PB Fintechowner of Policybazaar and Paisabazaar, is considering moving away from taking majority stakes when acquiring companies following the departure of the founder of MyLoanCare, which it bought in 2021.

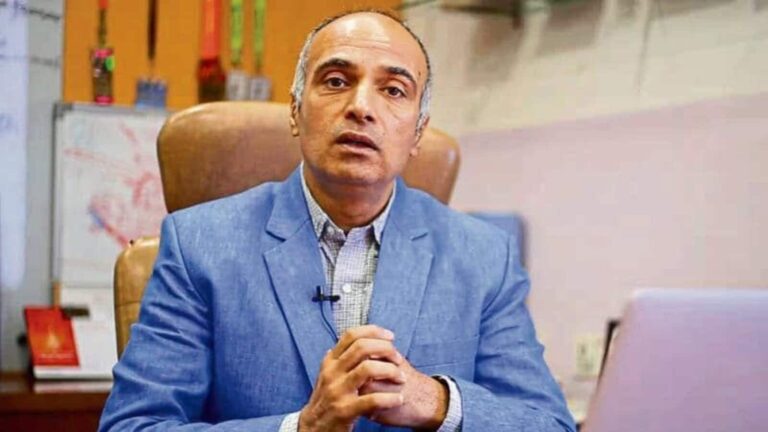

PB Fintech will now focus on minority investments, with exceptions for strategically critical transactions, co-founder Yashish Dahiya said.

“In hindsight, the mistake we made was to take too much of a stake. We took 70% of the shares. That’s a weak point for us. The right percentage would have been 22% to 30%. Because if you go over 50%, it’s not really the founder’s company anymore,” Dahiya said on an earnings call.

PB Fintech has acquired Gurugram-based lending marketplace MyLoanCare for ₹40.41 crores as of December 2021. Gaurav Gupta, the founder, exited the company earlier this year, handing over the reins to the parent entity, highlighting potential challenges associated with integrating acquired businesses.

Founded in 2013, MyLoanCare allowed customers to compare different loan products and interest rates, similar to what PB Fintech’s Paisabazaar does. According to his LinkedIn profile, Gupta stepped down as CEO of MyLoanCare in January, after leading the company for over a decade.

“Your business now”

“Basically, the founder said this is our company and we should run it, and he (the founder) left. Running the company was not our goal in investing. We always wanted it to be founder-led. And I think that’s really the mistake we made in the beginning,” Dahiya said.

Investment in Myloancare Ventures Private Ltd stands at ₹44.62 crore has been written down as share in net assets of Myloancare Ventures, the company said in a statement on Tuesday.

“This impairment takes into account the current situation and other relevant factors, including excessive cash burn, existing liquidity issues and significant uncertainty regarding future business plans. The Company continues to explore various options in the best interests of stakeholders and will reassess this position if and when the underlying assumptions regarding the survival and sustainability of the investee company improve,” the company added.

This comes as Paisabazaar’s loan disbursement fell 11% quarter-on-quarter to ₹3,140 crores in the first quarter of ₹3,542 crore as the company sold 1.34 lakh credit cards as against 1.4 lakh in the previous quarter. The company, however, continues to have positive adjusted EBITDA since December 2022, it said.

PB Fintech reported a third consecutive quarter of profits in the first quarter of fiscal 25. Net profit was ₹60 crores against a loss of ₹12 crores during the same period last year.

Revenues increased 52 percent to ₹1,010 crores ₹666 crore a year earlier. The company’s premiums from its online business grew 62% year-on-year, led by a jump of about 78% in the health and life insurance segment.