Nvidia (NVDA) stock rose 4% on Tuesday, marking its fifth straight day of gains.

Wall Street analysts at KeyBanc, Citi (C), Bernstein and several other investment firms reiterated their buy ratings on the stock this week.

KeyBanc analysts raised their fiscal 2025 sales outlook for Nvidia from $128.5 billion to $130.6 billion, with Nvidia’s new flagship Blackwell AI chips contributing $7 billion to fourth-year revenue. quarter. That’s more than Wall Street’s consensus estimate of $125.6 billion for 2025 revenue, according to Bloomberg data.

Even as production of Nvidia’s Blackwell chips ramps up, KeyBanc said in a note to investors Monday that demand for Nvidia’s previous AI chip models — H100 and H200 — “remains extremely robust.”

Nvidia shares are up nearly 14% over the past week and 190% over the last year.

Wedbush analysts said “another bright spot” for Nvidia is a potential new wave of funding for AI startups. The information reported OpenAI’s massive $6.6 billion funding round on Monday will likely lead to a wave of new investments in AI. New funding for AI-related startups would in turn fuel demand for Nvidia’s AI chips.

Wedbush’s Matt Bryson said Tuesday that the report indicates “the growth in AI spending is unlikely to stall for much (if not all of 2025) in favor of NVDA.”

Nvidia is also looking to prove its value beyond AI hardware. At its AI summit in Washington this week, the company is trying to highlight the strength of its AI software offerings in an effort to show that it is more than just a chipmaker.

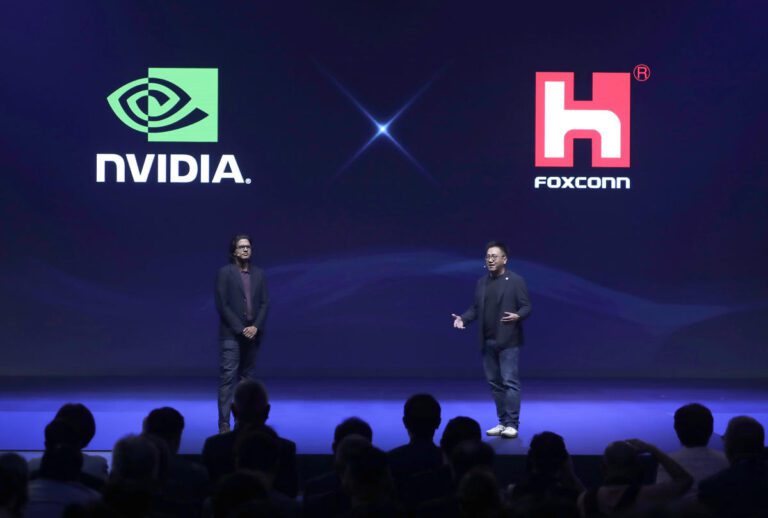

Added to the wave of positive press for Nvidia is the announcement from Foxconn (2354.TW) new megafactory assembling Nvidia’s AI servers. The Taiwan-based electronics maker’s president, Young Liu, said Tuesday at an annual event in Taipei that Foxconn is building the world’s largest Nvidia GB200 server assembly plant in Mexico, according to the Financial Times. Liu said there is “crazy” demand for Nvidia’s latest AI chips. The move will reduce Nvidia’s reliance on China amid growing trade tensions.

Nvidia and Foxconn said they were doing this too working to build Taiwan’s fastest supercomputer.

Nvidia isn’t the only semiconductor company thriving. Citing WSTS data from the semiconductor industry, JPMorgan (JPM) said Tuesday that industry-wide sales were up 28% in August compared to last year.

“We remain positive on semiconductor and semiconductor equipment stocks as we believe stocks should continue to rise in anticipation of better supply/demand in 2H24/25 (the second half of the year). 2024 and 2025) and stable/increasing trends in earnings power in FY24/25. (calendar years 2024 and 2025).

The PHLX semiconductor index (^SOX) and the very technological Nasdaq (^IXIC) both rose more than 1% on Tuesday.

Meanwhile, Chinese chipmakers faced a different fate on Tuesday. After the Chinese economic planning agency did not live up to market hopes for more stimulus measures, the Chinese company Semiconductor Manufacturing International Corporation (0981.HK) fell by 18%. Investors had expected recovery initiatives to boost the Chinese semiconductor sector.

Laura Bratton is a reporter for Yahoo Finance.

Click here for the latest stock news and in-depth analysis, including the events that move stocks.

Read the latest financial and business news from Yahoo Finance