The Managing Director and Managing Director of First Bank Nigeria, Olusegun Alebiosu, has highlighted the importance of strategic partnerships in advancing Nigeria’s financial technology landscape. Lagos State Governor, Babajide Sanwo-Olu, has commended the bank for its commitment to advancing technology within the sector. the financial ecosystem and its central role in promoting financial inclusion.

Speaking at the FirstBank FinTech Summit 6.0, themed “Leveraging on Partnerships”, Sanwo-Olu, represented by the Commissioner for Innovation, Science and Technology, Lagos State Government, Olatubosun Alake, said: “Digital innovation is also driving healthcare, food systems, commerce, the list is endless. Fortunately, First Bank has been at the forefront of digital banking for many years, and we should applaud their efforts to foster an environment of innovation.

“Their willingness to lead these conversations, to bring us all together, shows a deep understanding of the importance of partnerships in the digital age. Whether in banking, insurance, technology or government, collaboration is no longer optional; it is essential. We are all pieces of a larger puzzle and our success is intertwined.

“I must commend the First Bank of Nigeria team for putting together such a thoughtful and impactful event. This year’s theme, Building on Partnerships, could not be more timely, particularly at a time when our industries, economy and society desperately need collaborations, innovations and shared solutions that create value.

Regarding the deployment of road management systems, he said: “In traffic management, we have implemented intelligent transportation systems that solve problems such as expired registrations. I’m sure some people have received text messages that their inspection or registration has expired. This is just the beginning. Subsequently, as we speak, we are deploying other intelligent transportation systems, such as red light cameras and speed cameras, which have already begun, as well as indiscriminate lane change detection devices, which are underway installation.”

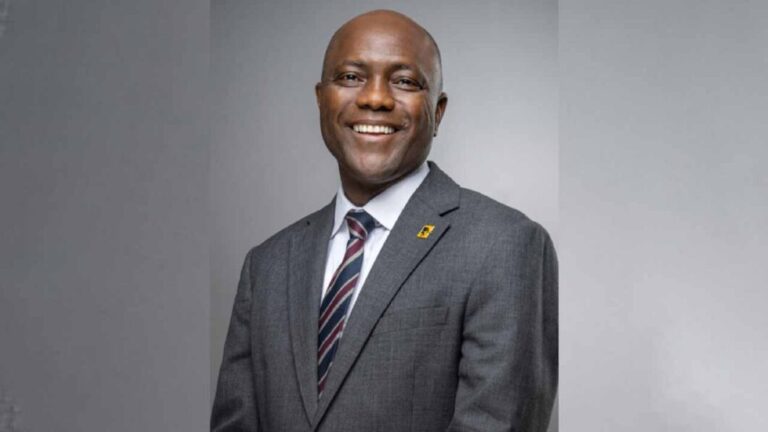

In his speech at the summit, Alebiosu highlighted that the convergence of finance and technology presents an unprecedented opportunity to drive growth, foster innovation and improve efficiency. He noted that FirstBank’s legacy of technological innovation was a focal point and that First Bank pioneered the use of ATMs in Nigeria in 1991 and has since introduced a series of milestones including biometric ATMs and of cash deposits in 2011, reaching a record figure of 100 million. monthly transactions in 2015.

Alebiosu reiterated that the bank has continued to make progress in digital transformation with the establishment of its Digital Innovation Lab in 2018 and the recent launch of an AI-based virtual assistant.

“As we navigate the rapidly changing landscape of the financial services industry, it is becoming increasingly clear that collaboration and partnerships are essential for banking itself to unlock the full potential of its digital age and the information.

“The intersection of technology and finance currently offers unprecedented opportunities for growth, innovation and improvement. That’s why we’re excited to meet the brightest minds and most forward-thinking organizations to share ideas and explore opportunities.