Technology sometimes evolves at a dizzying pace. When it comes to innovation in financial activities, often referred to as FinTech, the world is experiencing major advances. For banks, FinTech is disrupting core financial services and pushing them to innovate to stay relevant. For consumers, this means potentially greater access to better services. Such changes also raise the stakes for regulators and supervisors: Although most FinTech companies are still small, they can expand very quickly to riskier customers and business segments than traditional lenders.

This combination of rapid growth and the increasing importance of FinTech financial services to the functioning of financial intermediation may come with system-wide risks, which we cover in our latest report. Global Financial Stability Report.

Add risk

Digital banks are gaining systemic importance in their local markets. Also known as neobanks, they are more exposed than their traditional counterparts to the risks associated with consumer loans, which generally have fewer protections against losses because they tend to be less guaranteed. Their exposure also extends to higher risk taking in their securities portfolio, as well as higher liquidity risks (in particular, liquid assets held by neobanks relative to their deposits tend to be lower to those held by traditional banks).

These factors also pose a challenge for regulators: the risk management systems and overall resilience of most neobanks have not yet been tested in an economic downturn.

Not only are FinTech companies taking more risks themselves, but they are also putting pressure on their long-standing competitors in the sector. Look for example at the United States, where FinTech mortgage originators follow an aggressive growth strategy in periods when home lending is expanding, such as during the pandemic. Competitive pressure from FinTech companies has significantly harmed the profitability of traditional banks, and this trend is set to continue.

Another technological innovation, which has seen rapid growth over the past two years, is decentralized finance, a crypto-based financial network without a central intermediary. Also known as DeFi, it offers the potential to provide more innovative, inclusive and transparent financial services through greater efficiency and accessibility.

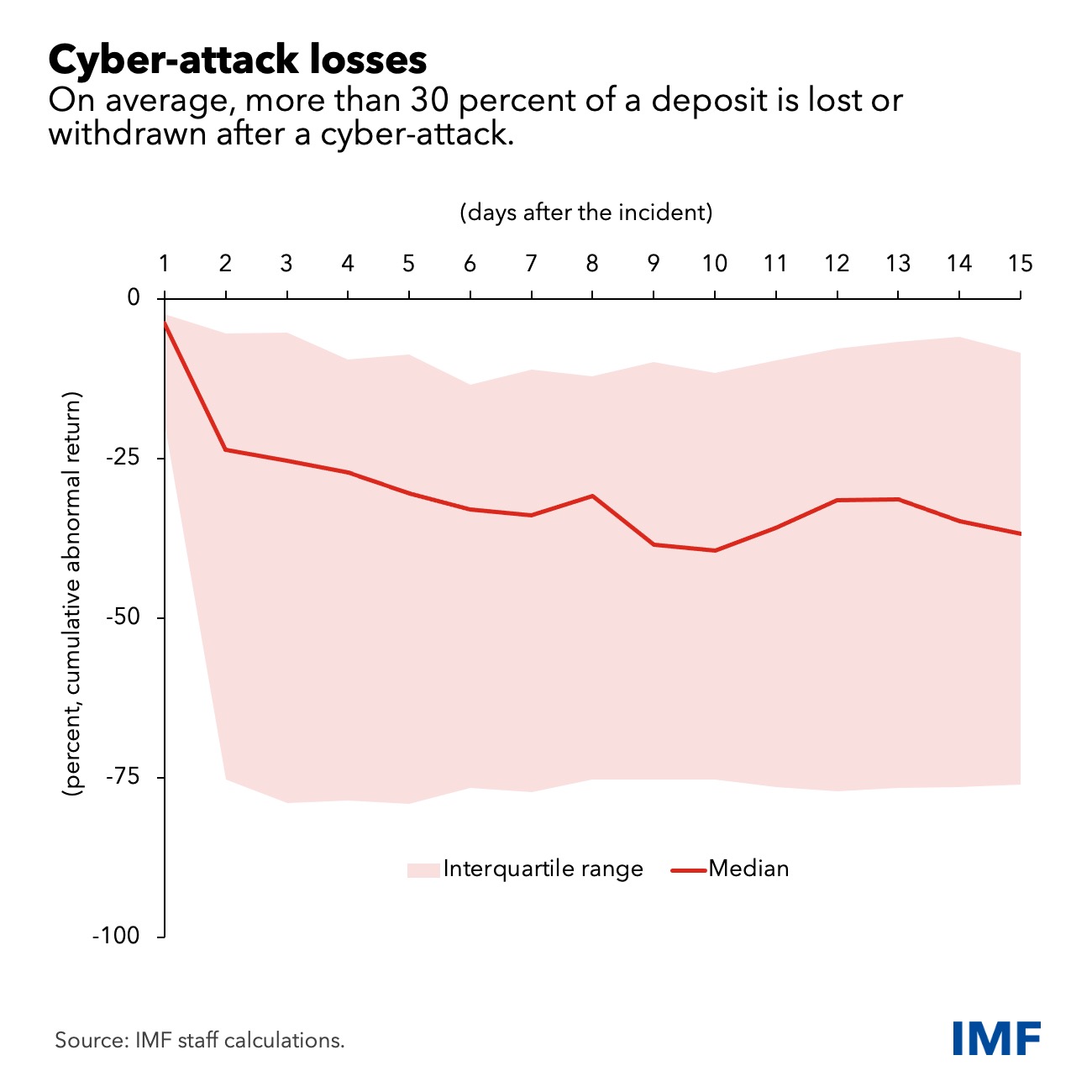

However, DeFi also involves the accumulation of leverage and is particularly vulnerable to market, liquidity and cybersecurity risks. Cyberattacks, which can be serious for traditional banks, are often deadly for these platforms, stealing financial assets and undermining user trust. The lack of deposit insurance in DeFi adds to the perception that all deposits are at risk. Historically, large customer withdrawals often follow news of cyberattacks against suppliers.

DeFi activities primarily take place in crypto-asset markets, but their growing adoption by institutional investors has strengthened ties with traditional financial institutions. In some economies, DeFi is helping to accelerate cryptoizationin which residents adopt crypto assets instead of local currency.

Strengthened regulations

As more financial services activities move from regulated banks to entities and platforms with little or no oversight, the associated risks also increase. Even as FinTechs step in to challenge traditional banks on their own playing field, they bring much more than competition. In fact, the two often remain linked, notably through the provision of liquidity and leverage by banks to FinTechs.

This poses challenges for financial authorities in the form of regulatory arbitrage (in which companies move or locate into less regulated sectors and regions) and interconnectivity which may require supervisory and regulatory measures, including better protection of consumers and investors.

Policies proportionally targeting both FinTech companies and traditional banks are needed. In this way, the opportunities offered by FinTech are promoted while controlling the risks. For neobanks, this means stricter capital, liquidity and risk management requirements, commensurate with their risks. For incumbent banks and other established entities, prudential supervision may need to focus more on the health of less technologically advanced banks, as their existing business models may be less sustainable in the long term.

The absence of governing entities means that DeFi poses a challenge for effective regulation and supervision. Here, regulation should focus on entities that are accelerating the rapid growth of DeFi, such as stablecoin issuers and centralized crypto exchanges. Supervisory authorities should also encourage strong governance, including industry codes and self-regulatory bodies. These entities could provide an effective channel for regulatory oversight.