protection, data privacy, cybersecurity and internal governance.

Fintechs should create a self-regulatory body to address their needs and challenges, says Reserve Bank of India governor. Shaktikanta Das said in September. A draft framework was published in January.

An SRO for fintechs (SRO-FT), an industry-led entity, “should gain legitimacy and credibility not only to set baseline standards and codes of conduct, but also to effectively monitor and enforce them “, according to the report. RBI said in a statement.

Industry bodies should relay sector-specific information, address regulatory concerns and work collaboratively towards the overall development of the sector, the RBI said, adding that fintechs are “encouraged” to participate in at least one of these bodies.

The entity’s shareholding must be sufficiently diversified and no entity must hold 10% or more of its paid-up share capital, whether alone or acting in concert, the central bank said.

The applicant must have a minimum net worth of Rs 20 million ($240,009) within one year of recognition as an SRO-FT by RBI, or before commencement of such operations, it said. -he added.

Such a candidate must represent the fintech industry with members from entities “of all sizes, stages and businesses”, with a board of directors and key executives with professional skills and a reputation for fairness and integrity, RBI said.

SRO-FTs could have fintechs domiciled outside India as members, he adds.

The number of SRO-FTs to be recognized will depend on the number and nature of the applicants received, the RBI said, adding that it reserves the right not to grant recognition to any such application.