AI in Fintech: A Market on the Rise

Market Overview

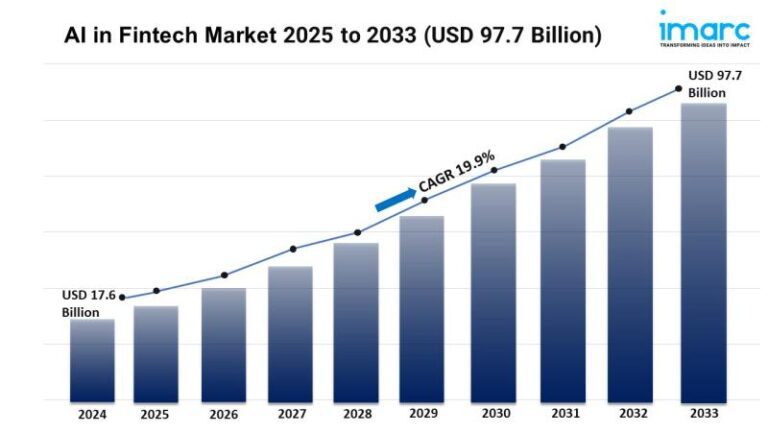

The integration of artificial intelligence (AI) in the fintech sector is growing rapidly. This trend is largely driven by banks’ increased adoption of AI technologies, regulatory demands for AI transparency, and a surge in personalized financial solutions. According to a recent report by the IMARC Group, the global AI in fintech market is projected to escalate from USD 17.6 million in 2024 to USD 97.7 billion by 2033, achieving a robust compound annual growth rate (CAGR) of 19.9% during the period from 2025 to 2033.

Comprehensive Market Analysis

The report offers an in-depth analysis that covers key aspects such as market size, emerging trends, market share, and significant growth factors. It presents a thorough overview based on extensive research, market evaluations, and data from various reliable sources. Additionally, the report highlights critical market dynamics, including opportunities and challenges, while emphasizing technological advancements and developing trends within the industry.

Key Industry Drivers

Several factors are propelling the growth of AI in the fintech sector:

- Increased Adoption of AI: Financial institutions are leveraging AI tools to automate processes, enhance customer experience, and improve operational efficiency. Chatbots, AI fraud detection systems, and personalized financial services are becoming commonplace as institutions compete for customer satisfaction.

- Regulatory Pressures for Transparency: As governments evolve legislation around AI’s use, fintech companies must navigate complex compliance requirements. This has led to investments in explainable AI (XAI) technologies to uphold regulatory standards while maintaining a competitive edge.

- Personalization Demand: As customer expectations shift towards hyper-personalized services, there is a growing demand for AI solutions that analyze consumer behavior to tailor financial products, particularly among younger generations who expect transparency and relevance in their digital experiences.

Market Segmentation Insights

The report categorizes the AI in fintech market into various segments to provide a clearer understanding:

- By Type: Solutions and Services. Solutions are leading due to the increasing adoption of AI software that enhances service efficiency.

- By Deployment Mode: Cloud-based and On-site. The cloud-based segment dominates owing to its scalability and cost-effectiveness.

- By Application: Virtual assistants (chatbots), credit scoring, asset management, fraud detection, among others.

Regional Market Analysis

The geographical segmentation reveals North America as the leading region in the AI fintech market, supported by its advanced technological infrastructure and significant investments in AI innovation. Other prominent regions include Asia-Pacific, Europe, Latin America, and the Middle East and Africa, each exhibiting unique growth dynamics and opportunities.

Conclusion and Future Projections

As the fintech realm continues to evolve, AI will play a central role in shaping the future of financial services. Companies that embrace AI technology will gain significant advantages in operational efficiency and customer engagement. The market’s trajectory from 2025 to 2033 is expected to be robust, driven by continued technological advancements, regulatory adaptations, and the increasing demand for personalized financial solutions.

Contact Imarc Group for More Information

If you require a detailed report or specific data not included in the current scope, the IMARC Group is ready to assist. They offer comprehensive consulting services tailored to client needs, ensuring that stakeholders in the fintech sector are well-equipped for the challenges and opportunities ahead.

For further inquiries, you can reach the IMARC Group at:

IMARC Group134 N 4th St. Brooklyn, NY 11249, United States

Email: sales@imarcgroup.com

Tel: +1 (631) 791-1145