(Bloomberg) — Shares of SK Hynix Inc. fell after record quarterly results failed to impress investors grappling with stagnant demand for smartphones and questions about AI spending in 2025.

Most read on Bloomberg

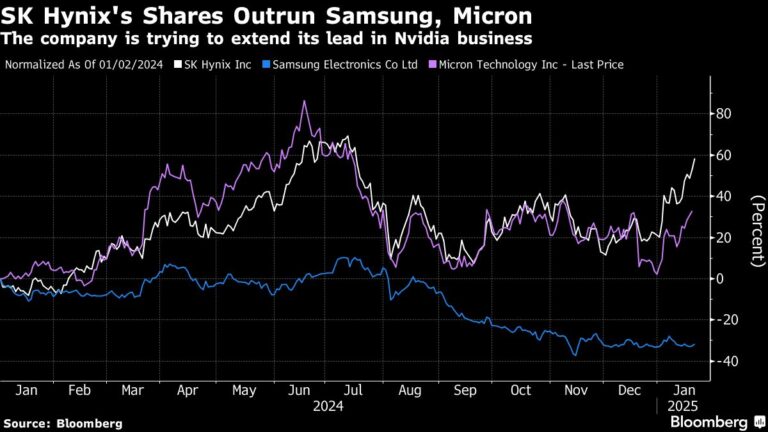

Nvidia Corp.’s leading high-bandwidth memory supplier reported a more than 20-fold increase in operating profit for the December quarter to 8.08 trillion won ($5.6 billion), eclipsing the profits of rival Samsung Electronics Co for the first time. But the stock slipped more than 2% after investors took advantage of a 30% stock market rally this year.

SK Hynix’s meteoric growth underscores the scale of the global boom in data center spending and the company’s place at the forefront of the HBM chips that Nvidia’s accelerators need to train AI. It could also help ease concerns that the AI-fueled spending spree by big tech companies, from Microsoft Corp. at Meta Platforms Inc., has reached its peak.

This week, SoftBank Group Corp., OpenAI, Oracle Corp. and Abu Dhabi-backed MGX unveiled a $100 billion venture to finance and build data centers. News of Project Stargate, promoted by President Donald Trump, fueled a rally of industry players from Nvidia to Arm Holdings Plc as investors anticipated a surge in data center construction.

SK Hynix said it expects HBM sales to more than double this year. The South Korean company also increased its annual dividend by 25%, to 1,500 won per share.

“SK Hynix will be a big beneficiary” of Stargate, said Sanjeev Rana, an analyst at CLSA Securities Korea. “They have a significant lead, whether in terms of product quality or production yields… It will take some time for competitors to catch up.”

Well ahead of Samsung and Micron Technology Inc. in designing and supplying HBMs, SK Hynix said it now plans to deliver cutting-edge 16-layer HBM4 chips in the second half of 2026. The company, which has said its capital spending would increase slightly this year. , must stay one step ahead of Samsung.

HBM accounted for 40% of its overall DRAM chip revenue in the quarter. Demand for such high-end memory will continue to rise as investments in AI servers grow and inference (making predictions from data) grows in importance, the company predicted .

And while demand for smartphones – even for Apple Inc.’s iPhone – remains subdued, the Korean company expects sales of PCs and devices equipped with AI capabilities to increase, fueling a recovery in the second semester.